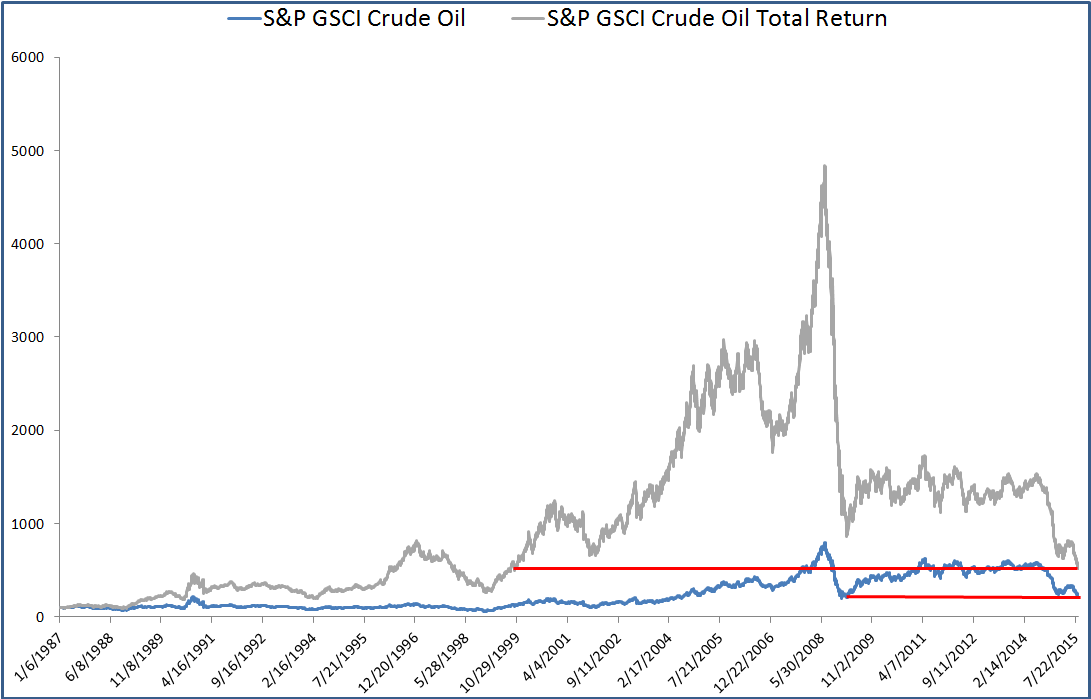

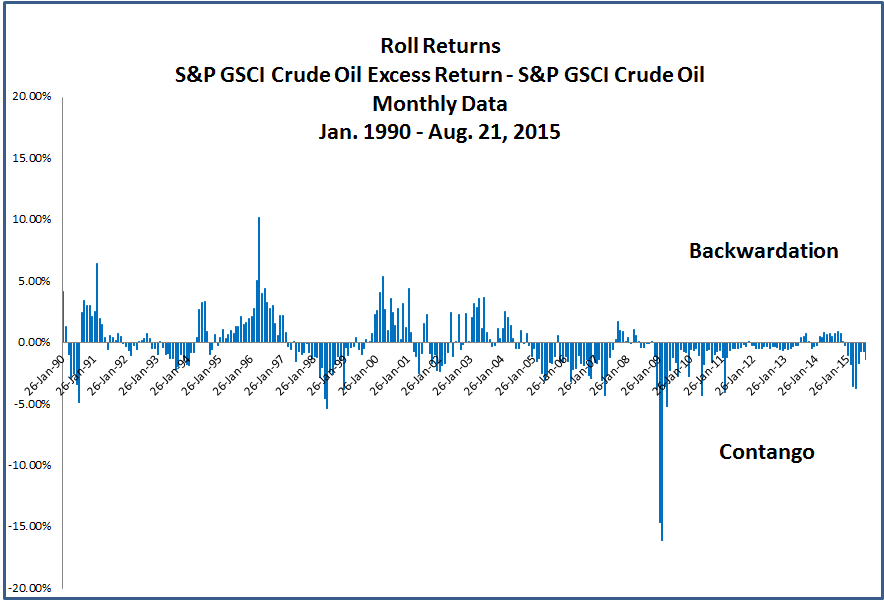

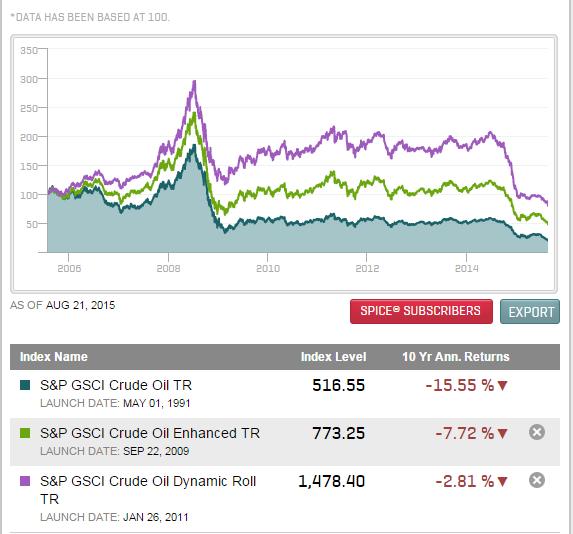

There is an old weather-predicting proverb that goes “red skies at night sailors delight; red skies in the morning sailors take warning.” Well, there has been a lot of red over the last two mornings, and it has not been in the hot August skies but more so in the global financial markets. Oil prices, which had recovered from a bad 2014, moved up from the January 2015 support price of USD 50 to a recent high of USD 63 in May. Since June 30, 2015, the price of oil has dropped from USD 60 to its current level of USD 39. The drop in the price of oil, in addition to other commodities, has boosted fears of a slowing global economy.

