This morning’s Wall Street Journal cites an adviser who opines that “the current stock market environment favors…active fund managers, who pick individual stocks in an attempt to beat broad market indices.” This immediately raises the question of how to define a stock picker’s market, and how to determine whether today’s conditions are more auspicious for stock picking than they were, say, a year ago?

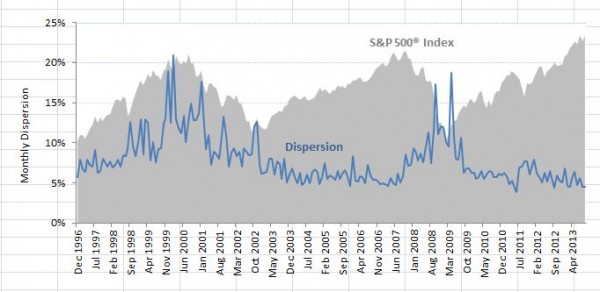

We recently introduced a metric called dispersion, one application of which is to answer precisely this sort of question. Dispersion is a cross-sectional measure — that is, it tells us at any point in time whether the constituents of a particular index are behaving largely alike or largely differently. Times of high dispersion represent great opportunities for stock pickers; low dispersion, not so much. We plot dispersion for the S&P 500 Index here:

As the graph shows, the S&P 500’s dispersion is very near the low end of its historical range — in other words, the variation in performance among the 500 members of the index is much lower than it has typically been. If variation in performance is low, it means that the benefit of picking the “best” stocks versus the “worst” stocks is correspondingly low.

None of this means that stock selection is more or less difficult than it usually is. What it does mean is that the rewards to successful stock picking are likely to be small by historical standards. We are by no means in a stock picker’s market.

The posts on this blog are opinions, not advice. Please read our Disclaimers.