Journalists and others occasionally offer comparisons of capitalization-weighted index funds with other weighting schemes. Some of these efforts are more useful than others, but none, in my experience, identify the question that cap-weighted indices were initially designed to answer, and which accounts for their enduring economic significance. That question is, simply put: What is the total value of the stock market?

If we want to compute the total value of any stock market, the procedure is simple: for each company in the market, multiply shares outstanding by price, and add up the individual results. We can make the calculation as often as we like (or as often as our computational powers permit). By comparing values at two different periods, we can derive the market’s return; dividing Tuesday’s market value by Monday’s market value tells us Tuesday’s return. This is mathematically equivalent to multiplying each individual stock’s return by its beginning weight. In other words, the percentage return of a capitalization-weighted index tells us the percentage change in the aggregate value of all the stocks in the index.

No other weighting scheme produces this result. The percentage return of an equally weighted index, for example, tells us the return of the average stock, but not the change in the value of the entire stock market. Factor and thematic indices likewise have many uses, but are not particularly useful in telling us anything about the value of the entire market. Capitalization-weighted indices thus have a unique importance for economists; the S&P 500®, for example, is a leading indicator of the performance of the U.S. economy.

None of this discussion has anything to do with index funds, and of course indices were used for economic analysis long before they became the basis for financial products. Serendipitously, several attributes of capitalization-weighted indices make them particularly useful as the basis for index funds. The most important of these is that cap-weighted index funds are relatively easy (and cheap) to maintain. Unless the underlying index changes, a properly constructed cap-weighted index fund is not required to trade. Changes in the value of index components are exactly reflected in the value of the fund. Other popular weighting schemes (e.g., equal weighting or factor weighting) inherently require more turnover.

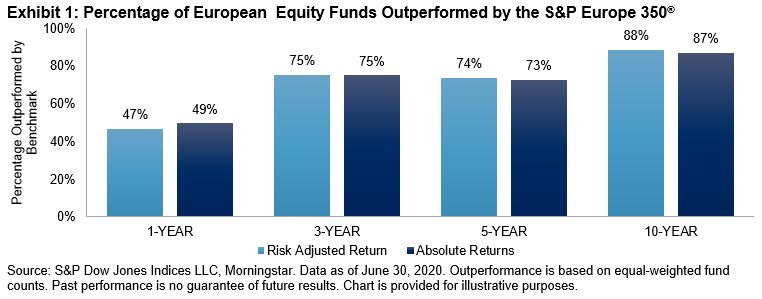

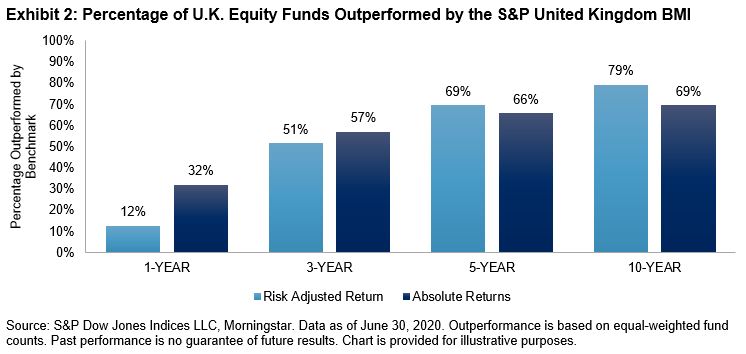

In part because cap-weighted indices don’t require much trading, in part because they can represent an entire economy rather than simply one aspect of it, and in part because we can’t all be above average, cap-weighted indices also continue to be demonstrably hard to beat. The popularity of capitalization-weighted indices is not arbitrary or inexplicable. We live in a capitalization-weighted world, and cap-weighted indices are a reflection of that reality.

The posts on this blog are opinions, not advice. Please read our Disclaimers.