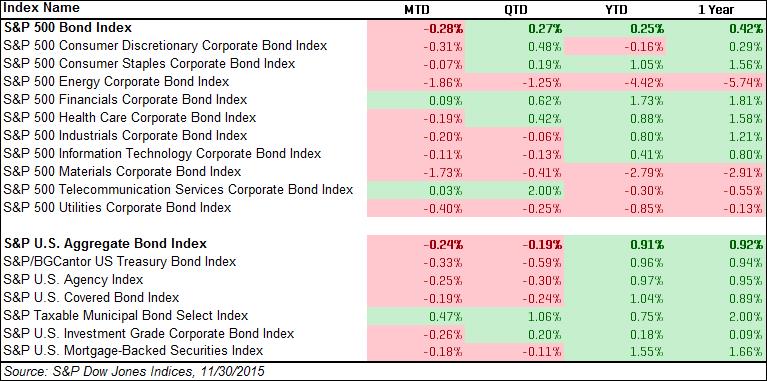

Following months of uncertainty, the U.S. Federal Reserve has indicated that there could soon be a hike in the Federal Funds Target Rate. Interest rates have been kept in a range between zero and one-quarter of a percent since December 2008 and have not risen since June 2006.

As interest rates have been at historically low levels for nearly the last seven years, some fixed income investors have shifted their focus to senior loan securities with floating-rate characteristics, such as interest rate floors, to protect themselves in the event of falling rates. Interest rate floors protect the loan interest rate by increasing the loan interest rate to the spread plus the floor if the reference rate ever falls below the floor. Simply put, the formula for loan rates in these structures can be stated as follows.

Loan Interest Rate = Maximum of (Reference Rate or Floor) + Spread

As of Nov. 28, 2015, the S&P/LSTA U.S. Leveraged Loan 100 Index consisted of 100 senior loans, of which 91 had interest rate floors based on the Federal Funds Target Rate. Of those loans, 31 had a floor of 0.75%, 55 had a floor of 1.00%, and 5 had a floor of 1.25%. As the Federal Funds Target Rate is currently below these floors, we know that the loan interest rates are currently established by the interest rate floors instead. This implies that as interest rates begin to rise, we may not see an immediate impact on senior loans with interest rate floors. Lenders may have to wait until the Federal Funds Target Rate rises above 0.75% for the rising interest rates to make a significant impact on this basket of loans.

The posts on this blog are opinions, not advice. Please read our Disclaimers.