This morning’s Wall Street Journal joined (actually, re-enlisted in) the chorus of those arguing that 2014 would be a time for stock pickers to “shine.” The lynchpin of the Journal‘s case will be familiar to advocates of a “stock-picker’s market.” That argument is that since correlations in the U.S. equity market are declining (perhaps as a consequence of the Federal Reserve tapering its support of the Treasury market), stock selection strategies will perform better than in a more macro-driven investment environment.

That conclusion may turn out to be correct — we’ll know in less than a year’s time. But it won’t be correct for the reason the Journal, and so many others, typically cite.

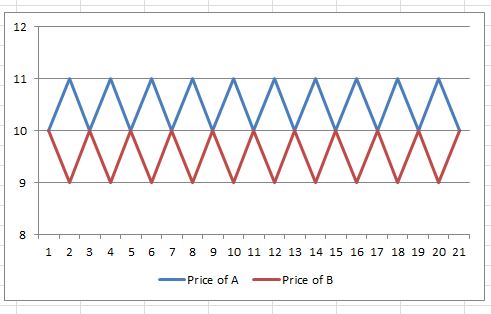

Correlation is largely a measure of timing — it tells us whether two assets tend to go up and down at the same time. Here’s a simple illustration:

Stock A and stock B are perfectly negatively correlated — whenever one goes up, the other goes down. But their returns are identical. An omniscient day trader would benefit hugely from their negative correlation. For a stock picker with a longer time horizon, it doesn’t matter — his return is the same regardless of which stock he picks. Despite the negative correlation, that doesn’t strike us as a good environment for stock picking.

Stock A and stock B are perfectly negatively correlated — whenever one goes up, the other goes down. But their returns are identical. An omniscient day trader would benefit hugely from their negative correlation. For a stock picker with a longer time horizon, it doesn’t matter — his return is the same regardless of which stock he picks. Despite the negative correlation, that doesn’t strike us as a good environment for stock picking.

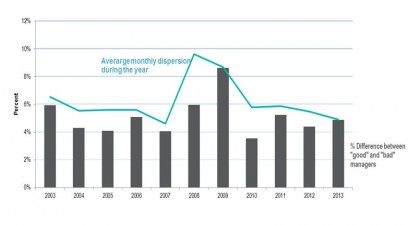

Dispersion gives us a better measure of the potential opportunity for stock pickers. Unlike correlation, which is a measure of timing, dispersion is a measure of magnitude — specifically, of the extent to which the return of the average stock differs from the market average. In a high dispersion environment, there’s a relatively large gap between the “best” and the “worst” stocks; when dispersion is low, the gap is small. We can think of dispersion as a measure of the value of successful stock selection:

The line in the graph above represents the average dispersion for the calendar year in question; the bars represent the interquartile range (i.e. the 25th percentile minus the 75th percentile) of large cap core equity managers in our year-end SPIVA survey. The relationship isn’t perfect, but it’s certainly true that the gap between better- and worse-performing managers tends to be greater when dispersion is higher.

The line in the graph above represents the average dispersion for the calendar year in question; the bars represent the interquartile range (i.e. the 25th percentile minus the 75th percentile) of large cap core equity managers in our year-end SPIVA survey. The relationship isn’t perfect, but it’s certainly true that the gap between better- and worse-performing managers tends to be greater when dispersion is higher.

And so what does dispersion tell us? Dispersion in calendar 2013 was lower than for any year since 1991. Recently, though, dispersion has begun to climb. At the end of March, S&P 500 dispersion stood at 4.90%. For the 30 days ended April 14th, dispersion had risen to 5.9%. This reading is still below average by historical standards, but well above the lows of 2013. If dispersion continues to trend upward, that could make 2014 a “stock-picker’s market.” And if 2014 is a “stock-picker’s market,” it will be because dispersion increased, not because correlation fell.

The posts on this blog are opinions, not advice. Please read our Disclaimers.