While growth stocks have the potential to grow at a rate significantly above the market, they have faltered during 2022 on the back of high inflation and rising interest rates. For market participants toying with the idea of when and how to get back in, the S&P 500® GARP (Growth at a Reasonable Price) Index may be worthy of consideration since it tracks companies with consistent sales and earnings growth, reasonable valuation, solid financial strength and strong earning power.

Methodology Overview

The S&P 500 GARP Index first identifies the top 150 stocks from the S&P 500 as ranked by their growth scores. From those 150 stocks, the top 75 are selected based on their Quality & Value (QV) Composite Score. The QV Score is based on the average of two quality factors (financial leverage ratio and return on equity) and one value factor (earnings to price ratio). Hence, these 75 stocks represent growth stocks with relatively higher quality and value characteristics.

These 75 constituents are weighted proportional to their growth exposure, subject to a maximum weight of 5%. This approach seeks to provide purer growth exposure and limit concentration risk. As of the end of July 2022, the index’s top 10 holdings accounted for less than 20% of the total weight, and it had exposure in all 11 sectors.

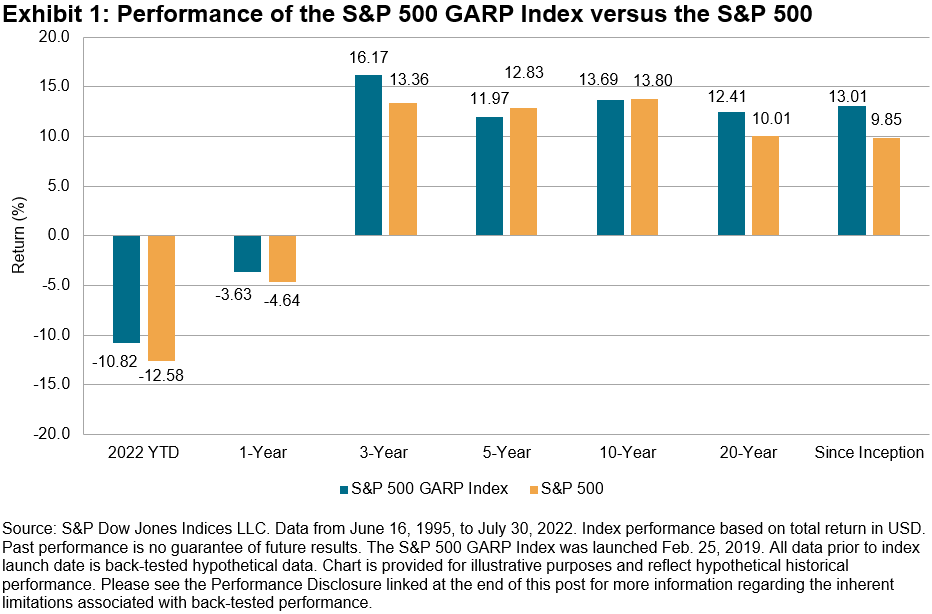

Short- and Long-Term Outperformance

Over the three-year period ending July 30, 2022, the S&P 500 GARP Index has outperformed its benchmark by 11.10% (see Exhibit 1). Additionally, over the full back-test period, the index has outperformed by an annualized 3.16%.

