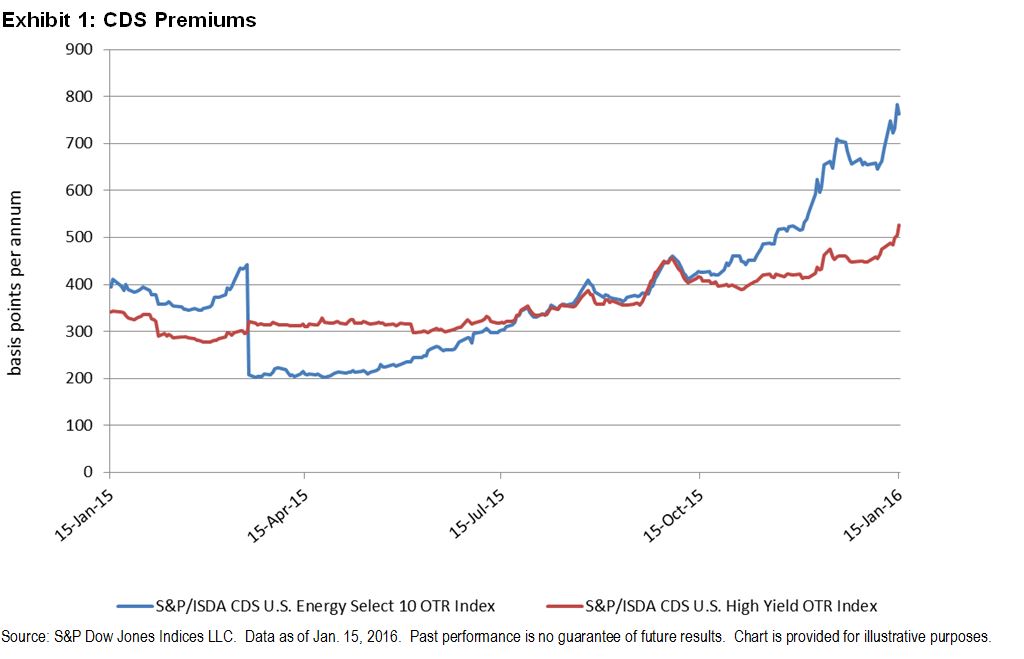

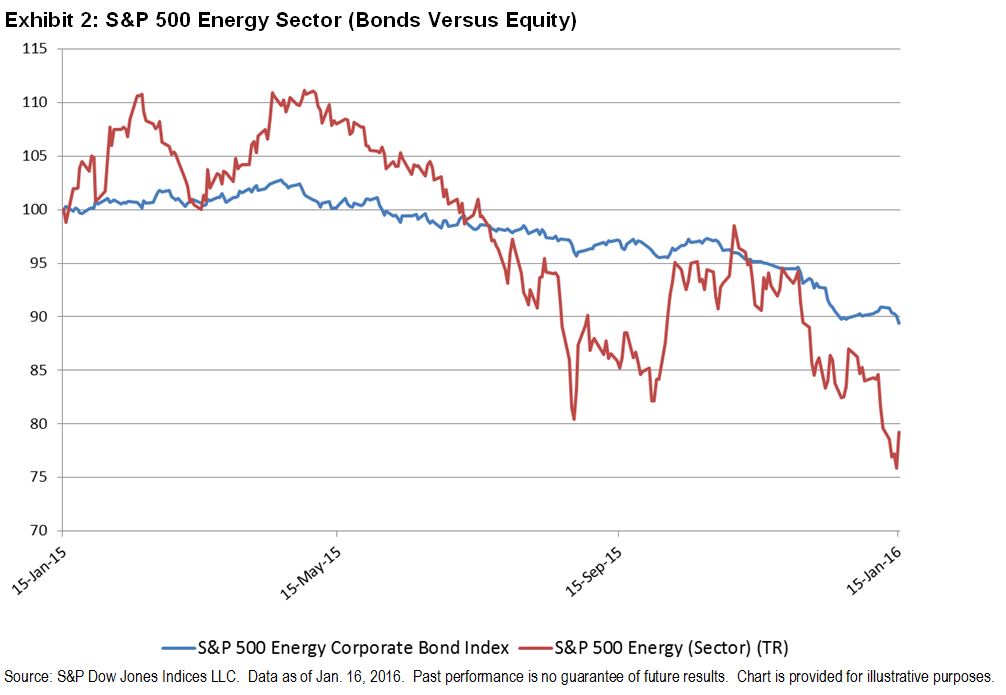

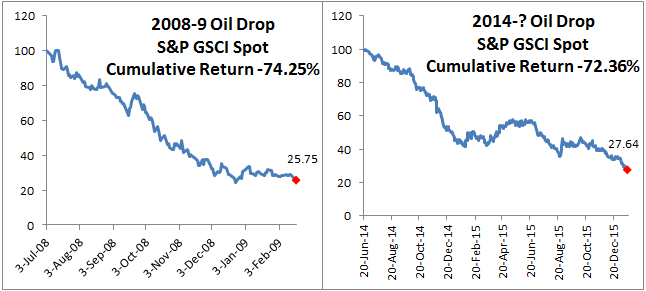

It has been the worst start in history for both stocks and commodities, and while rare, it is no accident. Fundamentally, this environment is the worst ever. It is like the demand crisis of 2008-9 combined with the supply war of 1985-6 – WITH a strong dollar. The oil drop from the peak in June 2014 is on the cusp of becoming the worst in index history, beating the 2008-9 drop.

