Technological advancements and resulting social transformations have changed our daily lives. Traditional retailers have increased their usage of business channels such as the internet, mail order, and TV home shopping to attract their customers. The trend of this business transition has been reflected in the stock market.

Among all the 68 industry indices in the S&P Composite 1500® as of July 31, 2020, the Internet & Direct Marketing Retail industry stood out with its rapid growth of market share. The S&P Composite 1500 Internet & Direct Marketing Retail Index includes companies providing retail services primarily on the internet and through mail order and TV home shopping retailers, as well as companies providing online marketplaces for consumer products and services. Within the S&P Composite 1500, the weight of the S&P Composite 1500 Internet & Direct Marketing Retail Index grew from 0.06% at the end of 1994 to 5.00% as of July 31, 2020.

The market value of the industry has also increased significantly, particularly in recent years. Exhibit 1 shows that the industry has expanded over the past 15 years. The float market capitalization of the S&P Composite 1500 Internet & Direct Marketing Retail Index grew more than 600 times its original size at the end of 1994. Meanwhile, the rest of the industries in the S&P Composite 1500 had an average sixfold increase in terms of float market capitalization. As of July 31, 2020, the industry had USD 1,468 billion in float market capitalization, with Amazon.com Inc., Booking Holdings Inc., and eBay Inc. being its largest companies.

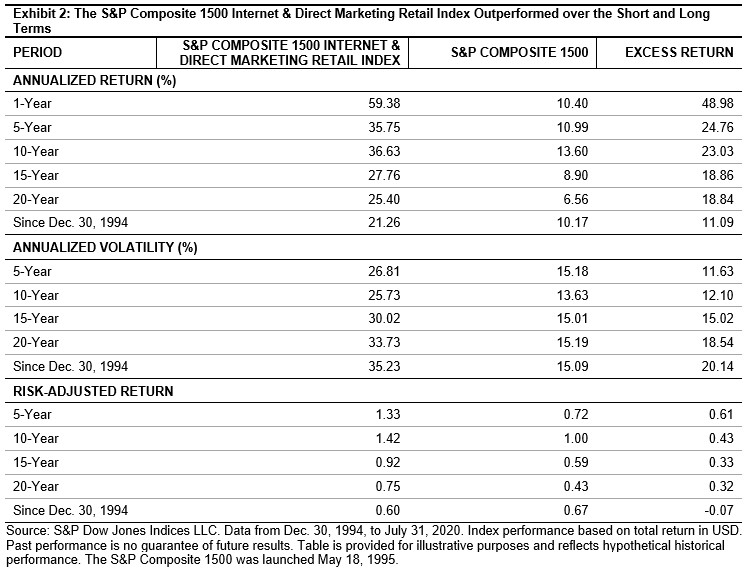

The S&P Composite 1500 Internet & Direct Marketing Retail Index delivered significant outperformance over the short- and long-term investment horizons (see Exhibit 2). During the past 5- and 10-year periods, the industry index provided risk-adjusted returns of 1.33 and 1.41, respectively, compared with the 0.72 and 1.0 generated by the S&P Composite 1500 during the same respective periods.

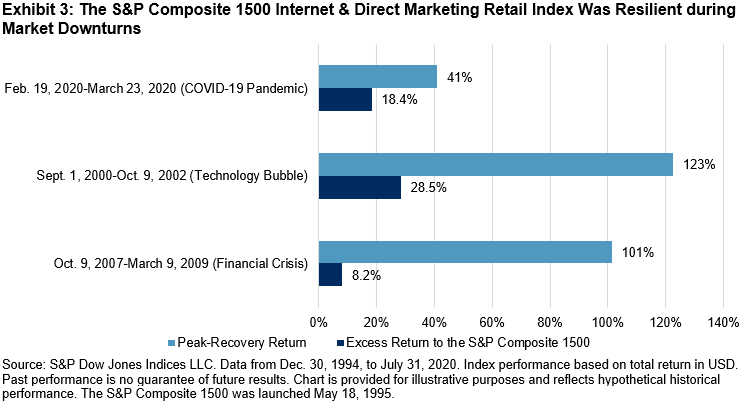

During market downturns, the industry demonstrated its strong resilience and ability to quickly recover. Exhibit 3 shows how the S&P Composite 1500 Internet & Direct Marketing Retail Index performed when experiencing the three worst market pullbacks, as measured by the S&P Composite 1500. The industry produced large margins of excess returns during the down markets and rebounded with powerful returns. The YTD return of the index as of July 31, 2020 was 61.27%, compared with 1.24% for the overall market.

The evolution of technology has encouraged the growth of online business. This trend is visible in the growth of the S&P Composite 1500 Internet & Direct Marketing Retail Index. Understanding the transformed economic reality can help identify potential investment opportunities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.