Where can environmental, social, and governance (ESG) benchmarks help investors and markets most? The answer may be in emerging markets, where it is crucially important to identify and navigate ESG concerns. The transparency that ESG benchmarks provide can help investors distinguish companies that prioritize the needs of not just their shareholders, but also their many additional stakeholders, including their employees, the communities they operate in, and the environment around them.

However, to truly drive change, an ESG index must be more than a flag to wave—it must set the foundation for investment. The S&P/BMV Total Mexico ESG Index, launched on June 22, 2020, is one such benchmark, built for investors looking for a tool to help them act.

The S&P/BMV Total Mexico ESG Index is built with the same philosophy underpinning the creation of many popular new ESG indices around the world, such as the S&P 500 ESG Index. The idea is that certain ESG indices should be more inclusive than exclusive to remain broad and diversified, such that the ESG index has a similar overall industry group weight as the benchmark, while providing an improved ESG profile.

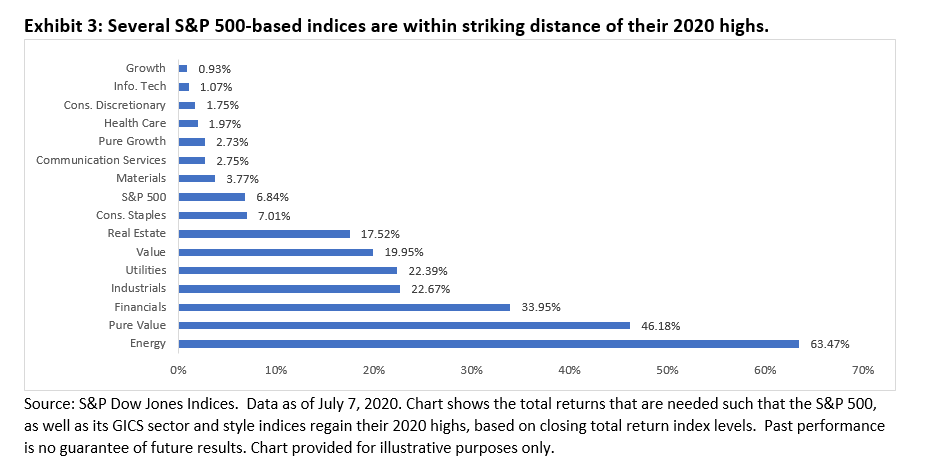

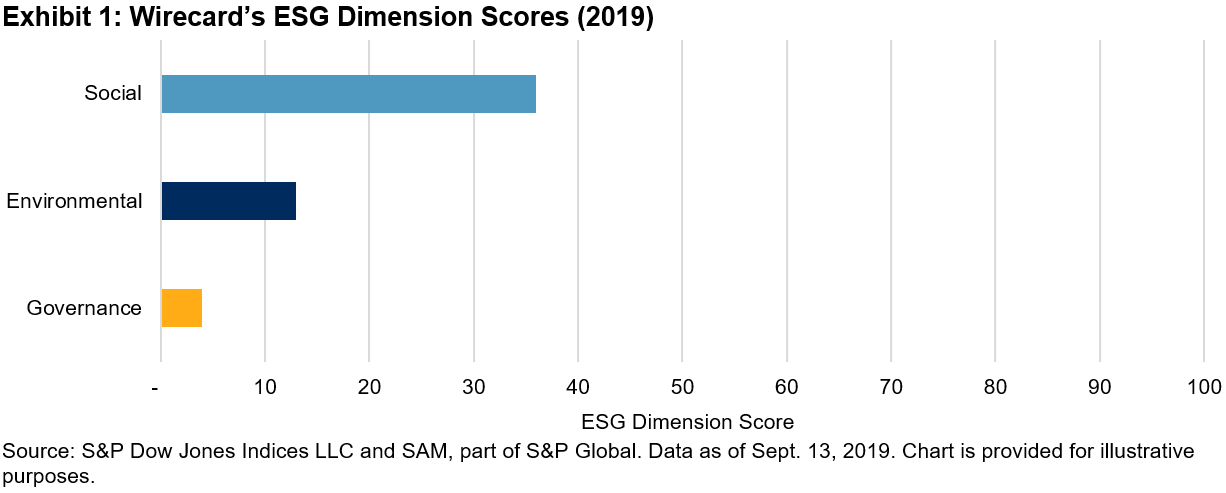

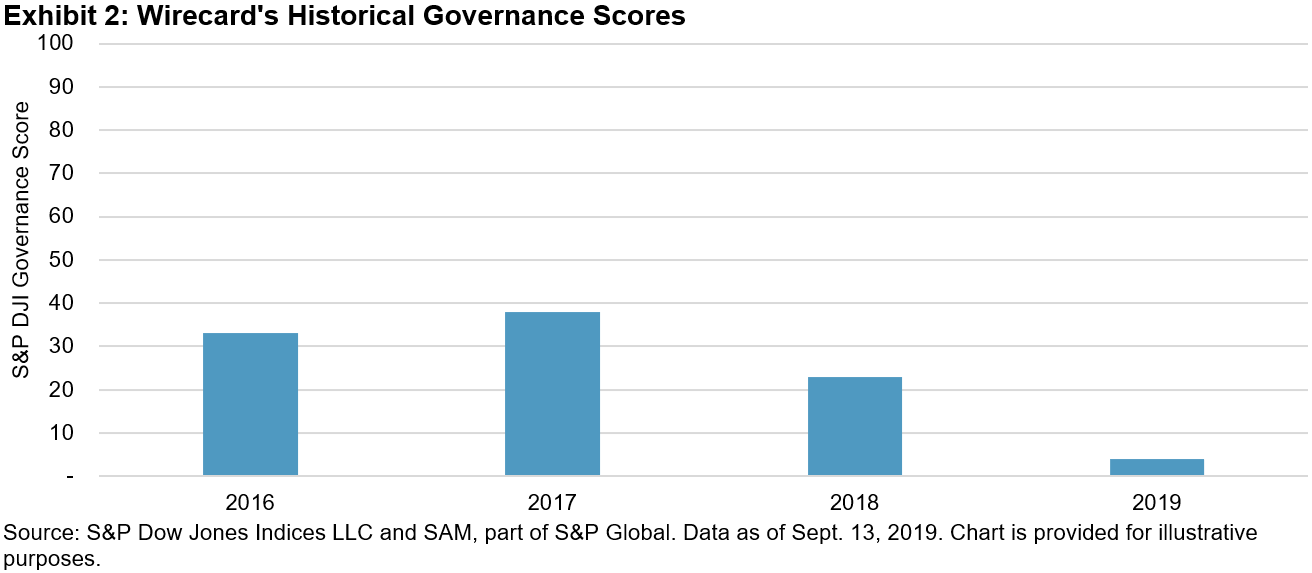

Exhibit 1 shows how this index is constructed. First, exclusions are made according to companies’ involvement in business activities related to tobacco or controversial weapons or low compliance with the United Nations Global Compact (UNGC). Next, the S&P DJI ESG Score is used to screen and select companies. Finally, companies are weighted by their ESG Score.

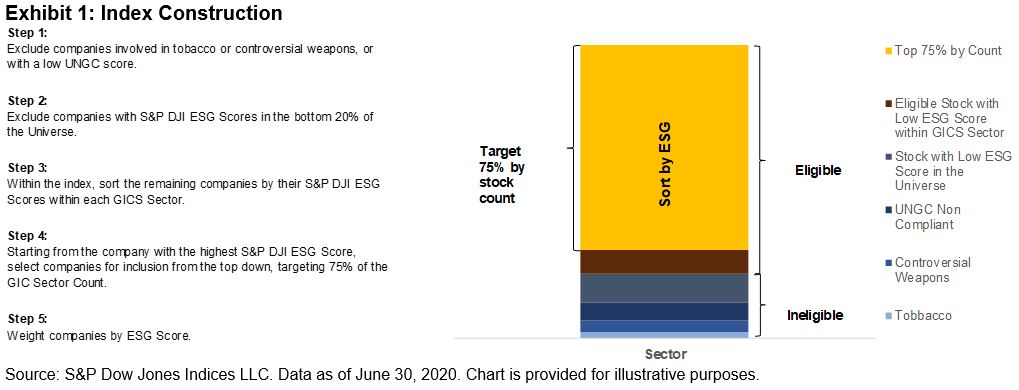

The result is an index that, at launch, retained 29 of the 56 companies in its benchmark index, the S&P/BMV Total Mexico Index. By maintaining more than half of the original number of constituents and selecting companies within their industries, the index remains relatively balanced from a sector perspective. Exhibit 2 shows the average sector exposure of the ESG index and the benchmark index from the time S&P DJI had enough ESG data to calculate this index.

