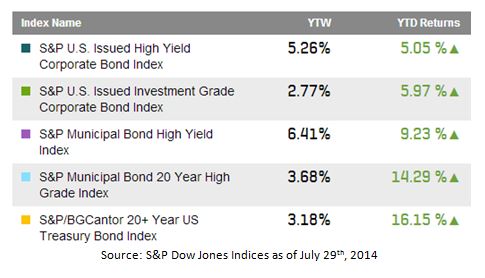

Long-term bonds have posted solid gains thus far in 2014, with rates holding low longer than most expected. The composition of the municipal bond market is heavily weighted with short duration bonds. The looming sentiment of rising rates and inflation has investors focused on reinvestment risk; however, a supply imbalance systemic of voters’ hindrance for governments to take on additional debt has municipals as a whole outperforming their peers. This is demonstrated in the S&P Municipal Bond 20-Year High Grade Index which has a YTD return of 14.29% due to low rates & short supply.

In a year of record corporate bond issuance from low cost/easily available financing in an environment where investors are looking anywhere for high-yield returns, corporates are under performing. The S&P U.S. Issued High Yield Corporate Bond Index has a YTD return of 5.05% compared to the S&P Municipal Bond High Yield Index which is 9.23%. The raw yield statistics can be misleading when considering tax implications, where the S&P Municipal Bond High Yield Index has a tax equivalent yield of 9.86%, far superior to its corporate bond counterpart of 5.26%.

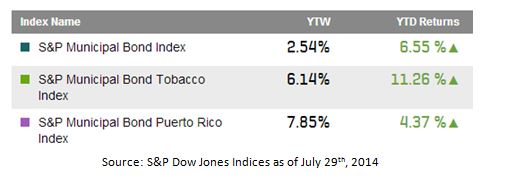

The heavily short-term weighted muni market is showcased in the broad market S&P Municipal Bond Index, which tracks over 75,000 bonds. The S&P Municipal Bond Index has a modified duration of 4.84 compared to 12.08 as seen in the S&P Municipal Bond 20-Year High Grade Index. Duration asserts not only the timeliness of cash flow repayment, but also the price volatility to interest rate changes. While the market prepares itself for rate inflation, those positioned for stagnant rates (long duration) have been benefiting.

Generally, all munis are surpassing analysts’ expectations in 2014, however, not all munis are created equal. High performing Tobacco bonds are up 11.26% YTD which can be seen in the S&P Municipal Bond Tobacco Index, whereas Puerto Rico bonds in the S&P Municipal Bond Puerto Rico Index continue to underperform at 4.37% YTD.

For a look into this week’s economic indicators, please refer to my colleague Kevin Horan’s recent post.

The posts on this blog are opinions, not advice. Please read our Disclaimers.