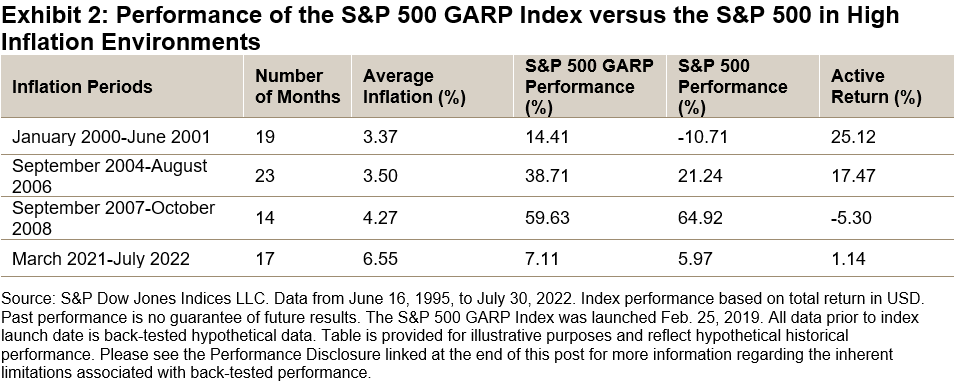

Historical Performance in High-Inflation Environments

Given the current economic environment, it is particularly interesting to observe that the S&P 500 GARP Index has tended to outperform in periods of high inflation. In Exhibit 2, we compare the performance of the S&P 500 GARP Index and S&P 500 in periods when the year-over-year CPI rate exceeds 3% for at least 12 consecutive months.

During the longest inflation periods (January 2000-June 2001 and September 2004-August 2006), the S&P 500 GARP Index outperformed its benchmark by 25.12% and 17.47%, respectively. In the inflation period from March 2021 to July 2022, the index outperformed the S&P 500 by 1.14%.

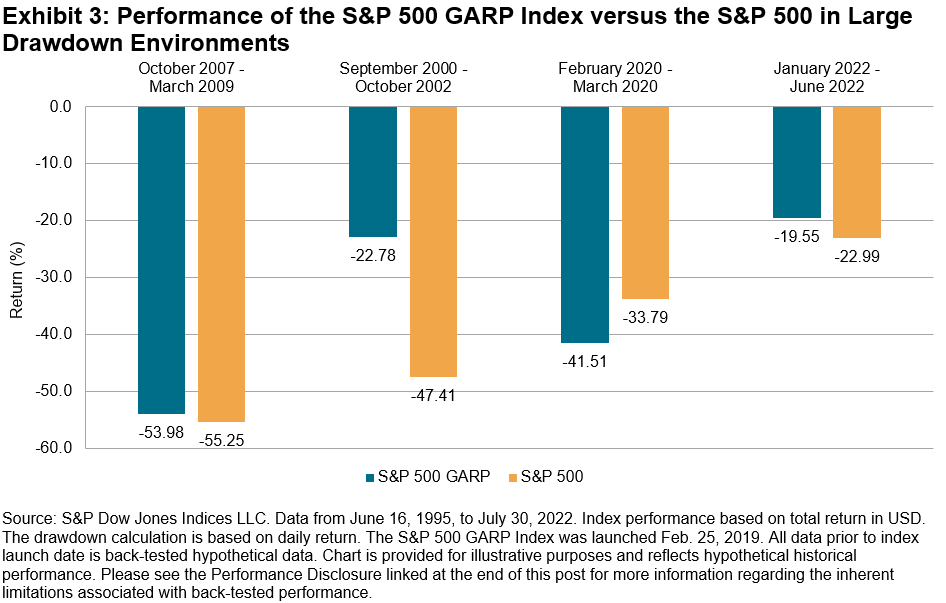

Historical Performance in Bear Markets

In addition to periods of inflation, the S&P 500 GARP Index has also historically performed relatively well in bear markets. In comparison with S&P 500, the S&P 500 GARP Index had smaller drawdowns in all but one bear market in early 2020, coinciding with the start of the COVID-19 pandemic (see Exhibit 3). During this unique and short-lived bear market (the broader economy shutdown, work-from-home phenomenon and worldwide desperation for effective vaccines), the mega-cap Information Technology stocks surged, leading to S&P 500 outperformance.

Conclusion

Aiming to capture multi-factor risk premiums, the S&P 500 GARP Index selects growth stocks with relatively high quality at a reasonable price. The strategy has strong historical outperformance over both short- and long-term horizons relative to the S&P 500. Moreover, it has tended to perform relatively better, historically, in long high inflation and long drawdown periods. As such, the S&P 500 GARP Index is uniquely situated as a potential approach for those looking to gain exposure to growth with relatively higher quality and reasonable valuations.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Systematically Reducing Carbon Intensity

Systematically Reducing Carbon Intensity