Thanks to the clever ad campaign by Policygenius, riders of the NYC subway have been reminded that we were promised glass-domed houses, flying cars, and vacation homes in outer space by 2020. Although robot maids may have come true via Amazon’s Alexa, they definitely fall short of the robot maid Rosie from the cartoon The Jetsons. When it comes to technological advances in fixed income, we may be somewhere in between those high expectations and reality. While over-the-counter trading still exists, a large and growing portion of trades are conducted through electronic trading instead of the traditional telephone shouting matches. In the world of fixed income indexing, advances in data processing, index calculations, and analytics have arrived to better meet the needs of investors.

A Big Data Solution for the Bond Market

Every day, S&P Dow Jones Indices calculates millions of data points in the fixed income market that cover hundreds of thousands of bonds. In January 2020, our largest bond index, the S&P Municipal Bond Index, grew to include over 200,000 bonds and has a market value that now exceeds USD 2.5 trillion. With thousands of additional indices and up to 30 years of daily inputs, we require a significant amount of calculation prowess to be able to power the markets of the future.

We built index capabilities with new technology that is better suited to iteratively scan through millions of records and return a set of bonds that qualify for a particular index. Our technology team leveraged MongoDB for our platform, creating more scale and flexibility than previous technology offered. Through its single document storage mechanism, we have achieved greater performance and efficiency to respond to increasing demand.

Inside the S&P Dow Jones Fixed Income Calculation Engine

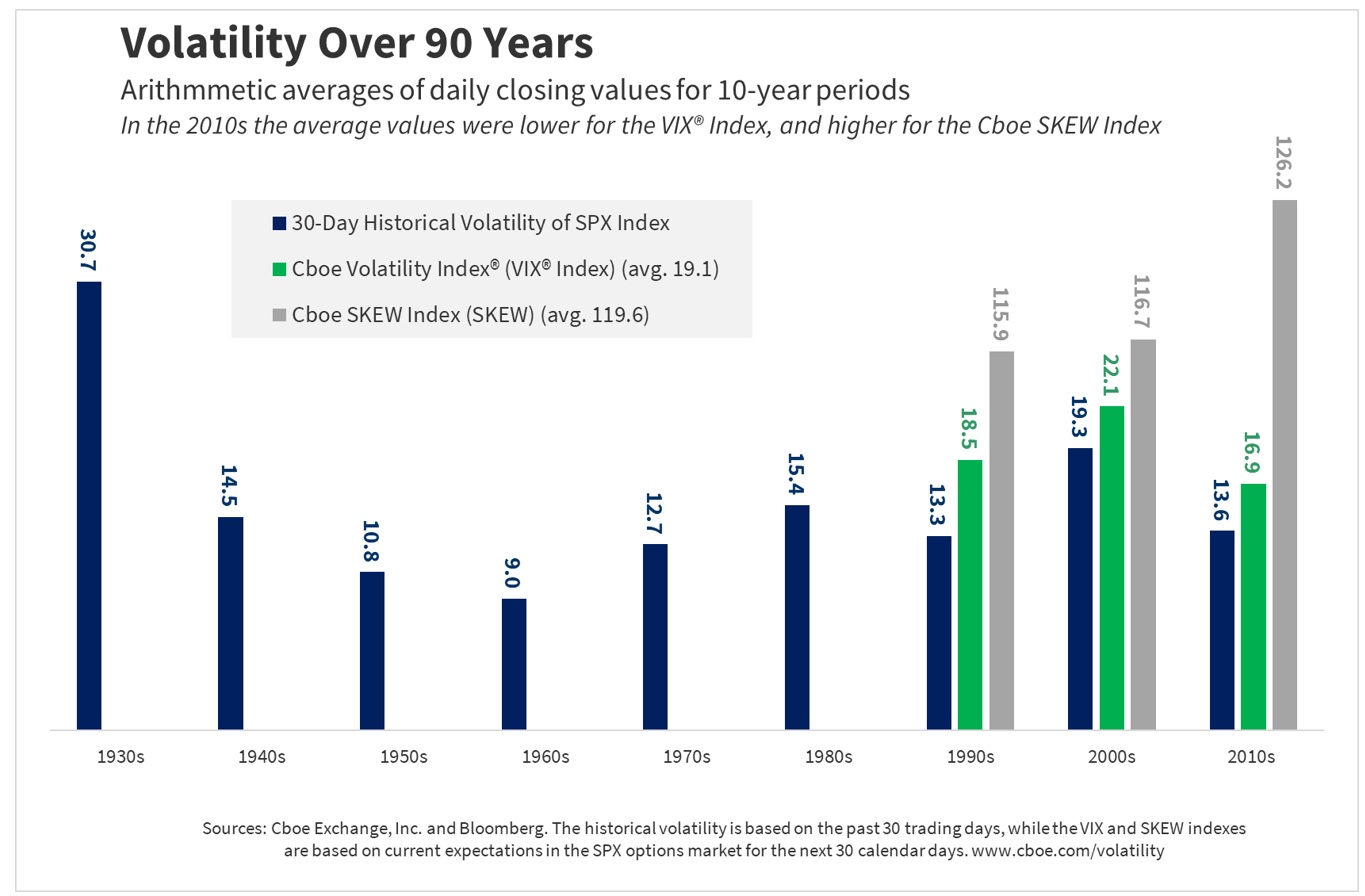

In addition to index returns, S&P DJI’s fixed income indices provide various risk measures for a given security or index. Going beyond yield, sophisticated measures such as duration, option-adjusted spread, spread duration, and convexity are critical to assess a bond’s risk. For the purposes of providing calculations related to the evaluation of interest rate risk, a proprietary interest rate model was built to calculate individual bond and index level characteristics. These models rely on a market-based approach to the term structure of interest rates. Security prices used for index return calculation, as well as the terms and conditions used for security selection, are fed into the model. This approach is a useful tool when evaluating interest rate risk for bonds with embedded options. This can be illustrated by observing the volatility surface on Aug. 1, 2019, when the 10-year yield had its largest one-day drop in 2019 and CBOE 10-Year U.S. Treasury Futures volatility spiked 17%.

Our proprietary calculation engine leverages the Hull-White Model for evaluating interest rate risk. This market-based approach maintains a no-arbitrage principal to align with widely held market standards for interest rate modeling. The model holds certain advantages, namely a mean-reversion parameter and the ability to evaluate negative interest rates. Like other models, a series of assumptions are made. The key assumptions used are constant volatility and a normal distribution of interest rates. Each interest rate node is calculated using a trinomial lattice, with assumptions applied to the term structure of rates, volatility assumptions, and mean-reversion parameters. Calculations are based on the currency of the bond (e.g., USD-denominated bonds will be priced to a USD model). Future plans include expansion into multi-currency bonds and models that incorporate tax implications for individual investors.

The posts on this blog are opinions, not advice. Please read our Disclaimers.