As we approach the mid-year point of 2017 the muni bond market has not been shaken by a heavy news cycle of downgrades, negative watches and ever present Illinois and Puerto Rico downbeat press. Technical factors play a big role in overcoming this pressure but there are other compelling rationale in support of munis in the current environment.

Technical factors: the muni market new issue supply / demand imbalance in place for some time is further out of kilter as we approach the summer months. Low new issue supply cannot keep up the pace of demand. That demand in turn is historically higher in these months due to coupon reinvestment needs which is a phenomenon in the muni market due to large clusters of municipal bonds paying interest semi-annually in June.

Some additional factors: (not all factors discussed in this blog)

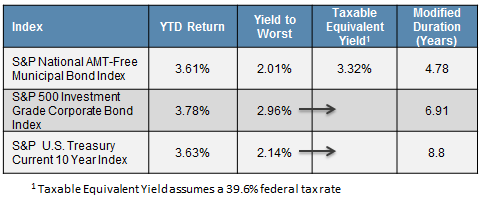

- Yield: investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index are yielding a tax-exempt 2.01%. Converting that into a Taxable Equivalent Yield results in needing a 3.3% yield for corporate bonds to keep the same amount of return as tax-exempt munis provide. At this writing, the S&P 500 Investment Grade Corporate Bond Index is yielding 2.96% and the S&P U.S. Treasury Current 10 Year Index is yielding 2.14%.

- Duration: investment grade municipal bonds currently have a shorter duration than investment grade corporate bonds which could make them an attractive option in the event rates begin to rise on the longer end of the curve.

Table: Select indices, their returns, yields & durations:

“The Kids are Alright” reference is to the song about troubled teens written by Pete Townshend of The Who and released by The Who in 1965.

For more information on S&P’s bond indices including methodologies and time series information please go to SPDJI.com.

Please also join me on LinkedIn .

The posts on this blog are opinions, not advice. Please read our Disclaimers.