I recently completed several meetings with financial advisors in Kansas and Tennessee. Traveling to meet with advisors in their offices or at events is something that I enjoy doing and informs my love of the work that our team does in advisor education. However, I am troubled by a reoccurring conversation that came up. In some of these conversations, advisors spoke of positioning for “participate but protect.” Having experienced a long bull market and higher-than-average gains in 2017, the positioning is “keep it between the guard rails” to describe how they are investing now.

But are these same advisors really positioned to protect? What changes has a 10-year “age of Taurus” brought to their portfolios? That bull market has slyly and slowly encouraged some to allow equity allocations to creep back up to pre-global financial crisis (GFC) levels of 70% equity weighting or higher. While they should not feel comfortable with that, they shouldn’t feel alone. Some of the most well-known U.S. asset managers offering target date solutions are in that same place. Our most recent S&P Target Date Scorecard indicated that a majority of “To” target date funds were at 70% or greater equity allocation for the 2035 vintage, and the same was true for “Through” for the 2030 vintage. To get to a more conservative 60/40 allocation, one would need to be well within 10 years of retirement (see Exhibit 1).

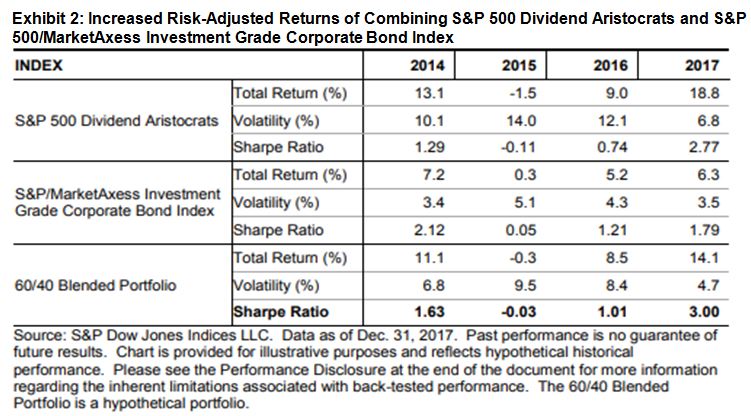

As a simple and uncluttered way to consider the risk/return of the more conservative 60/40 allocation, I commend Jason Giordano for his recently published Elevating the Aristocrats: Pairing the S&P 500® Dividend Aristocrats® with the S&P 500/MarketAxess Investment Grade Corporate Bond Index. His analysis of combining the S&P 500/MarketAxess Investment Grade Corporate Bond Index and S&P 500 Dividend Aristocrats is timely for an asset allocation discussion. In Exhibit 2, he shows the historical hypothetical[1] benefit in risk/return comparison to holding only the quality equity exposure of the S&P 500 Dividend Aristocrats during three market dips that have occurred in the U.S. equity market since the GFC.

A conclusion one might draw from this simplified portfolio example of data and analysis? Rather than lightening up on fixed income exposure to anticipate Federal Reserve actions, the advisor with an eye to protecting the portfolio may want to be more mindful of a prudent balance in their asset allocation.

[1] The S&P 500/MarketAxess Investment Grade Corporate Bond Index was launched on Jan. 9, 2017, so the data in his paper are back-tested data.

The posts on this blog are opinions, not advice. Please read our Disclaimers.