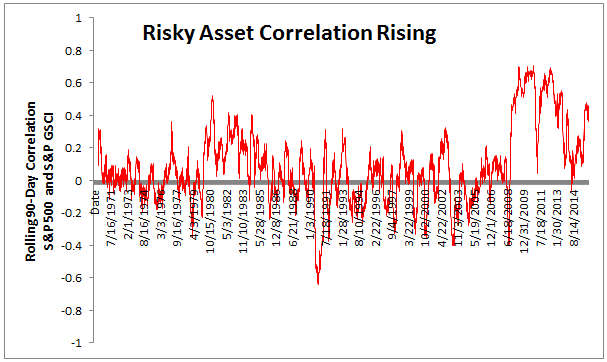

What’s worse is the oil crisis has spilled into other classes. The jitters started with the Chinese stock market crash back in July that sent stock volatility soaring. The fears got worse when the Fed raised rates as evidenced by the spiking correlation between the risky assets, stocks and commodities. The correlation now has quadrupled as stocks fall with commodities, erasing diversification benefits and making risk management difficult.

Today, there is a new risk-on/risk off based on rising interest rates. This is different than the risk on risk off we saw post the global financial crisis, since that one was from unprecedented quantitative EASING. One thing is the same – and that is the bi-modal view of either rising rates work – or they don’t. Right now it doesn’t seem like it’s working, so risk-off.

What are investors doing now?

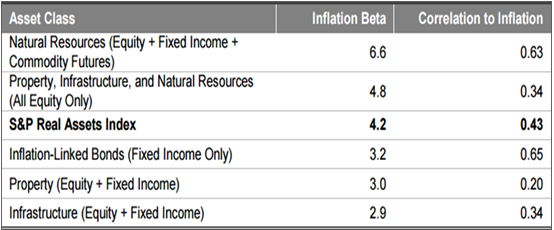

Mostly 3 things that may diversify away from stocks and commodities. 1. Going to cash; 2. Going to gold – though not the same safe haven it once was, it does diversify. However, the rates need to be higher, the dollar needs to be weaker and inflation needs to kick in to support gold prices; 3. Including other real assets like infrastructure, property and inflation bonds to preserve capital while getting inflation protection.

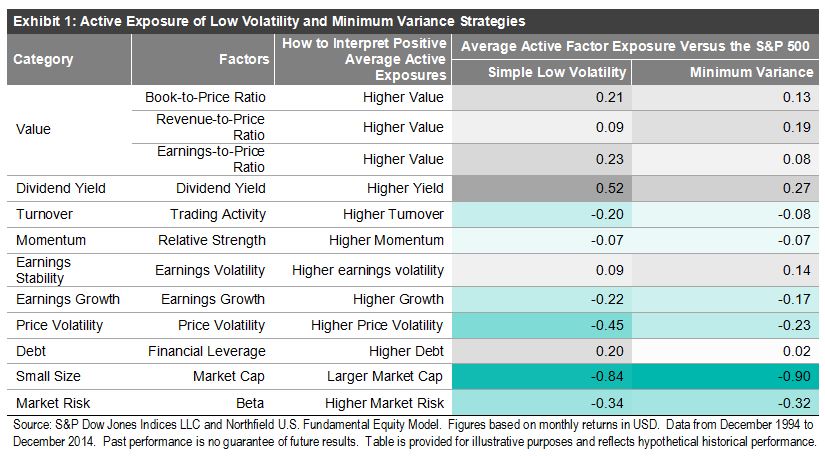

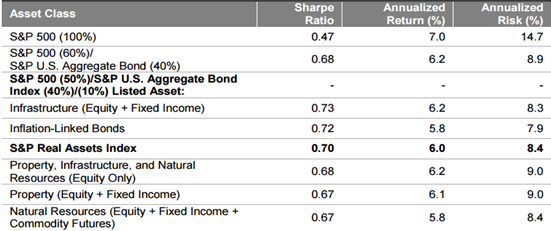

The combination of real assets allows investors to get inflation protection without giving up portfolio efficiency. Since two of the worst oil drawdowns in history have happened in the past ten years, the inflation protection from commodities is no longer worth the performance losses from a diversification standpoint. The losses are so big that the low average correlation has not reduced the risk enough to justify the loss.

The inflation beta of natural resources (equities, fixed income and commodity futures) is 6.6 that is the highest of any single real asset. While the equity real assets composite has relatively high inflation beta, its correlation to inflation is relatively low. The S&P Real Assets Index that uses both stocks and bonds of infrastructure, property, natural resources plus inflation-linked bonds has the highest inflation protection combination.

Now that is attainable without giving up on diversification. When natural resources are added to a portfolio of stocks and bonds, the Sharpe Ratio, a measure of risk-adjusted return, falls from the poor performance. On the other hand, infrastructure may provide a nice diversification benefit but fails to provide as significant inflation protection. The solution may be to combine them for stronger and more consistent inflation protection and diversification through risk management provided by the mix of not only real asset categories but by the asset class mix, including bonds and commodity futures in addition to stocks.

Learn more about how this works by reading our paper at:

For more information on real assets, I will be speaking at Inside ETFs next Monday.

The posts on this blog are opinions, not advice. Please read our Disclaimers.