How do S&P Dividend Aristocrats respond to volatility, inflation and rising rates? S&P DJI’s Pavel Vaynshtok and ProShares’ Simeon Hyman take a closer look at how these quality dividend growers have performed in different market environments.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Defending with S&P Dividend Aristocrats

These Go to 11: Diversification with S&P 500 Sectors

The S&P MidCap 400: An Overlooked Gem

Index-Based Tools for Tracking the Future

Food and Energy Inflation Concerns Drive Commodities Higher in May

Defending with S&P Dividend Aristocrats

These Go to 11: Diversification with S&P 500 Sectors

- Categories S&P 500 & DJIA

- Tags 2022, consumer staples, Core U.S. Equities, energy, equities, IIS, Index Investment Strategy, information technology, Joseph Nelesen, S&P 500 Consumer Staples, S&P 500 Energy, S&P 500 Information Technology, S&P 500 Sectors, sector, sectors, U.S. Equities, U.S. sectors, US FA

Many strategies (including passive ones) hold large allocations to Information Technology. A “barbell” approach can mitigate risk from high exposure to one sector by pairing it with another.

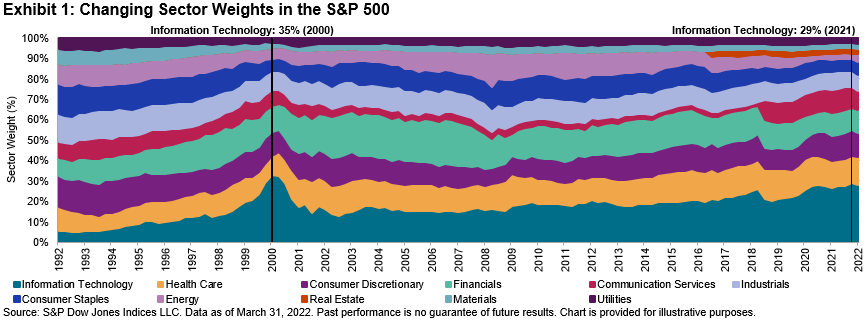

Do you remember sending your first email? For many, it was likely around the mid-1990s when a “googol” was still 10^100 rather than a verb and the @ key on your keyboard was seldom used. The world has changed indeed. In 1995, the Information Technology sector comprised just 10% of the S&P 500® but soon rocketed to 35% by March 2000 before a bursting bubble started its Icarian descent back below 20% (see Exhibit 1). By 2021, Information Technology reached a peak weight of 29% as the largest of the 11 S&P 500 sectors before leading the market downward this year.

Because each S&P 500 sector uses the Global Industry Classification Standard® (GICS®) to group businesses that are similar, sectors tend to exhibit non-aligned periods of outperformance. On any given day since December 2000, 51% of sectors have outperformed over a trailing six-month period. We find that whenever Information Technology has underperformed the S&P 500 during a six-month period, all 10 other GICS sectors have, on average, outperformed the benchmark (see Exhibit 2).

A recent example of sectors exhibiting different performance profiles can be seen in Energy and Information Technology since the emergence of COVID-19 in December 2019 (see Exhibit 3). While Information Technology has exhibited defensive resilience during pandemic-related tumult, it has traditionally been viewed as a more cyclical sector that benefits from periods of economic strength and market optimism toward future earnings, Energy tends to be a necessary purchase for consumers and businesses throughout the economic cycle (barring pandemic-driven reduced fuel demand). Some investors may eschew Energy when Information Technology is on the rise, but it has demonstrated usefulness as a diversifier of risk and return.

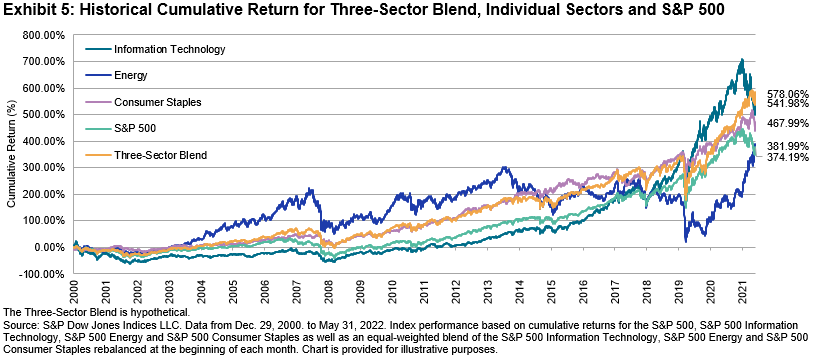

Historically, combining the Information Technology sector with less-correlated sectors has reduced risk and aided long-term performance. For illustration, we constructed an equal-weighted three-sector hypothetical blend of the S&P 500 Information Technology, S&P 500 Energy and S&P 500 Consumer Staples (rebalanced monthly) and compared it with the performance of the S&P 500 Information Technology alone during the first year of the 2000 dot-com crash as well as during the YTD 2022 downturn (see Exhibit 4).

