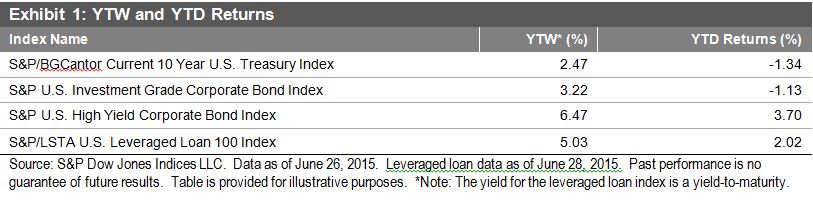

On June 28, 2015, the PBoC announced a 25 bps policy rate cut and a 50 bps targeted reserve ratio cut to support growth. Following the news, the money market rate opened lower and the yuan weakened. While there was no significant or immediate impact on China’s onshore bond market, the yield-to-maturity tracked by the S&P China Sovereign Bond Index continued its tightening trend seen in 1H 2015, dropped 48 bps to 3.08%, as of June 29, 2015. On the other hand, its total return added 0.56% in June, bringing its YTD return to 2.87%.

The S&P China Corporate Bond Index outperformed the S&P China Sovereign Bond Index and gained 4.26% YTD, and its yield-to-maturity tightened by 110 bps to 4.26% as of June 29, 2015—a level last seen in late 2010.

Looking at the country level, the S&P China Bond Index rose 3.24% YTD as of June 29, 2015, compared to the 1.95% YTD gain of the S&P Pan Asia Bond Index, which tracks the performance of local-currency-denominated government and corporate bonds from 10 countries in the Pan Asia region. The yield-to-maturity of the S&P China Bond Index tightened by 67 bps to 3.63% in the same period.

Exhibit 1: Yield-to-Maturity of the S&P China Bond Indices

The posts on this blog are opinions, not advice. Please read our Disclaimers.