Introduction

High-quality companies have always been appealing to investors. In fact, quality equity investing was documented as early as 1949 by Benjamin Graham in his original publication of The Intelligent Investor.1

Despite a wide range of definitions for what constitutes a high-quality company, characteristics such as profitability, competitive position, earnings quality, corporate governance and modest debt levels seem to be common markers agreed upon by the investment community.

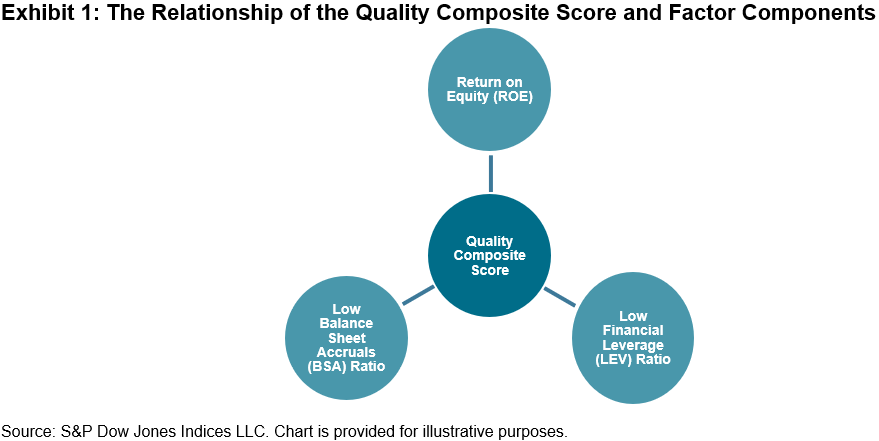

Currently, S&P Dow Jones Indices (S&P DJI) measures quality as a composite score of high profitability (ROE), low balance sheet accruals (BSA) and low financial leverage (LEV) (see Exhibit 1). A company’s overall quality score is the average of the z-scores of these three components.2

Refinement

To better align the computation of the quality factors with both industry and academic research practices, S&P DJI is implementing the following four changes after consulting with market participants.

- If the underlying earnings per share (EPS) or book value per share (BVPS) for a given stock’s ROE is negative, its ROE value will not be calculated, and the stock’s ROE z-score will be set equal to the lowest ROE z-score in the universe.

- If the underlying EPS or BVPS for a given stock’s ROE is negative, the quality score will be calculated, but it will be ineligible for index inclusion for the highest quintile (or equivalent) quality indices. For the S&P Quality, Value & Momentum Top 90% Multi-Factor Indices and S&P Quality – Lowest Quintile Indices, if the underlying EPS or BVPS for a given stock’s ROE is negative, the stock’s quality score will be calculated, and it will be eligible for index inclusion.

- The denominator of the accruals ratio calculation will use the average total assets rather than the average net operating assets.3

- For stocks classified in the Financials (GICS 40) or Real Estate (GICS 60) sectors, the accruals ratio calculation will not be applied. The ROE and LEV ratios will only be used to calculate a stock’s quality score.3

Rationale for Changes

The first change penalizes negative EPS or BVPS stocks by assigning them the lowest ROE z-scores in the universe, while the second change ensures that all constituents of the highest quality quintile have positive EPS and positive BVPS. Such requirements set higher standards for a stock to be included in the quality indices. The third change reduces the accruals ratio volatility and avoids negative values in the denominator. Lastly, the fourth change addresses the issue that the accruals ratio is not applicable to the Financials and Real Estate sectors. Importantly, these changes further align our factor metrics with industry and academic norms.

Potential Impacts of Changes

To help evaluate the potential impacts of the proposed changes, we built three hypothetical indices (Proposed S&P 500® Quality Index, Proposed S&P MidCap 400® Quality Index and Proposed S&P SmallCap 600® Quality Index), which incorporate the changes specified. We then compared the constituents of the current S&P 500 Quality Index, S&P 400® Quality Index and S&P 600® Quality Index with those of the corresponding proposed indices. The impacts are evaluated from the following aspects.

Names, Weights and Turnovers

The current quality indices and the corresponding proposed indices select the top 20% of stocks from the underlying universes (S&P 500, S&P 400 and S&P 600), resulting in 100, 80 and 120 constituents, respectively. The overlapping names were all above 71%, while the overlapping weights are all above 74% (see Exhibit 2).

Starting from the pre-rebalance of constituents in June 2022, the Proposed S&P 500 Quality Index had a slightly lower turnover than the current S&P 500 Quality Index. Conversely, the proposed S&P 400 and 600 Quality Indices had slightly higher turnovers than the current S&P 400 and 600 Quality Indices.

Sector Comparison

Exhibit 3 shows that the Proposed S&P Quality Indices had higher weights in the Information Technology, Consumer Discretionary, Industrials and Health Care sectors, while having a significantly lower weight in the Financials sector versus the current S&P Quality Indices.

Implementation

The proposed changes will be implemented during the regular index rebalance, starting with the September 2022 rebalancing period.

Importantly, the S&P Quality Indices Methodology, S&P Quality, Value & Momentum Multi-factor Indices Methodology, S&P Factor-Based Quintile Indices Methodology and other impacted methodologies will be updated to reflect these changes.

1 Ung, D., Luk, P. and Kang, X. “Quality: A Distinct Equity Factor?”, S&P Dow Jones Indices, 2014.

2 For further information about the factor definition, factor score calculation and index design, please see the S&P Quality Indices Methodology.

3 Sloan, R. Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings? The Accounting Review, Vol. 71, No. 3. (July 1996), pp. 289-315.

The posts on this blog are opinions, not advice. Please read our Disclaimers.