Extending the study period of the three-sector blend since 2000, we find that the combination of the three-sector blend not only exhibited similar annualized volatility (19.33%) to the S&P 500 (19.61%) but also produced higher cumulative return (578.06%) than the S&P 500 (374.19%) as well as the individual sector components thanks to diversification and regular rebalancing.

Although the path of any individual sector over time can be difficult to predict, data suggest that long-term diversification qualities among the S&P 500 sectors have been robust. If one sector bet goes wrong, others tend to go right. With 11 sectors to choose from, investors are equipped with time-tested tools to make thoughtful pairings and navigate their investing strategies through the cycle.

The posts on this blog are opinions, not advice. Please read our Disclaimers.The S&P MidCap 400: An Overlooked Gem

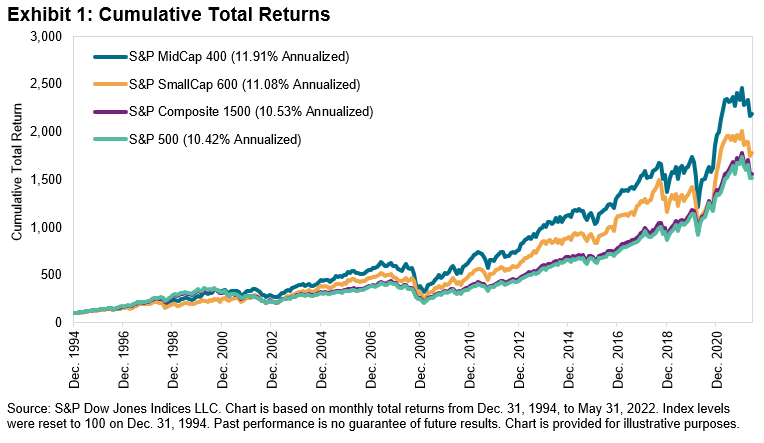

The S&P MidCap 400® is an often-overlooked member of the S&P Composite 1500® series, despite outperforming the S&P 500® and S&P SmallCap 600® since 1994 (see Exhibit 1).1 The mid-cap U.S. equity index also weathered the market volatility slightly better during the first five months of 2022 by falling less than 11%, compared to a near 13% decline for the S&P 500 and more than 11% for the S&P SmallCap 600.

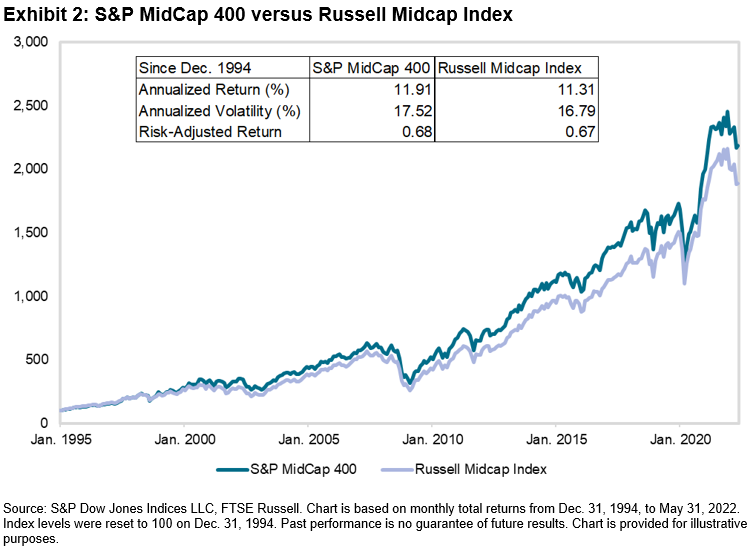

The S&P MidCap 400 is not the only index designed to represent the performance of mid-cap U.S. equities; the Russell Midcap Index also tracks this segment. Exhibit 2 shows that the S&P 400® has outperformed the Russell Midcap Index since 1994. Such outperformance has also been observed so far this year, with the S&P 400 beating the Russell Midcap Index by 1.9% through the end of May 2022. So, what helps to explain this difference?

As we have pointed out before, the S&P Composite 1500 series is constructed differently than the Russell 3000. One of the major differences is that the S&P Composite 1500 uses an earnings screen, which impacts the selection of companies in the indices. Exhibit 3 shows the results from a 2-Factor Brinson Attribution analysis by GICS® sectors between the S&P MidCap 400 and Russell Midcap Index from Dec. 31, 2021, to May 31, 2022.

The results show that the choice of constituents (selection effect) drove the S&P 400’s outperformance during the first five months of 2022, particularly in the Information Technology, Financials and Health Care sectors. Differences in sector weights (allocation effect) slightly detracted from relative returns. The S&P 400’s lower weight in Energy helped to explain this result.

