When a company makes profit, it may choose to reinvest all of its earnings (common for growing stage companies) or pay back some to its shareholders in the form of dividends (for more mature companies). For market participants who seek a steady income stream and potential dividend reinvestment opportunities, dividend strategies can be one potential option.

Numerous academic and practitioner studies as well as empirical evidence have shown that, over the long term, dividend-paying stocks tend to outperform non-dividend-paying stocks and the broader market.[1][2] Furthermore, if a company is committed to paying dividends, we can reasonably think that the company is profitable, which is key for future capital appreciation.

One way to measure the attractiveness of an income-oriented strategy is its dividend yield. Companies with high dividend yield can be generally considered desirable if their fundamentals support a high payout ratio. This is because dividend yield alone only tells part of the story. We know from the dividend yield formula, computed as a stock’s dividend amount divided by its share price, that both dividend payment and share price influence yield level. All else equal, a high dividend yield coming from stable or increasing dividend payments is superior to the one stemming from declining price.

Since dividends are paid out in cash, the amount of distributable cash flow that a company holds should be considered when evaluating the sustainability of dividends. Distributable cash flow can be estimated from free cash flow, which is the excess cash generated by a company’s operating activities, excluding capital expenditures. When a dividend-paying company demonstrates positive or growing free cash flows, it is an indication that the company has the financial strength to fund its future payout, since its dividends are supported by sufficient cash. On the other hand, negative or decreasing free cash flows may signal insufficient cash flows for a company’s operational growth.

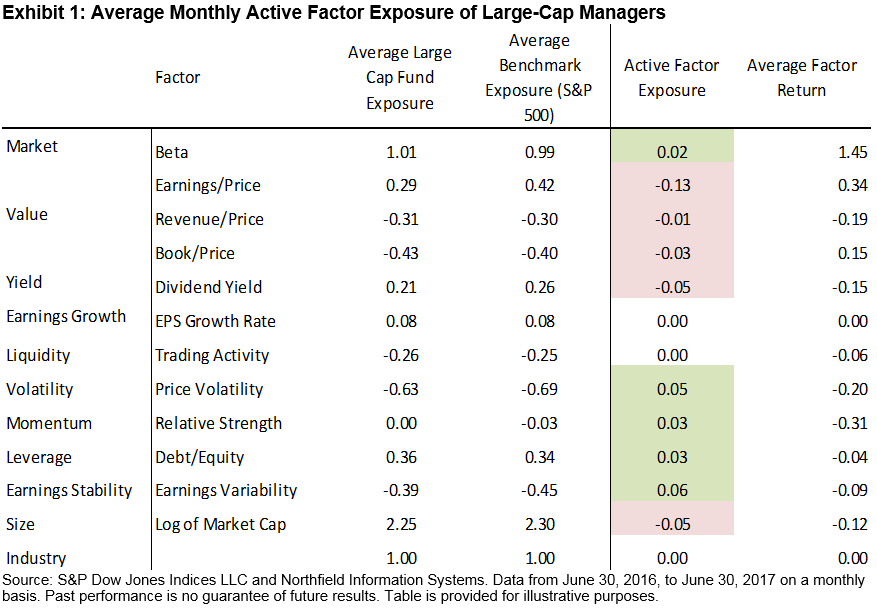

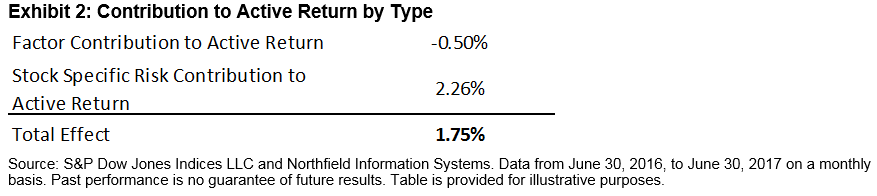

The recently launched S&P 500 Dividend and Free Cash Flow Yield Index combines dividend yield and free cash flow yield in the constituent selection process. Only sector leaders exhibiting both high dividend yield and free cash flow yield are included in the index. The index has demonstrated an attractive yield level, strong tilt to value characteristics, and attractive risk-adjusted returns compared with the S&P 500 (see Exhibit 1).

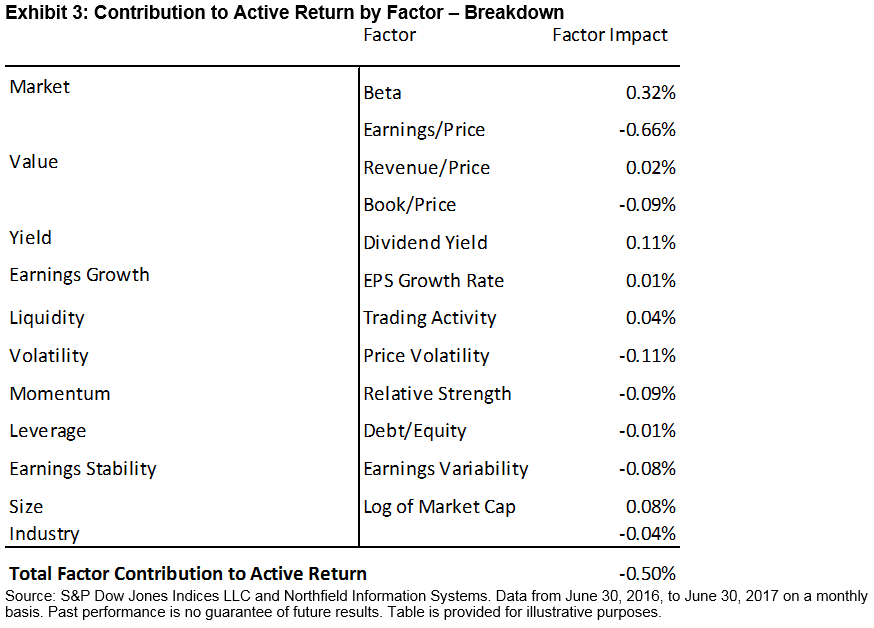

But did adding free cash flow yield help reduce the risk of dividends being cut? We looked at the dividend decrease or suspension by S&P 500 constituents for the last decade (2007-2016). The percentage of dividend reductions for the S&P 500 Dividend and Free Cash Flow Yield Index has been lower than that of the S&P 500 in 6 out of 10 years (see Exhibit 3). In 2009, the highest number of dividend cuts occurred in the stock market in over 50 years,[3][4][5] and the dividend investment strategy suffered the most as companies preserved cash to get through the financial crisis. However, we see that, overall, a company was more likely to sustain its dividend yield level when there were adequate free cash flows.

Our analysis of the combined high dividend and free cash flow yield characteristics shows that a durable dividend income could be achievable when the dividend yield is supported by high free cash flow yield, which will be discussed in coming blogs.

[1] Ploutos. “Do Dividend Stocks Outperform?” 2016.

[2] J. Siegel. “The Future for Investors: Why the Tried and the True Triumph Over the Bold and the New.” 2005, pp. 127.

[3] Seeking Alpha. “2009: A Bad, Bad Year for Dividends.” Jan. 7, 2010

[4] Seeking Alpha. “Everything You Ever Wanted To Know About Dividend Cuts But Were Afraid To Ask.” Nov. 15, 2014

[5] New York Times. “As Dividends Have Fallen, So May They Rise.” Jan. 8, 2010

The posts on this blog are opinions, not advice. Please read our Disclaimers.