T-G-I-F. And I would’ve written something sooner about The Dow but the Wi-Fi in my underground bunker, where I retreated for the impending apocalypse, is spotty. I’ll need to do something about that if this keeps up.

Obviously, that’s a joke. I don’t have Wi-Fi in my bunker. But it’s no joke that this has been a volatile couple of days for the U.S. equity markets. Offered here are a few highlights (lowlights?) from a tumultuous week:

- A Weak Week – Closing at 24,190.90, the DJIA lost 5.21% over the last 5 days resulting in the worst weekly performance since the early days of January 2016. Then, a potential Chinese economic slump and crashing oil prices imbued the markets with pessimism. Ironically, and in contrast, many commentators pointed to good economic news as a leading culprit this time. As bad as it was, this week could have been worse: today’s volatile session – down sharply intra-day – eventually rallied for a 330+ point gain.

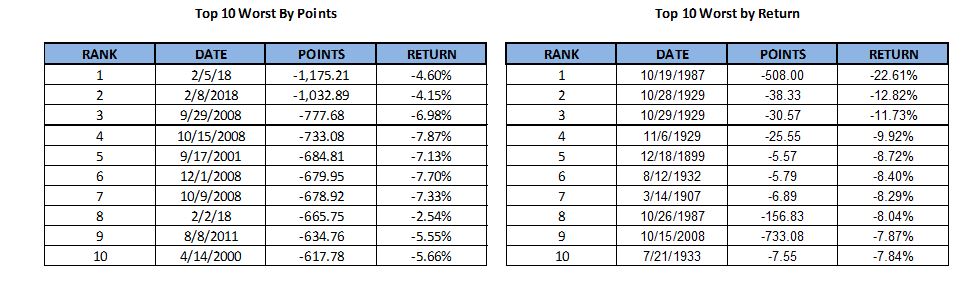

- 1,000 Point Days – Prior to this week, there had never been a single day 1000 point move. Now, there’ve been two. After a 665 point swoon last Friday, Monday piled on with an historic drop of 1,175.21 points (-4.67%). Then came Thursday’s fall of 1,032.89 (-4.15%). Keeping perspective, as repeatedly noted, while 1000 point declines make for frightening headlines, the percentage changes represented by those moves are not uncommon. To wit, there have been nearly 300 daily 4% or greater moves since the DJIA’s inception. Put another way, 3 of the top 10 worst point drops on record occurred during this recent spell; none of them, however, come anywhere near the worst percentage drops.

- I Can Go In, I Can Go Out – The generally accepted definition of a “correction” is a drop of 10% from recent highs; the DJIA both entered and exited correction mode this week. At Thursday’s close, the Average had fallen 10.36% from the high of 26,616.71 posted on January 26; with today’s rally, the DJIA is currently off 9.11% from that record.

- Company Contributions – Alas, the pain was widespread. For the week, every one of the DJIA’s 30 stocks made negative contributions for a total loss of over 1,330 points. The three biggest detractors were 3M (MMM), Boeing (BA) and UnitedHealth Group (UNH). Perhaps not surprisingly, these same three names were also the three biggest positive contributors during the Average’s huge run from 20k to 25k.

5. Volatility Spike – The return of volatility was clearly the most prominent theme this week. Two 1000 point declines plus two days of strong gains plus huge intraday swings throughout the week were evidence of whipsaw trading and increased realized & implied volatility. How much more volatile? The trailing 21 day volatility of the DJIA closed out last year at 6.58; today, that same measure is more than 4 times higher at 26.87.