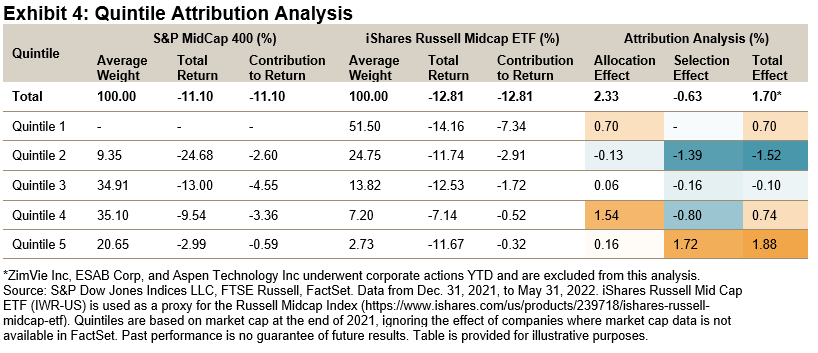

Another important difference between the two indices is they have different size exposures. For example, Exhibit 4 shows that more than 50% of iShares Russell Midcap ETF’s weight fell in the largest size quintile at the end of 2021. The S&P 400 had no exposure to these companies, which helped its relative performance in the first five months of 2022. The S&P 400 also benefited from its greater exposure to the smallest size quintile.

Overall, the S&P 400’s recent returns highlight the potential benefit of mid-cap U.S. equities—the index outperformed the S&P 500 and S&P SmallCap 600 since 1994, and YTD in 2022. The S&P 400’s outperformance compared to the Russell Midcap also demonstrates the importance of index construction and the potential impact on stock selection and size exposure.

1 For more information, see Bellucci Louis, Hamish Preston and Aye M. Soe. “The S&P MidCap 400: Outperformance and Potential Applications.” S&P Dow Jones Indices. June 2019.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Index-Based Tools for Tracking the Future

Get to know the S&P Kensho New Economy Indices, a comprehensive, rules-based, thematic index framework powered by AI and designed to help investors better understand and precisely measure the long-term transformative trends and exponential innovation and growth of the sectors and industries driving the Fourth Industrial Revolution.

Learn more: New Economies – Investment Themes | S&P Dow Jones Indices (spglobal.com)

The posts on this blog are opinions, not advice. Please read our Disclaimers.Food and Energy Inflation Concerns Drive Commodities Higher in May

- Categories Commodities

- Tags agriculture, commodities, energy, May Commodities Performance, nickel, S&P GSCI, wheat

Record inflation prints, export embargos and import bans helped the S&P GSCI, the broad commodities benchmark, to post another monthly gain in May, ending the month up 5.1% and bringing its YTD performance to 47.0%. The ongoing disruptions to the flow of energy and agricultural commodities out of Ukraine and Russia pushed energy and grain markets higher, while the metals markets continued to be weighed down by the prospect of higher interest rates and fears of global economic slowdown.

Energy prices extended their bull run into the end of May after the EU agreed to a partial ban on Russian oil and China decided to lift some coronavirus restrictions. EU leaders agreed in principle to cut 90% of oil imports from Russia by the end of 2022, equivalent to around 1.5 million barrels per day. Russian crude oil exports that have traditionally been destined for the EU will not necessarily be lost to the global market, but even if it can find willing buyers, it will be a challenge to transport the oil to new markets and prices will be discounted. The S&P GSCI Petroleum ended the month 9.8% higher. Targeting Russian natural gas supplies may be the EU’s next diplomatic battleground in the economic war, and U.S. natural gas prices are increasingly pricing in this scenario. The S&P GSCI Natural Gas rallied 11.3% in May and 129.3% YTD.

Industrial metals prices fell again in May. The S&P GSCI Nickel took the biggest hit, down 10.7%. Despite tight nickel supply around the world, recent pandemic hits to demand out of China have pushed prices lower, as the market continues to recalibrate from the unprecedented price spike and associated disruptions in March. Nornickel, the world’s largest refined nickel producer, announced during the month that it expects a mild surplus this year after deficits in prior years.

Gold and silver’s lackluster year continued with both precious metals falling in May. The U.S. dollar reached another 20-year high, pressuring precious metals. After some strength earlier in the year, the S&P GSCI Precious Metals ended May flat YTD.

A growing concern among central bankers and others regarding food security serves to highlight the importance of agricultural commodities to the global economy from both a societal and environmental perspective. The war in Ukraine has disrupted global food supplies to an unprecedented degree. A prime example is the tightening global wheat supply picture. Ukraine is considered Europe’s breadbasket and roughly one-third of global exports of wheat come from Ukraine and Russia. Severe restrictions on wheat exports from this region combined with worsening harvest prospects in China, parts of Europe and the U.S., as well as an export ban by major producer India, have tightened stocks and exacerbated global food supply concerns. As a result, global wheat prices have skyrocketed; the S&P GSCI Wheat was up 3.1% in May and 39.2% YTD.

In contrast to the agriculture commodity sector, the livestock markets were benign in May, with the S&P GSCI Livestock ending the month down 1.7%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.