In 1993, the Chicago Board Options Exchange (Cboe) announced the launch of the Cboe Market Volatility Index or VIX®, which provides market participants with a barometer to measure market sentiment. Since then, the index has become one of the most followed benchmarks. In commemoration for its 29th anniversary, we take a look at the evolution of the index.

The VIX concept arises from the research of Menachem Brenner and Dan Galai in 1989. They believed that the so-called Sigma index “would play the same role as the market index plays for options and futures on the index.”1 Professor Robert E. Whaley then designed the first version of VIX based on the Black-Scholes model, using at-the-money S&P 100 options.2

In 2003, Cboe revised the VIX methodology with the help of Goldman Sachs.3 The revised VIX now uses a more robust model that captures options of all strikes and the most liquid index option in the market, S&P 500® options. The index name became the Cboe Volatility Index, or VIX.

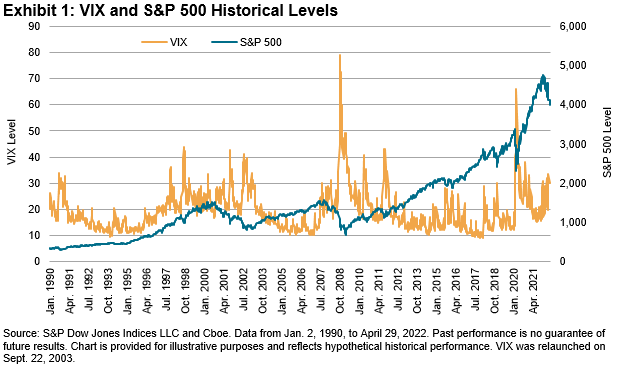

With nearly three decades of history, VIX exhibits a few time-honored characteristics. In the long run, VIX has shown a clear mean-reverting trend. For most of the time, it ranges between 13 (~20th percentile) and 25 (~80th percentile), with a mean of ~19.5 and a median of ~17.5. In the first four months of 2022, we’ve seen VIX hovering above 25 or even 30 (~90th percentile), indicating the elevated risk and anxiety in the financial market.

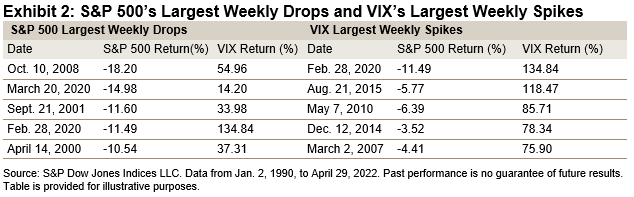

In the short term, however, VIX tends to move fast, usually in the opposite direction of the S&P 500. The correlation between VIX and the broad U.S. equity market is ~-75% on average and has gone as high as -90% during volatile market environments. For example, during all the weeks since 1990 when the S&P 500 dropped at least 5%, VIX showed a positive return. In the week ending Feb. 28, 2022, the S&P 500 declined 11.49% and VIX jumped 134.84%, its highest weekly return since 1990. This is why VIX is sometimes referred to as Wall Street’s “fear gauge.”

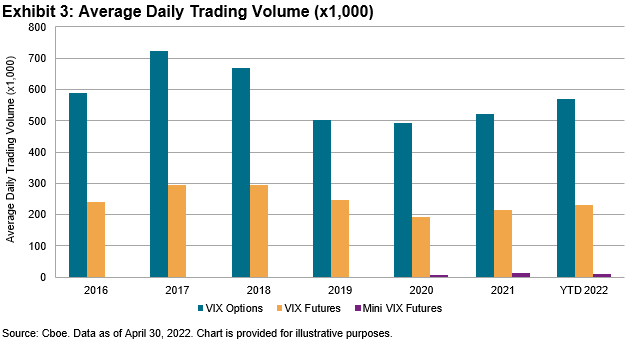

The strong negative correlation between VIX and the U.S. equity market makes VIX derivatives attractive hedging tools for market participants. VIX options are now the second most liquid index options on Cboe. Increased demand from market participants led Cboe to extend VIX futures trading hours and list mini VIX futures in recent years. In the first four months of 2022, the average daily value of VIX futures and options increased by 7% and 9%, respectively, compared with 2021.

In January 2009, the first suite of tradable VIX futures indices were launched in response to increasing demand for effective hedging tools for broad equity market risk. The S&P 500 VIX Short-Term Futures Index has since grown into one of the most actively followed indices for equity and volatility traders.

VIX and VIX futures indices are still new compared with other broad market measures such as the S&P 500 and the Dow Jones Industrial Average®. However, their negative correlation with the U.S. equities market and hedging capabilities indicate that their popularity among investors could continue for decades to come.

1 Brenner, Menachem; Galai, Dan (1989). “New Financial Instruments for Hedging Changes in Volatility.” Financial Analysts Journal. 45 (4): 61–65. ISSN 0015-198X.

2 Bob Pisani (March 29, 2020). “Father of Wall Street’s ‘fear gauge’ sees wild volatility continuing until coronavirus cases peak.”

The posts on this blog are opinions, not advice. Please read our Disclaimers.