“Middle Child Syndrome” is a psychological label for the empirical observation that middle children often do not receive as much parental attention as first and last-born siblings. But within the ashes of (relative) neglect may lay the seeds of a strong sense of independence, according to Catherine Salmon and Katrin Schumann in their book, “The Secret Power of Middle Children”[1].

Mid-caps stocks are also relatively neglected and often overlooked – to the detriment of equity investors who may miss out on holding future leaders in their respective industries before becoming better known large-cap names. The relative obscurity may be partially due to the academic focus on the size factor as a structural driver of returns. “Small Minus Big (SMB)”, as the Fama/French size factor is known, leaves no thought of “mid” as a way to drive long-term performance. Another reason may be the popularity of large-cap and small-cap benchmarks like the S&P 500 and Russell 2000. But mid-caps stocks, as a group, have some interesting characteristics. In many ways, they have the potential to offer the best of both worlds – possibly greater dynamism than grown-up siblings and more maturity than little brothers and sisters.

As it turns out, mid-cap stocks have a unique fundamental profile in comparison with large-caps or small-caps. For example, see the bar chart below showing the median of total assets among constituents of the S&P 500, the S&P MidCap 400, and the S&P SmallCap 600 indices:

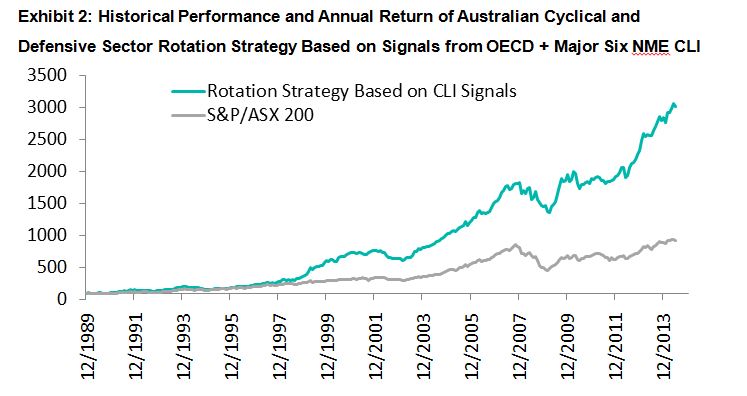

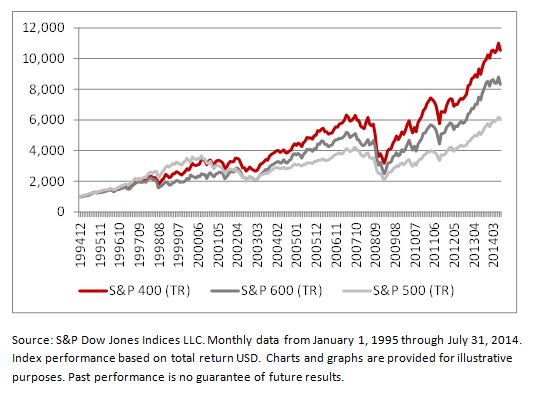

Mid-cap stocks also have performed very differently than other market segments. This is a chart of the total return index levels for the same three benchmarks:

If you are interested in hearing more about mid-caps as a unique market segment and mid-cap indexing, join S&P Dow Jones Indices and guest panelists for a webinar on September 4, 2014.

[1] Hudson Street Press, 2011.

The posts on this blog are opinions, not advice. Please read our Disclaimers.