On the back of these fears, safe-haven investments, like government securities, have increased in demand. The yield-to-worst of the S&P/BGCantor Current 10 Year U.S. Treasury Index dropped 15 bps between Aug. 14-21, 2015, to 2.05% and is now even lower, at 2.03% as of Aug. 24, 2015. The yield had been as high as 2.49% as recently as June 10, 2015. The index had a total return of 1.53% for the month of August and 2.94% YTD as of Aug. 24, 2015.

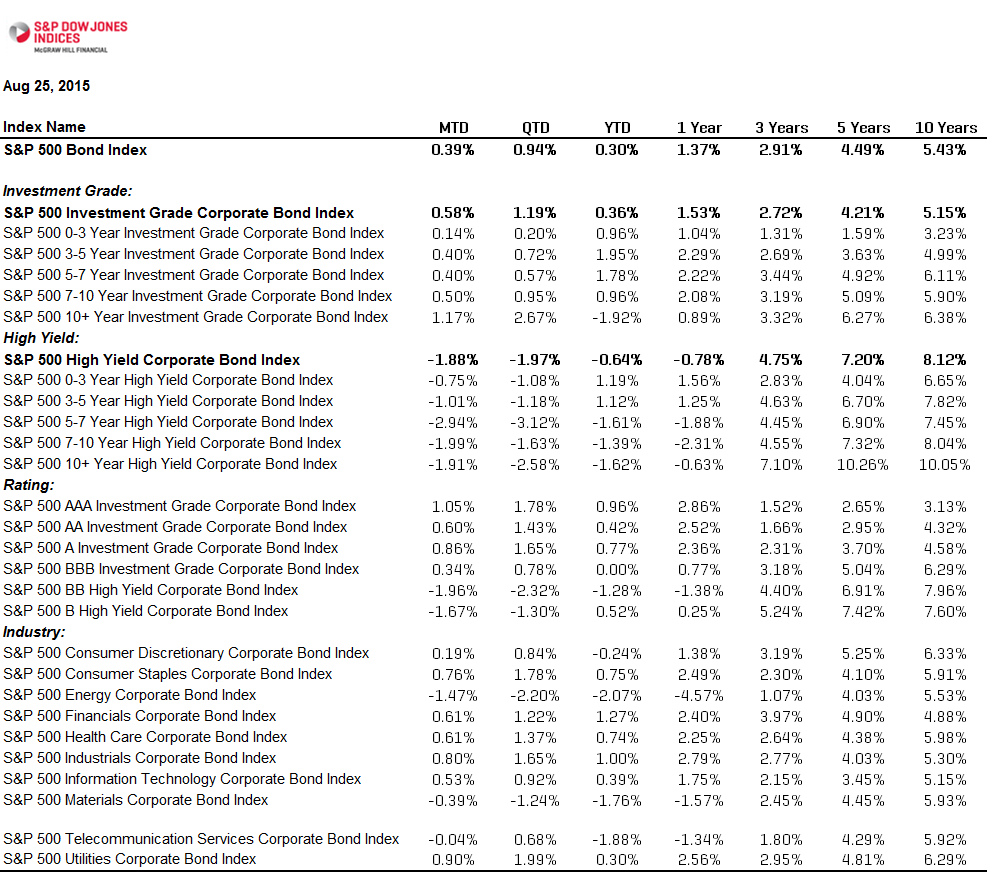

Recent events have highlighted the importance of the credit quality of investment holdings. The S&P 500® Bond Index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap U.S. equities. The bond index is a broad index that is designed to measure 430 of the 500 equity issuers who have issued debt, and it includes both investment- and high-rated securities. The majority of the index is investment-grade bonds, with only 7.6% of the issuers rated high yield. As of Aug. 24, 2015, the worst-performing sector for the month is energy. Energy makes up 7% of the S&P 500 Investment Grade Corporate Bond Index and 10% of the S&P 500 High Yield Corporate Bond Index.

As of Aug. 24, 2015, the overall bond index (S&P 500 Bond Index) has returned 0.39% for the month and 0.30% YTD, while the S&P 500 Investment Grade Corporate Bond Index has returned 0.58% month-to-date and 0.36% YTD, and the S&P 500 High Yield Corporate Bond Index has returned -1.88% for the month and -0.64% YTD.

Source: S&P Dow Jones Indices LLC. Data as of Aug. 24, 2015. Table is provided for illustrative purposes. Past performance is no guarantee of future results.

The posts on this blog are opinions, not advice. Please read our Disclaimers.