I recently had the pleasure of participating in a webinar on the basics of passive management. A portfolio manager in the audience posed an important question which I’ll paraphrase: “If my goal is to earn a return of X%, why is an index’s performance relevant?” Otherwise said, if I want to earn a particular absolute return, why should I care about returns relative to an index?

This is a good question, and the answer, like the answer to many good questions, is that “it depends.” What it depends on is the answer to a subsidiary question: if an investor’s goal is to earn a return of X%, by what means does he intend to pursue that goal?

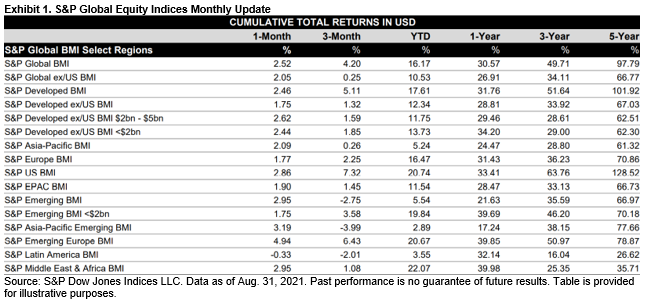

There are many asset classes out there: one might buy gold bars, or bitcoins, or Old Master paintings. But for the most part, investors and fiduciaries pursue their absolute return goals by investing in securities. And in securities markets, index returns are relevant for at least two reasons.

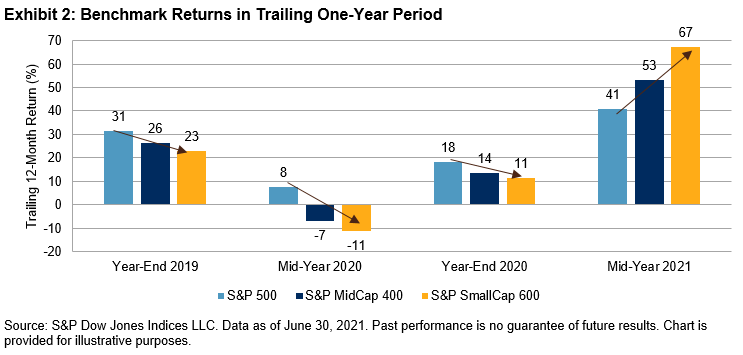

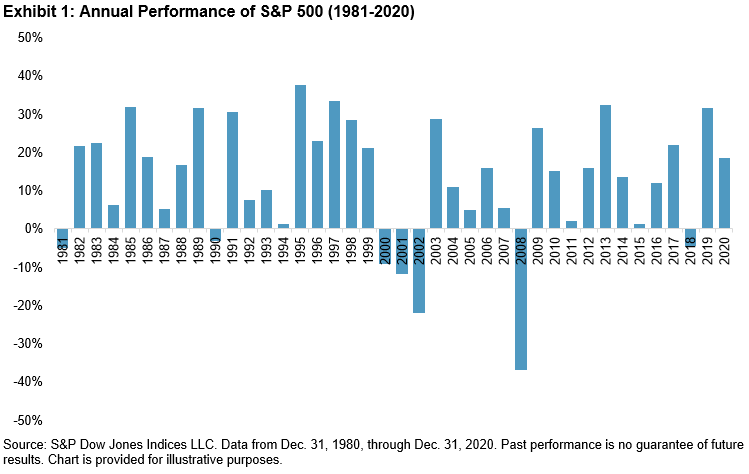

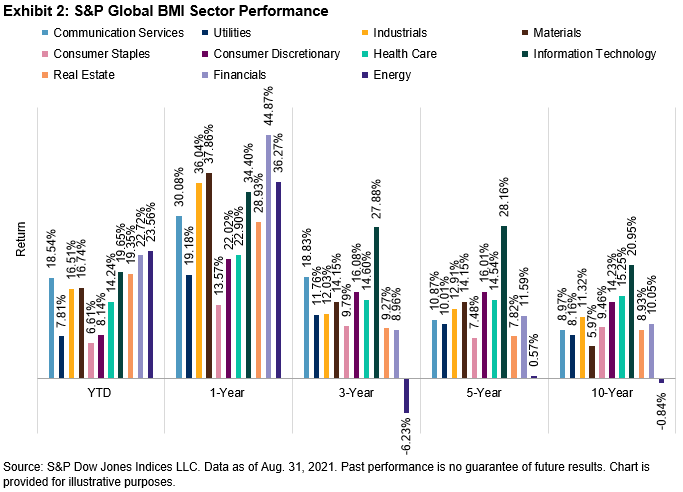

First, properly constructed benchmarks define the investor’s opportunity set. Capitalization-weighted indices like the S&P 500® are designed, in part, to track the value of a stock market; changes in the aggregate value of the stock market are reflected directly in the returns of the index. If the investor’s goal is to earn 8% annually, and the market in which he’s invested declines by 20% this year, he’s almost certainly not going to make it. And if the market index rises by 20%, he’s almost certainly not going to be satisfied with 8%. Absolute return is an aspiration; relative return is actionable.

Second, the returns of a portfolio relative to a market index are evidence of a manager’s skill. Clients have choices: they can own a market passively or attempt to outperform it actively. If the measure of success for an active manager is to outperform a benchmark appropriate to his investment style, the evidence is clear that most active managers fail most of the time; indeed over long time horizons, the advantage of index management is enormous.

Investors who are willing to accept index returns, therefore, typically see better results than those who strive to outperform. A willingness to forgo relative returns may be the key to improving absolute performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.