It has been a rough start for commodities in 2015 with only six (natural gas, aluminum, lead, sugar, gold and silver) posting gains so far. At our commodities seminar in London last Sept, our speakers agreed picking a winner in this environment is diificult. However, it looks like one of our panelists may have done the job and picked “long sugar” as his best guess.

It is possible he based his guess on fundamentals that indicate rebalancing is often a source of return in commodity investing where mean reversion works by capturing systematic opportunities. In 2014, sugar lost 30.9% with a peak to trough drawdown from March through Dec., ending the year with a 1.8% weight in the world-production weighted S&P GSCI.

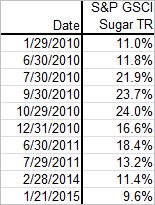

As of the close yesterday, Jan. 21, 2015, sugar’s weight had increased to 2.2% (18.7% growth) with a YTD return of 9.64%. It is the best month for sugar since Feb. 2014 and the last time we saw a January this sweet for sugar was in 2010 when it posted an 11.0% gain.

According to a Reuter’s article, sugar is rising after the Brazilian government restored a fuel tax on gasoline and diesel that is likely to encourage Brazil to produce more ethanol biofuel from sugar. It has also been reported that India is considering higher subsidies for raw sugar exports to cut large stockpiles.

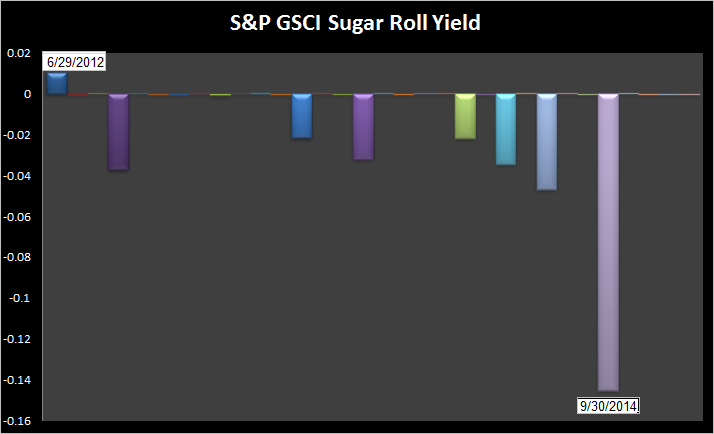

It is possible these interventions may be what sweetens sugar’s term structure given there hasn’t been significant shortages indicated by backwardation (adding more than 1% to the excess return) since June 2012.