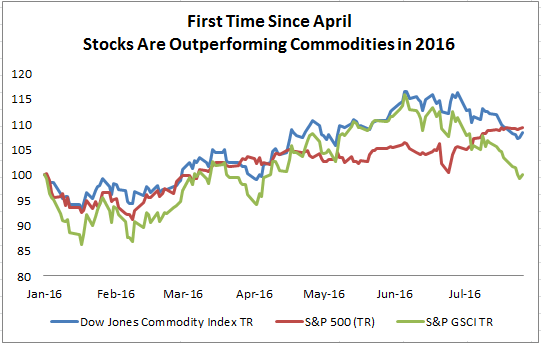

July was a bloodbath for commodities in the Dow Jones Commodity Index (DJCI) losing 6.0% and in the S&P GSCI losing 9.6% in total return. Although the equally weighted DJCI is still up 7.4% YTD through July 29, 2016, the S&P GSCI that is world-production weighted gave up all its gains from Q2 and is now negative 65 basis points for the year, allowing stock performance in 2016 to overtake commodities for the first time since April.

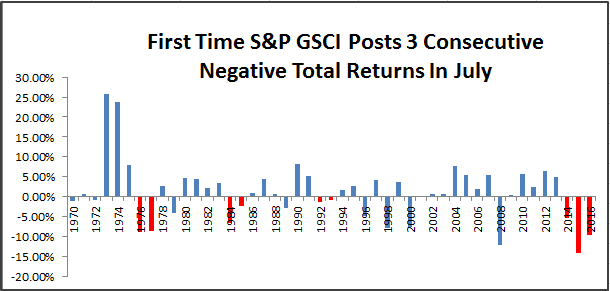

For the S&P GSCI with history going back to 1970, this is the 3rd worst July on record, only after July in 2008 and 2015 when the index lost 12.2% and 14.1%, respectively. This is also the first time ever there have been 3 consecutive negative July’s (July 2014 lost 5.3%.) It is pretty unusual to even see two consecutive negative July’s (1976-77, 1984-85 and 1992-93) given it is mostly a seasonally positive month, posting gains about 2/3 of the time.

In total, 16 of 24 commodities lost in July, which is the most since November’s Nightmare in 2015 when 22 were down. The month’s performance was highly segmented by sector with major losses from energy (-13.6%,) agriculture (-6.5%) and livestock (-7.4%.) Brent crude and (WTI) crude oil each declined notably -13.5% and -15.3%, respectively, in their 2nd worst July and 13th worst month ever on declining Chinese demand and rising supplies. Further, lean hogs posted its 4th worst month on record, -17.5%, and its biggest loss since Aug. 2002. Also, gasoil posted its 6 worst month on record, -16.8%, only the worst since Dec. 2015, but its worst July ever. All the single commodities in these sectors lost except cocoa +0.4% and cotton, the best performer of all, gained 15.4% from plunging inventories due to drought. This is cotton’s 13th best month and fifth consecutive positive month, driving its longest winning streak since Nov. 2013 – Mar. 2014.

However, cocoa and cotton weren’t the only bright spots in commodities in July. Both industrial and precious metals performed well, gaining 2.0% and 3.1% for the month in the S&P GSCI, respectively. Aluminum was the only loser, down slightly, shaving off 79 basis points from oversupplied markets and excess capacity. Nickel gained 12.4%, the most of any metal in the month on stainless steel production, though zinc’s gain of 6.5% brings its 2016 performance up to an impressive 38.5%, surpassing gold’s 2016 gain of 27.1%.

While gold held onto its record gain post Brexit vote, silver showed its sensitivity, adding 9.3% in July more than quadruple gold’s monthly gain of 2.3%. This may indicate real fear hasn’t gripped investors into holding gold instead of silver yet and that they are willing to take some economic risk from industrial applications of silver. On average when gold rises, silver rises about 2.7 times as much, but when gold falls, silver falls about twice as much. Though in crisis times, gold often gains while silver falls. This last happened in Aug. 2015 around the Chinese stock market volatility, but also occurred in the global financial crisis, tech bubble burst, Black Monday and the early 80’s recession.

Last, one more potentially positive note is that nine commodities are showing positive roll returns, measuring shortages. This is happening in corn, cotton, feeder cattle, lean hogs, live cattle, natural gas, soybeans, sugar and wheat, It is the most since Mar. 2015 when 11 commodities were in this condition, and is particularly rare for natural gas which hasn’t seen a positive roll in 18 months. Overall, it is a complete turn around from the commodity conundrum experienced in April despite the record positive performance just 3 months ago.

Our 10th Annual Commodities Seminar takes place in London on 29th September. Additional information and registration are available online now. #SPDJICommods

The posts on this blog are opinions, not advice. Please read our Disclaimers.

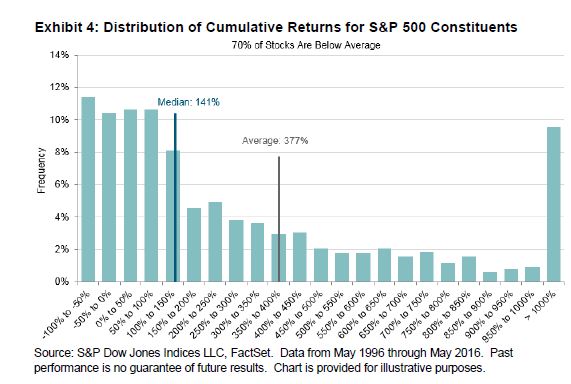

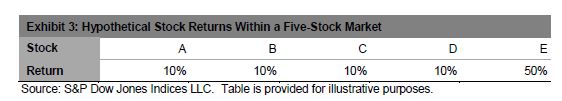

We can form portfolios of various sizes from these five stocks. There are five possible one-stock portfolios, four of which underperform the market as a whole. Alternatively, there are also five possible four-stock portfolios, four of which outperform the market as a whole. The expected return of the complete set of one-stock and four-stock portfolios is the same 18%, but the distribution of portfolio returns is different. In this case, holding more stocks increases the likelihood of outperformance.

We can form portfolios of various sizes from these five stocks. There are five possible one-stock portfolios, four of which underperform the market as a whole. Alternatively, there are also five possible four-stock portfolios, four of which outperform the market as a whole. The expected return of the complete set of one-stock and four-stock portfolios is the same 18%, but the distribution of portfolio returns is different. In this case, holding more stocks increases the likelihood of outperformance.