Many market participants invest in small-cap equities seeking high-growth potential and portfolio diversification. In this blog, we will examine how growth factors performed in Australian small-cap equities by measuring the hypothetical top-quintile portfolio returns for three growth factors with long- and short-lookback periods, including 12- and 6-month price momentum, 3- and 1-year earnings growth, and 3- and 1-year sales growth based on the S&P/ASX Small Ordinaries index universe.1

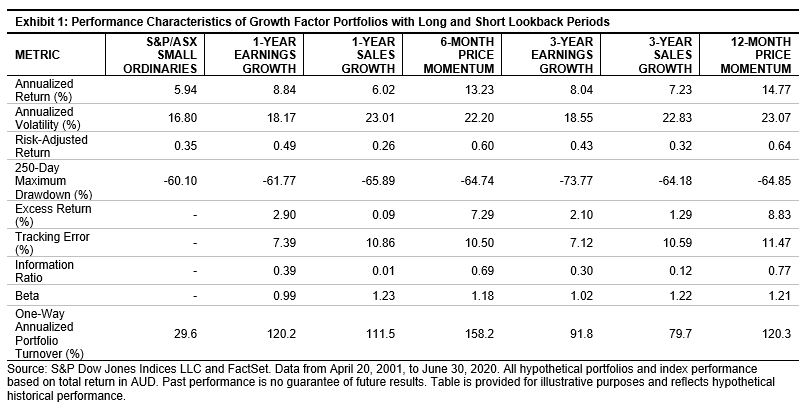

For the period from April 20, 2001, to June 30, 2020, the 12- and 6-month price momentum were the best-performing factors, with 8.83% and 7.29% annualized excess returns, respectively, compared with the S&P/ASX Small Ordinaries (see Exhibit 1). The 3- and 1-year earnings growth factors had relatively modest annualized excess returns of 2.10% and 2.90%, respectively, with a tracking error of nearly 7%, which was the lowest among the other growth factors studied. The 3- and 1-year sales growth factors recorded the smallest annualized excess returns at 1.29% and 0.09%, respectively, compared with the S&P/ASX Small Ordinaries. The earnings growth factor had a beta close to 1, whereas sales growth and momentum had higher betas at 1.2 relative to the S&P/ASX Small Ordinaries.

For the price momentum and sales growth factors, the portfolios with longer lookback periods (12-month price momentum and 3-year sales growth) had higher risk-adjusted returns and information ratios than those of the portfolios with shorter lookback periods (6-month price momentum and 1-year sales growth), though the earnings growth portfolios did not follow the same pattern. Overall, the portfolios with longer lookback periods witnessed lower portfolio turnover. The 3-year earnings growth, 3-year sales growth, and 12-month momentum portfolios recorded one-way annualized portfolio turnovers of 91.8%, 79.7%, and 120.3%, whereas the 1-year earnings growth, 1-year sales growth, and 6-month momentum portfolios had much higher turnover rates of 120.2%, 111.5%, and 158.2%, respectively. Considering the excess returns and replication cost of the portfolios, constructing growth portfolios with longer lookback periods tended to deliver higher returns historically.

Over the period studied, we noticed the outperformance of various growth factors was not consistent across different periods of time (see Exhibit 2). Though momentum was the best-performing factor across the observed horizon, it tended to underperform the S&P/ASX Small Ordinaries and other growth factor portfolios when market regimes transitioned from a bear or time-correction phase to a bull phase. This trend was visible in 2004 (following the war in Iraq), in 2009 after the Global Financial Crisis (GFC), and in 2016 and 2018.

On the other hand, sales growth portfolios did not deliver pronounced excess returns over the entire period, but they tended to perform better during bull markets, which were seen during the pre-GFC period (2006-2007), post-GFC period (2009), and between 2016 and 2019. The sales growth portfolios also had the highest portfolio betas, which accentuated their outperformance during the stock market bull runs.

The earnings growth portfolios had a higher tendency to better perform during market distress, especially in the 3-year earnings portfolio. During the European sovereign debt crisis from 2011-2013, the 3-year earnings growth portfolio delivered pronounced excess returns, and in the recent pandemic crisis (the first half of 2020), both the earnings growth portfolios outperformed the S&P/ASX Small Ordinaries. During volatile periods, market participants may look for safer investments by tilting their portfolios toward profitable companies with robust earnings growth.

From these observations, we conclude that the three growth factor portfolios of price momentum, earnings growth, and sales growth clearly delivered risk premia over the long term in Australian small-cap equities, with the most pronounced excess returns from the price momentum factors, though these growth factors played out differently across changing market regimes over the period studied. We also noted that growth factors with shorter lookback periods did not necessarily deliver better absolute and risk-adjusted returns compared with their respective portfolios with longer lookback periods, but they recorded higher portfolio turnover, hence higher replication costs. This implies that growth factors with longer lookback periods may be more effective for constructing growth factor portfolios in Australian small-cap equities.

1 Z-scores for each of the growth factors are computed for all constituents in the S&P/ASX Small Ordinaries. Companies ranked in the top quintile by their factor z-scores form the respective growth portfolios, which rebalance semiannually on every third Friday of April and October. All portfolios are weighted by their float-adjusted market caps that are tilted by factor z-scores, with individual constituent weights capped at 10%. As earnings and sales growth cannot be evaluated for companies with negative values in the base year, they are ineligible to be part of the earnings and sales growth portfolios.

The posts on this blog are opinions, not advice. Please read our Disclaimers.