Issuer name recognition and entity size seem to be factors in bond liquidity and as a result may be important considerations in index design. Tracking the trade activity of corporate bonds issued by the ‘blue chip’ companies of the S&P 500 Index indicates liquidity is improved for these bonds over other bond issues.

Of course, when making decisions about depth of liquidity there are some important elements of the markets to consider:

- There are many issuers of bonds and different types of issuers.

- Some issuers borrow infrequently and others come to the bond markets with higher frequency.

- Some issuers are well known entities to the investor community; others are smaller and less known.

- Many bonds can be issued from one entity, each with differing term structures (deal size, par amount, maturity, coupon, as well as redemption and security provisions to name a few).

- Bonds are often buy and hold assets.

- Bonds often represent long term obligations intentionally designed with maturities that match the useful life of the projects they fund.

Issuer name recognition and entity size as a factor can be illustrated by comparing the trade volume data of two indices: the S&P 500 Investment Grade Corporate Bond Index and the broader S&P U.S. Issued Investment Grade Corporate Bond Index. Both have the same inclusion rules with the difference being the bonds in the S&P 500 Index must be bonds from the S&P 500 companies.

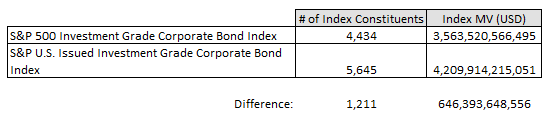

Table 1: Key index statistics as of December 2015:

What the data is telling us:

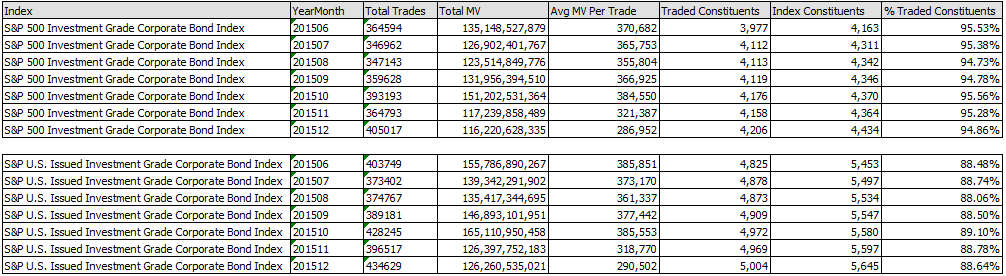

- For the period of June – December 2015, on average about 95% of the bonds in the S&P 500 Investment Grade Corporate Bond Index traded each month compared to 88.5% of the bonds in the broader index.

- Average trade size as measured by both market value and par value per trade has been similar in both indices.

- In December 2015, there were 405,017 trades of bonds in the S&P 500 Investment Grade Corporate Bond Index or 93% of the 434, 629 trades of bonds in the broader index.

- In December 2015, the S&P U.S. Issued Investment Grade Corporate Bond Index had 1,211 more bonds than the S&P 500 Investment Grade Corporate Bond Index. While those 1,211 bonds represented over 21% of the constituents they contributed less than 7% of the trading volume of bonds in that index.

Table 2: Trade data statistics for June – December 2015

Please contact us to receive the time series referenced above.

The posts on this blog are opinions, not advice. Please read our Disclaimers.