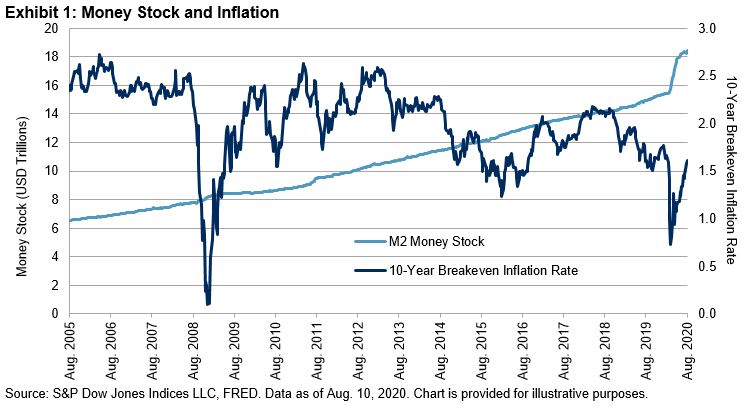

As the recovery from the Global Financial Crisis edged forward in the early 2010s, inflation hawks warned about the “certainty” of an imminent spike in inflation following the aggressive stimulus measures taken by global central banks. Unfortunately for the U.S. Federal Reserve and some of its other monetary counterparts, that certainty never materialized, and it then spent the better part of the next decade attempting to stoke what was once thought to be a sure thing.

Today, following another crisis and subsequent monetary rescue, the inflation hawks are back, as is uncertainty around the path forward for inflation. Despite massive stimulus and a spike to the money supply earlier this year, the 10-Year Breakeven Inflation Rate is right around where it was to start 2020 (1.72% on Aug. 26, 2020, versus 1.77% on Dec. 31, 2019), 30 bps below the Fed’s previous 2% long-term inflation target.

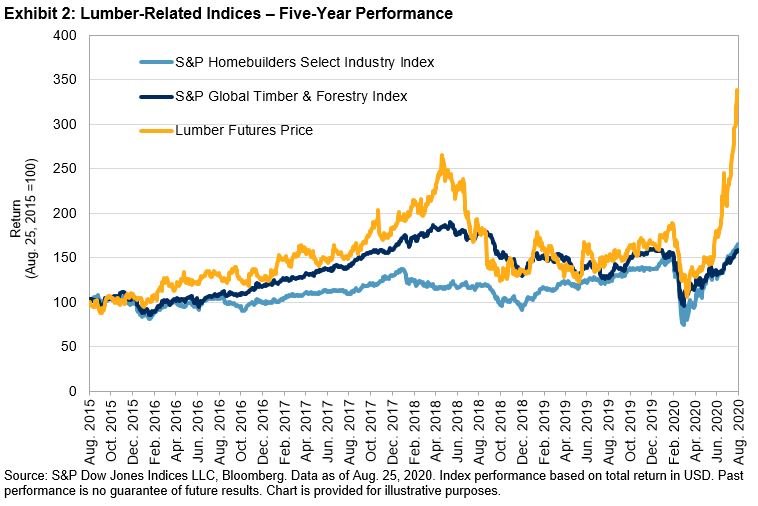

Movement in real asset prices has also sparked inflation fears. The S&P GSCI Gold, for example, was up 25% YTD as of Aug. 26, 2020, though the underlying dynamics likely extend far beyond a potential jump in inflation—gold’s rise also reflects general market fears of economic uncertainty and the sharp decline in bond yields we’ve seen already this year. To pick a commodity somewhat esoteric for the financial markets, but most decidedly “real,” lumber prices have also soared in the past four months, and recently reached record highs on the back of a surge in new home sales.

To help combat the inflationary uncertainty, on Aug. 27, 2020, Fed Chairman Jerome Powell unveiled a new direction for the central bank’s travel: average inflation targeting. This approach would allow the Fed to monitor inflation over longer periods of time and set policy based on where inflation has been on average, rather than where inflation is today. In practice, this means that should inflation rise, the Fed would likely let it run above its 2% annual target for some time before enacting contractionary measures. If the Fed’s policies have the effect of suppressing yields across the fixed income markets even as inflation begins to rise, perhaps investors could be disposed to take a second look at the equity markets for reliable income.

If they do, they might be wise to discern between companies that can maintain a steady stream of cash payouts to shareholders, and those that (perhaps due to a collapse in price) have a high dividend yield. The S&P Dividend Aristocrats® Indices are designed to track the performance of companies with a long history of maintaining or increasing their dividends per share, and that accordingly might be hoped to continue to do so. While those stocks classified as “Aristocrats” are not always those with the highest dividends, the yields on this series of indices can also be quite chunky: the S&P Global Dividend Aristocrats, for example, boasts a 6.2% yield.

Though the future for inflation is uncertain, bond yields could be lower for longer even if inflation picks up. For investors seeking income, perhaps it is time to give the equity markets a second look, and to let the Fed power your entry into the Aristocracy.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

As a brief review, index modifications to the

As a brief review, index modifications to the