Every year, certain trends take centre stage and help to explain market returns. For example, expectations over trade negotiations and Fed policy were useful for explaining market performance in 2019. Many of these developments often appear obvious with the benefit of hindsight, but identifying the trends and their subsequent impact in advance is far from easy: there are countless possible scenarios, each with its own distinct outcomes.

Given the inherent difficulties of forecasting, it may be helpful for market participants to focus on forming return expectations about market segments that represent a relatively large portion of their respective universes. Correctly predicting trends that influence these areas is likely to be more relevant to a wider range of investment theses, and so may be more meaningful in explaining subsequent returns.

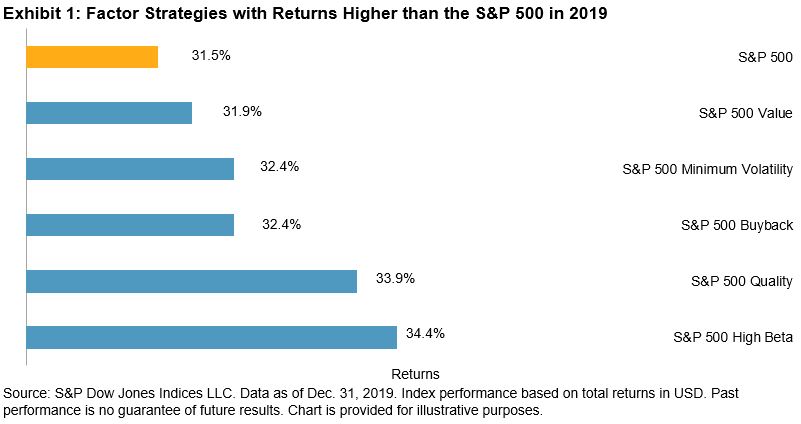

Although definitions of “the Market” can vary depending on one’s investment objective and area of domicile, having a U.S. view is vital in a global equity context. Indeed, U.S.-domiciled companies accounted for over 50% of the market cap in most S&P Global BMI industries at the end of 2019, and so trends impacting these companies will be relatively important in driving global equity market returns. Exhibit 1 also suggests that global investors may have to turn to the U.S. for certain exposures (such as Information Technology), which could help them alleviate some of their domestic sector biases.

Of course, any talk of the U.S. in 2020 is likely to lead quickly to discussions about the November Presidential election. But before concluding that a given result will be entirely positive or negative for U.S. equities, it is worth remembering that different market segments have reacted differently to prior elections. For example, there was a tremendous increase in S&P 500 sectoral dispersion around the 2016 U.S. Presidential election as the anticipated policies from the incoming administration were expected to have varied impacts on companies in different market segments – this was the beginning of the so-called “Trump trade”. As a result, it may also be useful to have a view on the various components of the U.S. equity market.

The sizeable representation of U.S. companies in global equity markets means that having a view on the U.S. is likely helpful for explaining performance. And while we’ll have to wait and see which trends emerge, the rise in sectoral dispersion around the 2016 U.S. Presidential election may indicate that having a view on sectoral performance could also prove helpful.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

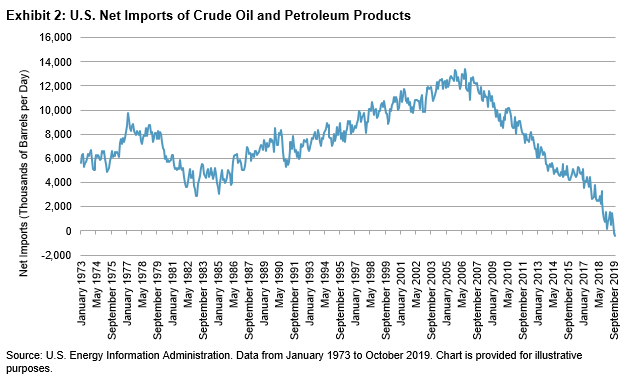

Taking market performance as a measure, there has been little visible dent to investors’ confidence from the most recent geopolitical flare up. Have market participants, irrespective of asset class, grown complacent to geopolitical risks, or have they decided that the overall threat to the global economy of further incremental deterioration in U.S.-Iranian relations and more broadly, Middle Eastern stability, is relatively contained?

Taking market performance as a measure, there has been little visible dent to investors’ confidence from the most recent geopolitical flare up. Have market participants, irrespective of asset class, grown complacent to geopolitical risks, or have they decided that the overall threat to the global economy of further incremental deterioration in U.S.-Iranian relations and more broadly, Middle Eastern stability, is relatively contained?