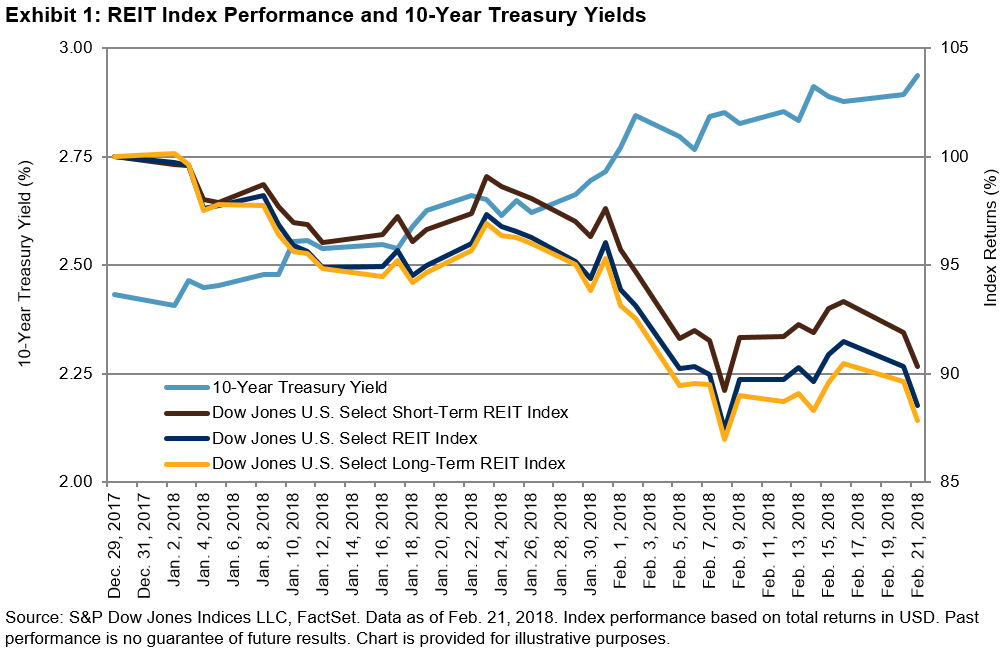

U.S. REITS have been lagging broad U.S. equities. During the recent climb in 10-year Treasury yields from the 2018 low of 2.41% on January 2, to as high as 2.94% on February 21, the Dow Jones U.S. Select REIT Index declined 11.2%. Though we have found that REITS have generally fared well over full cycles of rising rates, periods of sharper increases tend to weigh heavily on the minds of REIT investors.

However, REITs with shorter-term lease durations—apartments, hotels/resorts, manufactured homes, and self-storage—have generally fared more favorably. Theoretically, these REITs should be less sensitive to interest rates since they can reprice their rental agreements more quickly. The performance of the Dow Jones U.S. Select Short-Term REIT Index[1] illustrates this concept well, falling a lesser 9.3% over the same period, while its counterpart, the Dow Jones U.S. Select Long-Term REIT Index, fell 12.3% (see Exhibit 1).

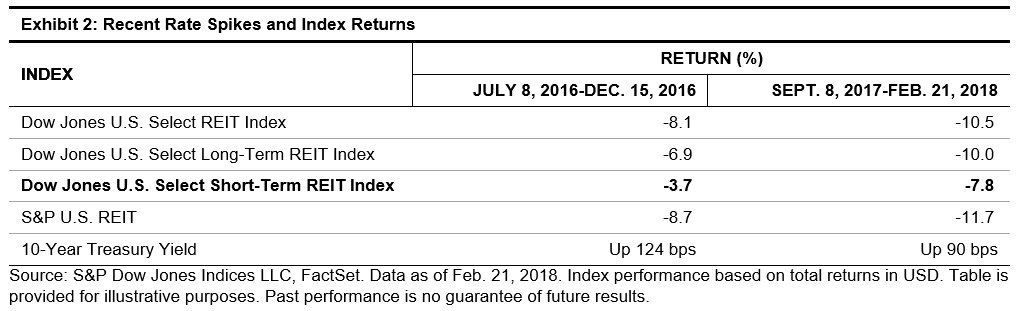

If we expand the data to include the full run of the two most recent spikes in rates, we see that the Dow Jones U.S. Select Short-Term REIT Index has outperformed benchmark REIT indices. The performance of the Dow Jones U.S. Select REIT Index has been somewhat insulated by its exclusion of net-lease REITs, which tend to have relatively high sensitivity to interest rates. For this reason, we have also included the S&P U.S. REIT, which includes net-lease REITs as an added comparison (see Exhibit 2).

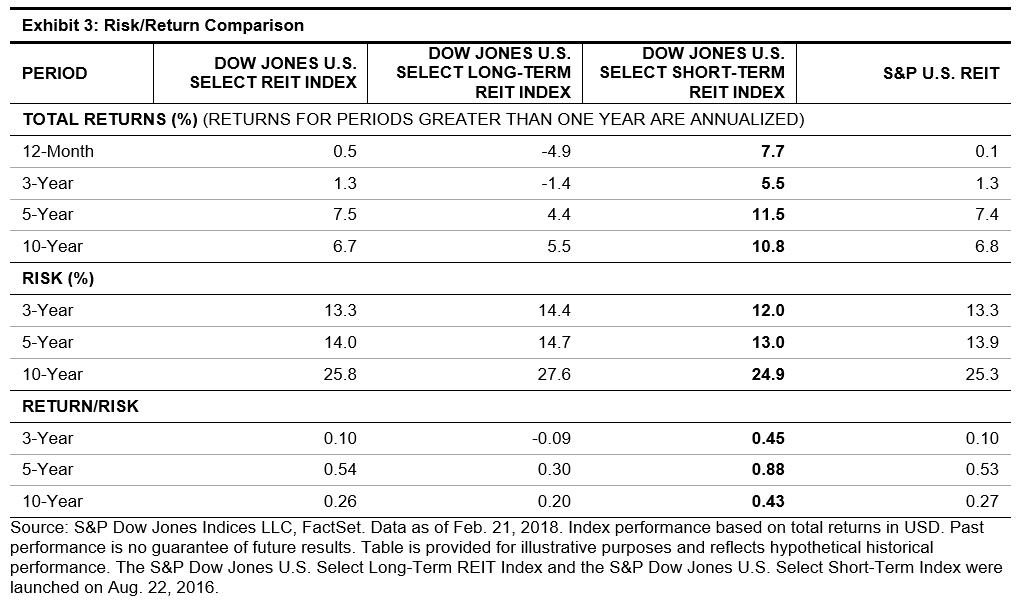

The Dow Jones U.S. Select Short-Term REIT Index has significantly outperformed the broader REIT market over the long run, with modestly lower volatility. This effect seems to be a byproduct of the index’s less-severe drawdowns during periods of rapidly rising rates.

It may be a good time for REIT investors to consider the duration of their REIT holdings. The Dow Jones U.S. Select Short-Term REIT Index may offer beneficial risk/return characteristics when compared to benchmark REIT indices, particularly during periods of rapidly rising rates.

[1] https://spindices.com/documents/education/talking-points-dj-us-short-term-reits.pdf

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Chart is provided for illustrative purposes. Assumes that the first dollar of income is received at the end of the first year of retirement. Present value calculation assumes a hypothetical discount rate

Chart is provided for illustrative purposes. Assumes that the first dollar of income is received at the end of the first year of retirement. Present value calculation assumes a hypothetical discount rate