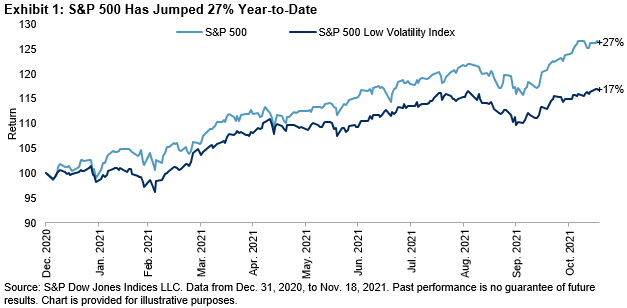

Equities in 2021 had a slow start, but as December approaches it looks to be another stellar year. Through Nov. 18, 2021, the S&P 500® was up 27%. For a strategy that is explicitly designed to mitigate risk, the S&P 500 Low Volatility Index’s year-to-date gain of “only” 17% is well within the range of reasonable expectations.

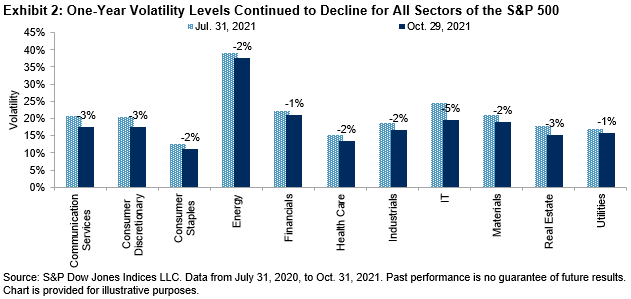

One-year volatility declined across all sectors of the S&P 500, with Information Technology experiencing the largest reduction.

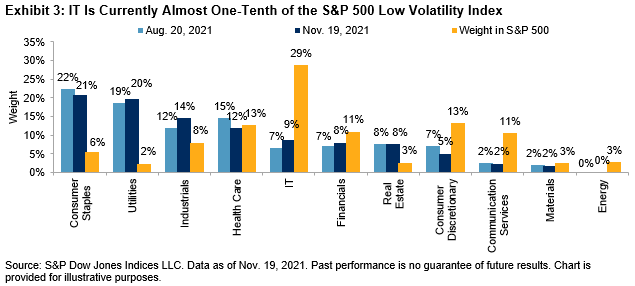

Changes in the latest rebalance for the S&P 500 Low Volatility Index, effective after the market close on Nov. 19, 2021, were small. Notably, IT still holds a significant weight (9%) in the context of the history of the low volatility index. Since 2017, it has maintained a weight of 5% or more in the low volatility index, the lengthiest run in index history back to 1991.

Health Care pared its weight to 12% of the index. Consumer Staples, Utilities, and Industrials together accounted for more than half of the index. Energy’s weight remained at 0%.

For the broader S&P 500, IT’s underweight is still the largest difference between the S&P 500 Low Volatility Index and the S&P 500. The overweights in Utilities and Consumers Staples pick up the slack on the other end of the spectrum.

The posts on this blog are opinions, not advice. Please read our Disclaimers.