The Federal Reserve’s decision to continue its monthly stimulus purchases on Sept. 18, 2013, had a euphoric effect on the markets, as the S&P 500 immediately rose from 1702 to 1715, eventually closing the day at 1726. Treasuries reacted to the news in the same way, as yields on the 10-year Treasury went from 2.86% to 2.73%, finally ending the day at 2.68%. The market’s reaction is in stark contrast to the last few months of communication and preparation for a September tapering, as the expected change in policy was already priced into the market. The reasoning behind the Fed’s lack of action could be even more unsettling, as it points to continued weakness in the U.S. economic recovery. The Fed’s stimulus program must end at some point, and the question is when that point comes, will the markets heed the Fed’s communications and be as prepared as they were this go around? With that in mind, fixed income investors should be thinking about how to manage their portfolio in a rising interest rate environment.

Portfolio laddering is a traditional bond market strategy for investors during periods of rising rates. The underlying principle of the strategy is that while rates are rising, re-investment of returning short principal and interest at higher rates negates the negative price action. A ladder strategy can be structured from a variety of fixed-income products, including: Certificates of Deposit, Treasury notes, Agency notes, Municipal notes, and Corporate notes. Credit risk will factor into the selection choice but, depending on the length of the ladder, shorter maturities will have a smaller degree of risk.

The ladder provides better income and total returns when rates are rising than selecting a single security because of the strategies’ ability to re-invest maturing proceeds at more current rates. Creating a ladder strategy begins by combining similar or differing bonds in a portfolio with differing maturities in semi-annual or annual increments. As each bond rolls down the curve and matures, it is replaced by purchasing a similar security in current market conditions at the longest target date of the strategy. A common example would be a one- to five-year annual Treasury bond strategy. A year from now the one-year bond will mature and be replaced with a five-year security. Assuming yields have risen over that year, the five-year security that is added to the strategy will incrementally add yield to the portfolio. If the replacement bond is going to be a Treasury, choose the off-the-run rather than the on-the-run so that you’re not paying for liquidity premium, which is additional richness priced into the on-the-runs due to the demand by the repo markets.

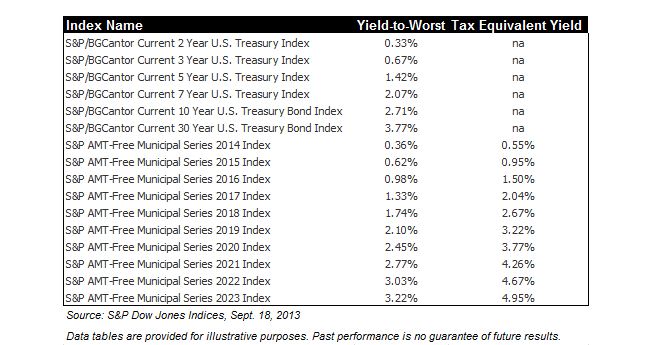

Indices can be a helpful way to study the performance of a ladder strategy. In some cases, the index may have an investible ETF issued against it, which gives an investors access to that segment of the market. The following table shows the current levels of yield within certain fixed income areas.