The SPIVA® U.S. Mid-Year Scorecard continues to show that active funds’ strong absolute returns do not always translate into relative success compared with their benchmarks. In 15 out of 18 categories of domestic equity funds, the majority of actively managed funds underperformed their benchmarks. Over the 12-month period ending June 30, 2021, 58% of large-cap funds, 76% of mid-cap funds, and 78% of small-cap funds trailed the S&P 500®, S&P MidCap 400®, and S&P SmallCap 600®, respectively.

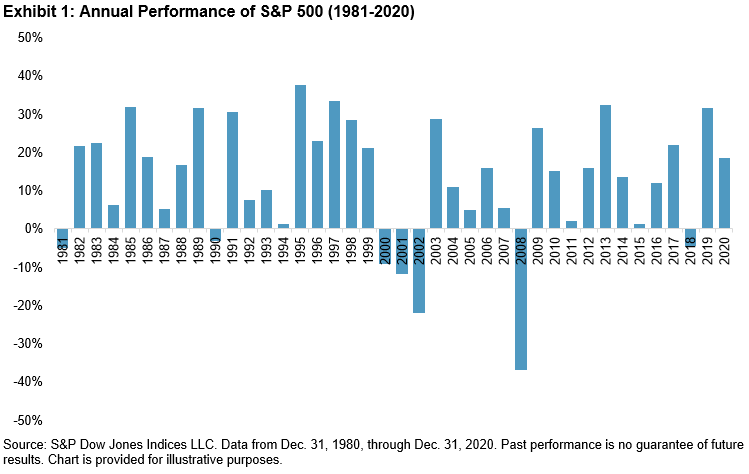

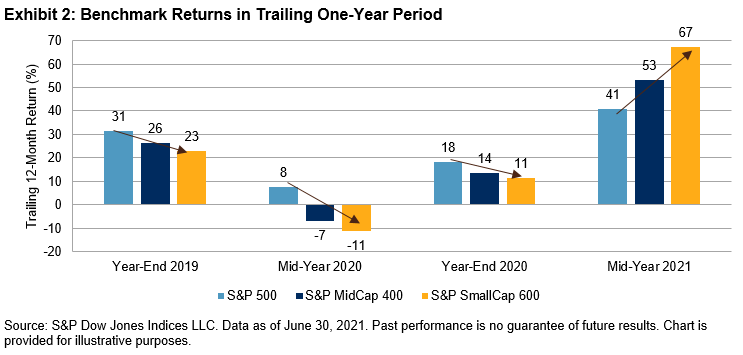

Vast underperformance in the mid- and small-cap segments is particularly interesting in that these active funds managed to do better than their large-cap counterparts in recent reports. Given that their outperformance seemed to occur when the large-cap benchmark had a higher return than the respective mid- or small-cap benchmark (see Exhibits 1 and 2), it is more likely that mid-cap and small-cap fund managers are quietly edging into the larger-cap space and benefiting from the higher returns available there. The re-opening gains of early 2021 add one more data point to that hypothesis. As the rest of the market caught up to the large-cap rally of the initial pandemic phase, mid-cap and small-cap managers who tilted up the capitalization scale were caught leaning in the wrong direction.

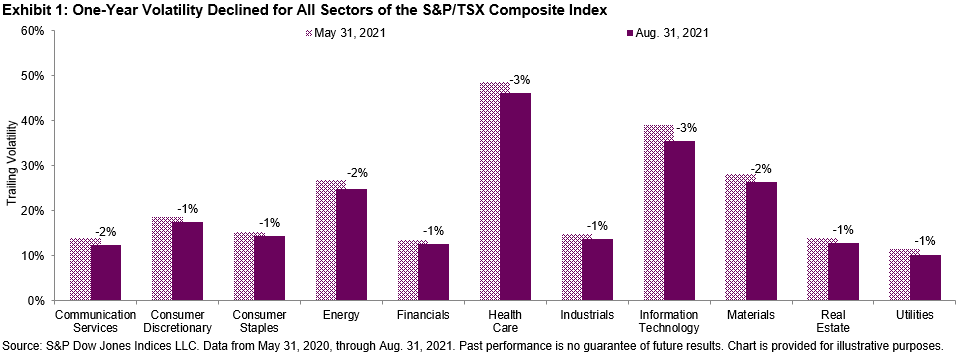

This is the first time we included risk-adjusted SPIVA scores in the report. We consider volatility, calculated through the standard deviation of monthly returns, as a proxy for risk, and use return/volatility ratios to evaluate performance. After adjusting for risk, the majority of actively managed domestic equity funds in all categories underperformed their benchmarks on a net-of-fees basis over long-term investment horizons.