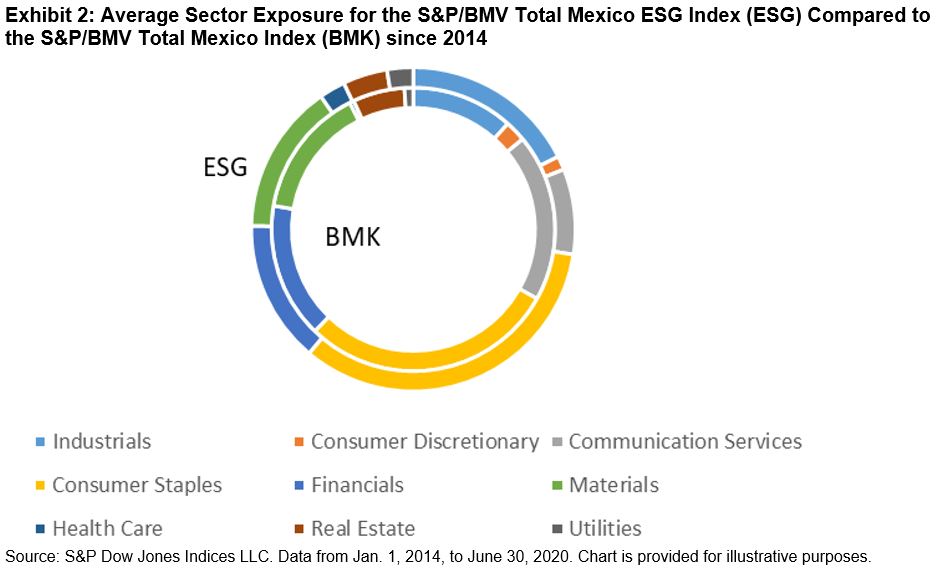

Because of the sector alignment and the ESG index constituents exhibiting an average beta of nearly 1—1.02 to be exact—the indices have historically performed largely in line with each other. This is attractive to many investors seeking to integrate ESG into their portfolios at a manageable level of risk.

In addition to this new index having achieved a similar risk/return profile as the market historically, market participants are also investing in better-performing companies from an ESG perspective—companies that align with their values. At launch, the composite ESG score for the S&P/BMV Total Mexico ESG Index was 59.6, a full 17 points higher than the composite score of its non-ESG benchmark index.

What does this higher score practically mean? It means more exposure to companies that have governance structures, human capital development, and environmental impacts better than their peers and in line with international standards, among many other positive qualifications. Further, it means that an investor using this index is aligning their investments with their values, thereby driving change in Mexico, creating a hopeful and sustainable future.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

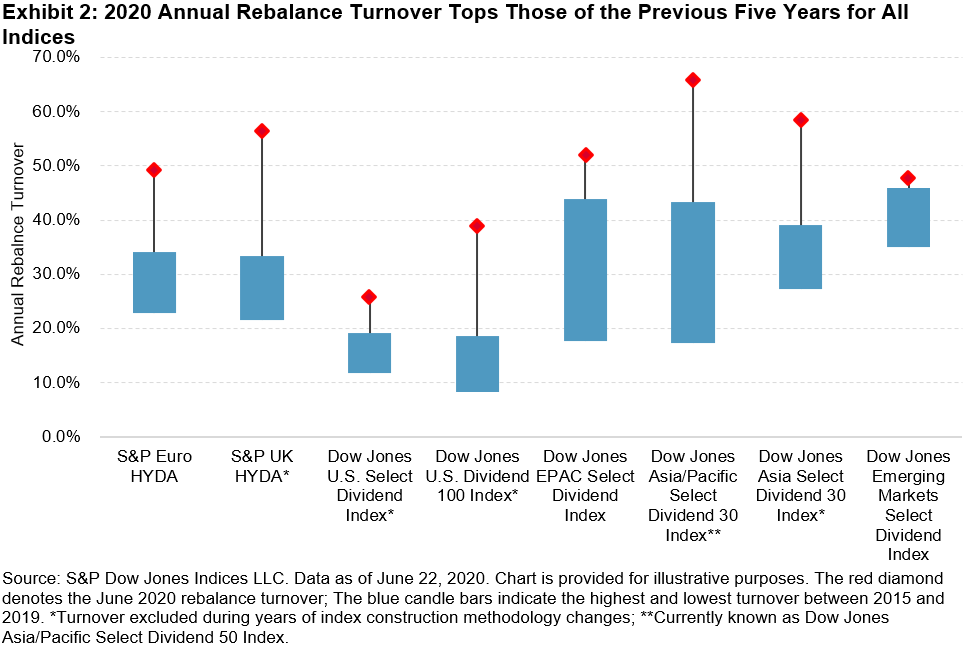

A Major Turnover Event by Historical Standards

A Major Turnover Event by Historical Standards