On Friday morning the GDP (Gross Domestic Product) for Q2 2018 is set to be announced, and the consensus estimate from the Wall Street Journal survey of more than 60 economists is at 4.1%, the highest (actual) growth since Q3 2014. Although forecasts greatly vary this quarter, the main factors likely influencing growth are tax policy, retail sales, international trade and manufacturing shipments.

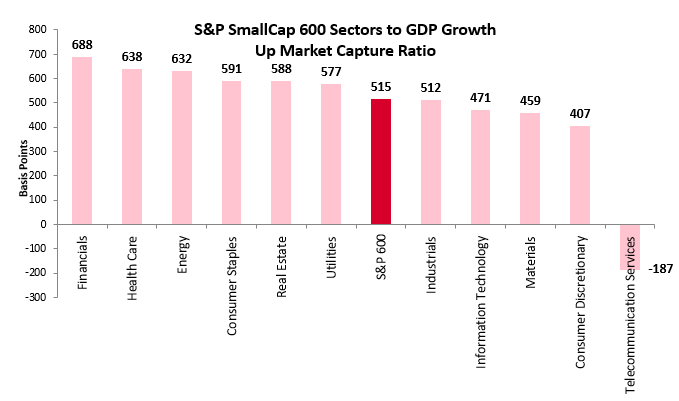

While U.S. GDP growth is beneficial for stocks in general, the growth has been better for small caps than for large- or mid-caps. On average for every 1% of GDP growth, the S&P SmallCap 600 has risen 5.2%, while S&P MidCap 400 and S&P 500 have risen a respective 4.9% and 4.0%. Within small caps, the financials, health care and energy sectors have risen most with growth, gaining on average 6.9%, 6.4% and 6.3%, respectively for every 1% of GDP growth.

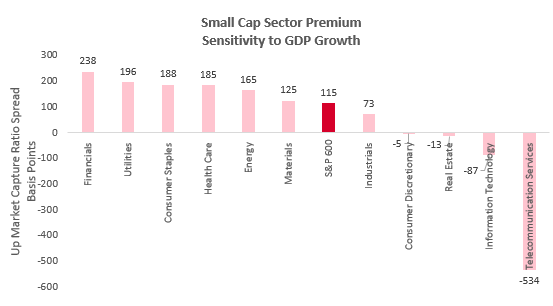

Although in small caps, financials have delivered 50 basis points more of return than health care from each 1% of GDP growth on average, the financial small cap premium is by far the most sensitive to GDP growth. For every 1% of GDP growth on average, small cap financials have returned 2.4% more than large cap financials.

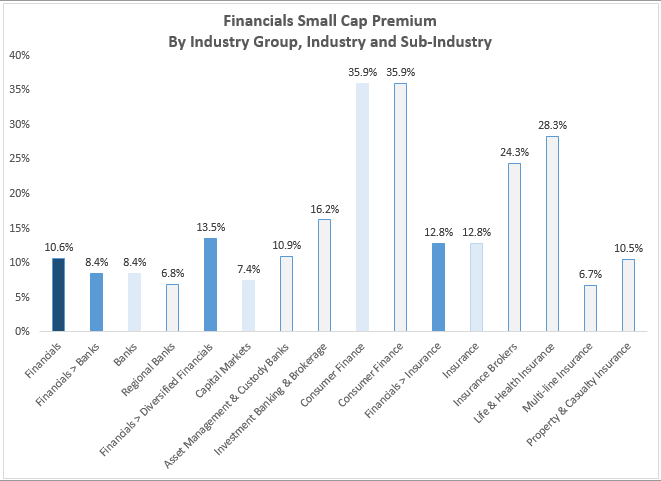

One contributing factor for the relatively large financials small cap premium is the percentage of revenues that are generated domestically from the small caps versus large caps. The small cap financials generate about 95% of revenues from the U.S., 17% more than the large cap financials. The result is the small cap premium in financials is 10.6% year-to-date through July 26, 2018. While all 3 industry groups of the small cap financials outperformed their large cap counterparts, the small diversified financials outperformed most by 13.5%, just ahead of the small cap outperformance by insurance of 12.8%, and more than the 8.4% premium of small banks.

Within the diversified financials, the small cap premium was greatest from the consumer finance industry that may be attributed to strong consumer spending that accounts for more than two-thirds of U.S. economic activity, and is likely being driven by lower taxes and a robust labor market. Similarly, small consumer staples have been more greatly benefiting than their large cap counterparts, outperforming by 16.6% YTD. Also contributing to the small cap premium in financials is the life and health insurance sub-industry and the insurance broker sub-industry, with respective small over large performance of 28.3% and 24.3%. This goes along with the small health care companies have been outperforming their large counterparts significantly this year by an impressive 31.3%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.