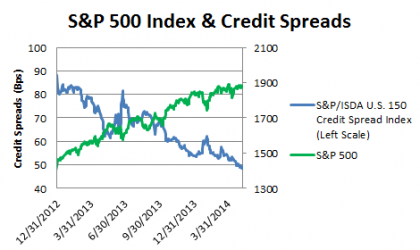

The companies in the S&P 500 that borrow the most money are enjoying the benefit of a positive credit market. The cost of buying default protection on the largest bond market borrowers in the S&P 500 is tracked by the S&P/ISDA U.S. 150 Credit Spread Index and has fallen to lows which can be an indicator of strength for the equity markets. The cost of buying default protection on $100,000 par value of bonds issued by these companies has dropped from $890 (89bps) on December 31 2012 to $490 (49bps) as of May 9, 2014.

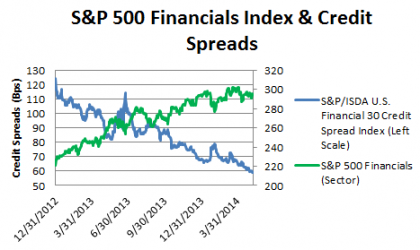

In the recent blog Sectors: A Tale of American Culture sectors and their weights are discussed in some detail. The financials sector represents approximately 16% of the S&P 500. Using that sector as an example, the change in credit spreads of the S&P/ISDA U.S. Financial 30 Credit Spread Index has dropped significantly over the last 16 months. This is reflecting that the credit markets perspective has turned incrementally more positive with credit spreads dropping from 125bps on December 31, 2012 to 59bps on May 9, 2014.