The S&P/ASX 200 ESG Index recently underwent its annual rebalancing, and it was the first rebalance following the recent changes to the S&P ESG Index Series Methodology. As a result, 14 companies were added to the index and 23 companies were removed, with some high-profile names on the move. In this blog, we’ll discuss the methodology changes recently implemented and their impact on the index, and we’ll highlight a few key movers in and out of the index.

Effective with this rebalancing, companies with involvement1 in oil sands, small arms and military contracting became ineligible for the S&P ESG Index Series. At this point in time, there are no companies in the S&P/ASX 200 that have meaningful involvement in these areas, though the possibility exists for future entrants into the index to find themselves ineligible for the ESG version. In addition, the data source for compliance with the United Nations Global Compact (UNGC) has been updated from a continuous (scores ranging from 0 to 100) to a discrete (compliant/non-compliant) data set for greater transparency and easier interpretation. This modification also resulted in no immediate changes to the index.

Lastly, existing constituents of the S&P/ASX 200 ESG Index will begin to be reviewed on a quarterly basis to ensure they continue to meet the eligibility criteria for the index. This will ensure that changes to a company’s business profile that violate the index methodology are actioned upon in a timely manner.

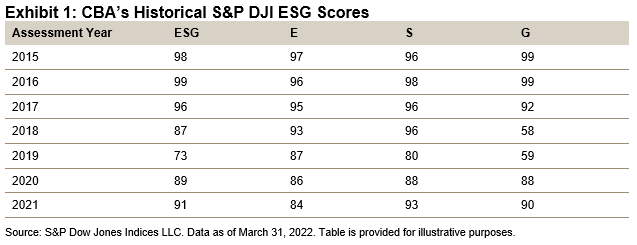

The most noteworthy change to the index composition is the addition of Commonwealth Bank Australia (CBA) and subsequent removal of Westpac Banking Corp. (WBC). CBA’s controversies surrounding breaches of anti-money-laundering laws and complaints of fraud, poor financial advice and charges for services not provided to customers (all of which were captured by S&P Global’s Media & Stakeholder Analysis) have been well documented, though over the past two years, their S&P DJI ESG Score has recovered, as the company has made jumps in the areas of sustainable finance, climate strategy and human rights.

As such, CBA leapfrogged WBC in their industry group, moving up from being ranked fourth to third (by S&P DJI ESG Score) and resulting in its first-time addition into the index.

Additionally, another first-time eligible company was added to the index: Paladin Energy Ltd., part of the GICS® Energy industry group. Paladin Energy was added to the underlying S&P/ASX 200 last December. In many cases, new additions to an index result in a corresponding drop from the same industry group. In this case, Worley Ltd., whose S&P DJI ESG Score dropped 12 points from 42 to 30, was removed from the index.

Overall, the 14 additions to the index represented just over AUD 268 billion in float-adjusted market capitalization (as of April 29, 2022, the index rebalancing date), with the 23 drops totaling over AUD 174 billion. The changes implemented as part of this rebalancing ensure that the index continues to provide broad-market exposure to the Australian market alongside an improved sustainability profile.

1 Exact revenue thresholds for eligibility can be found in the S&P ESG Index Series Methodology.

The posts on this blog are opinions, not advice. Please read our Disclaimers.