On Wednesday morning the US Bureau of Economic Analysis reported disappointing numbers for first quarter GDP with real growth a scant 0.1% at annual rates – essentially zero. The same day the Fed reported on its two day policy meeting stating that the economy continues to improve and, as a result, the reductions in quantitative easing will continue. Commentators are wondering if the Fed somehow didn’t see the GDP numbers or is suddenly not worried about low inflation and the weak labor market.

Rest assured that the Fed does read the GDP numbers, probably more closely than most people do. The headline GDP was nasty but there are some explanations. Exports fell sharply indicating weak economies abroad. Cold weather was also a factor, probably contributing to the decline in inventories. Consumer spending grew by about 2%, certainly not a big gain but almost ok. Moreover, consumer spending grew less in January than February and less in February than March. Monthly patterns within the quarter can have a surprising impact on quarterly GDP. To calculate consumer spending first quarter growth, one divides the first quarter dollar value of consumer spending by the figure for the fourth quarter of last year. The quarterly number is average of the the three monthly numbers. If the first quarter consumer spending consisted of no growth in January or February followed by a jump in March the average would be lower than if the growth was front loaded in January followed by two flat months. The first quarter consumer spending was tilted towards much more growth in March so the averaging understated the strength. The really bad GDP news was the poor results in housing and business investment, both are a real concern. So, digging into GDP, things were a bit better than they appeared, though not wonderful.

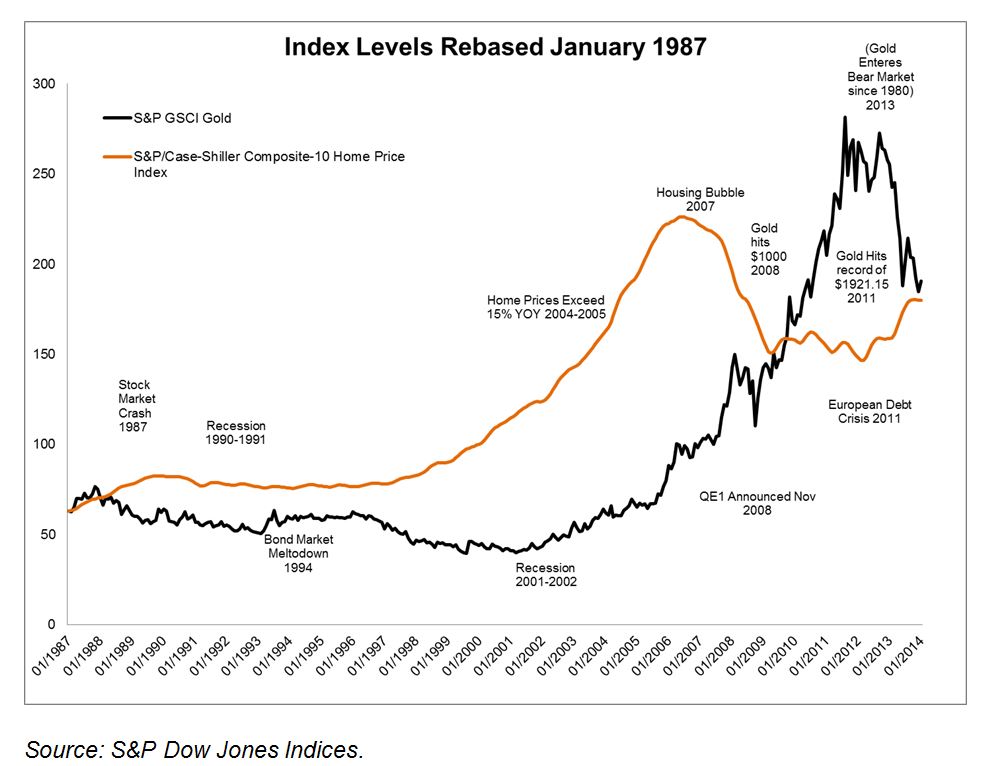

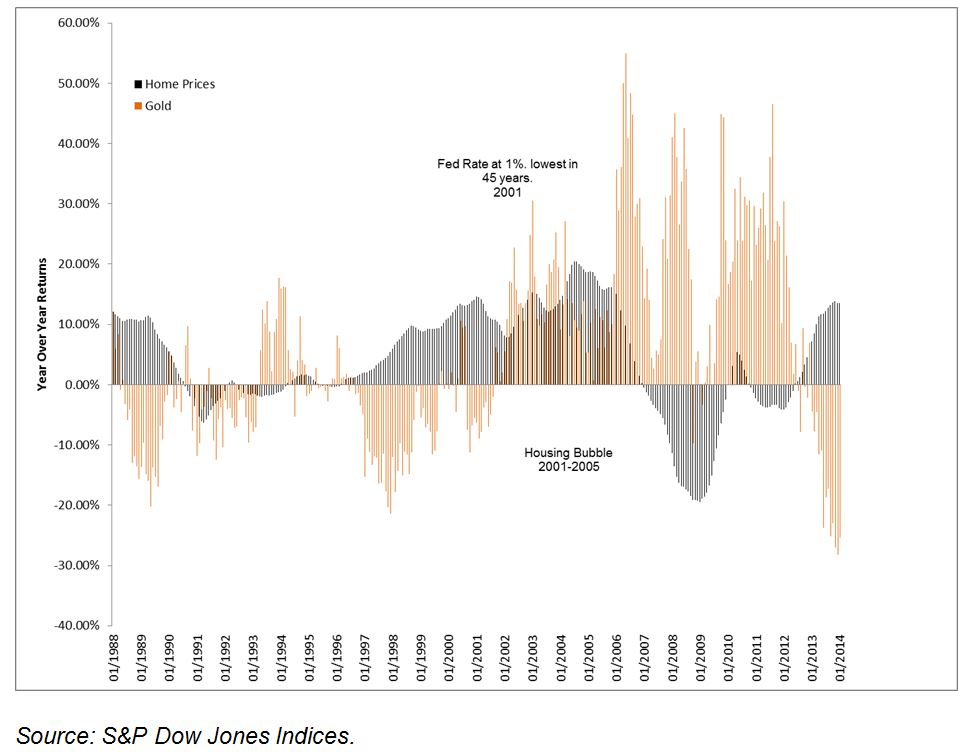

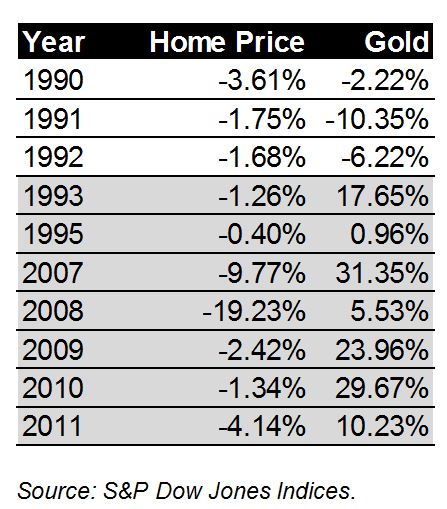

There are other reasons for the Fed to continue the process of ending quantitative easing. QE, even at reduced levels, is boosting asset prices of bonds, stocks and houses. Were the Fed to halt the QE wind-down we would be back to talking about bubbles. Second, aside from bubbles, the Fed would like to move back to a more normal monetary policy regime where it can reassert its control of interest rates. We have a long way to go and the first step is to do away with QE.

The posts on this blog are opinions, not advice. Please read our Disclaimers.