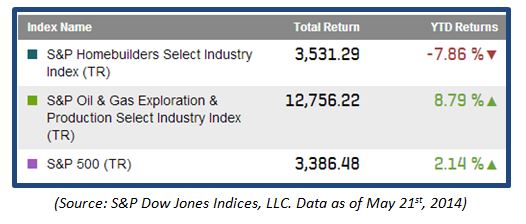

The S&P/LSTA U.S. Leveraged Loan 100 Index has returned 1.76% year to date under performing vs. fixed rate high yield bonds. The low rate environment and continued demand for yield generating asset classes has pushed the S&P U.S. Issued High Yield Corporate Bond Index returns to 4.32% year to date as yields have fallen by 38bps since year end.

Three myths of the U.S. senior loan market:

Myth 1: Senior loans are more volatile than high yield bonds: the data just does not support this statement.

The five year standard deviation of index level changes (as of quarter end March 31, 2014):

- S&P/LSTA U.S. Leveraged Loan 100 Index: 7.28%

- S&P U.S. Issued High Yield Corporate Bond Index: 8.27%

Biggest index drop:

- S&P/LSTA U.S. Leveraged Loan 100 Index: -27.9% Dec 2008

- S&P U.S. Issued High Yield Corporate Bond Index: -30.4% Nov 2008

(In Feb 2009, the S&P 500 was down over 46% and the S&P GSCI was down over 67%)

Myth 2: Interest rate floors built into many floating rate loans are a negative attribute of these loans: Senior loans are floating rate. As rates rise, the interest rates these loans pay eventually rises. Currently, approximately 80% of the loans in the S&P/LSTA U.S. Leveraged Loan 100 Index have interest rate floors that have protected buyers from the current extremely low rate environment. As rates rise above those floors, the loans can be expected to pay even higher interest rates. Meanwhile, lenders are getting higher rates due to these floors than had the floors not been in place. Prices of fixed rate bonds of course fall as bond yields rise.

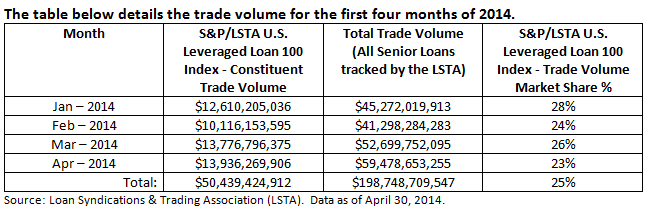

Myth 3: The liquidity of the loan market is nonexistent: During the first four months of 2014 over $198billion of senior loans have traded in the secondary market. The 100 constituents of the S&P/LSTA U.S. Leveraged Loan 100 Index represented 25% of the trade volume (over $50billion). The Index is designed to track the most liquid of these senior loans and results in tracking over $237billion of loans by market value.