Markets across the globe were rocked by volatility from sources new and old last month.

The old was a play-by-play repeat of the “taper tantrum” as capital fled from emerging markets in anticipation of a September date for the first rise in U.S. rates since 2006.

The new was triggered by evidence that the rollercoaster performance of equity markets in China (previously judged to be the result of high-octane day-traders learning the pain of a margin call) was also the first sign of a stall in the world’s economic growth engine.

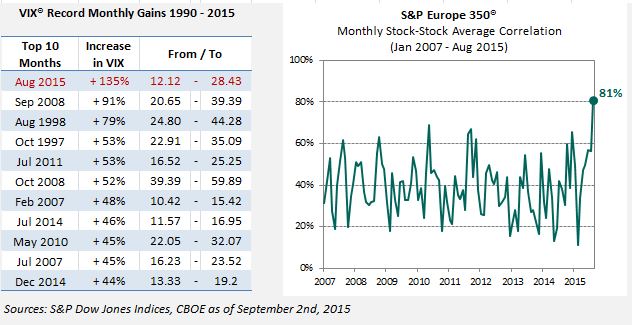

August was a month of records – the VIX® recorded its biggest ever monthly gain, the average correlation between European equities rose to their highest ever.

Why such high correlations in Europe, and such dramatic gains in VIX? The answer is twofold.

- August is typically a quiet month. When something “happens”, it tends to dominate. The only other major market to record a monthly stock-to-stock correlation in the 80’s was the U.S. S&P 500 during August 2011 (at that time, the failure to agree the budget threatened a technical default on U.S. Treasuries).

- There still remains very little dispersion. The world’s equity markets have been feeding on vast amounts of global, fiscal stimulus. Our limited historical data suggests that such environments result in very little distinction between the performances of different stocks. When every stock follows the same story, dispersion falls. The impact of this is there is less diversification in stock indices; their correlations rise and index volatility rises with it.

This makes for a fragile environment. As we saw in the “Flash Crash” of 2010, when correlations are high and dispersion is low, even a small and otherwise minor market disruption can have catastrophic consequences. This is the “bad” kind of market volatility, with few stocks providing refuge and little benefit to diversification. Be careful out there…

The posts on this blog are opinions, not advice. Please read our Disclaimers.