In this blog post, we present five eclectic thoughts for commodity investors to ponder as we look forward to the New Year and the start of a new decade.

- S&P 500® versus S&P GSCI

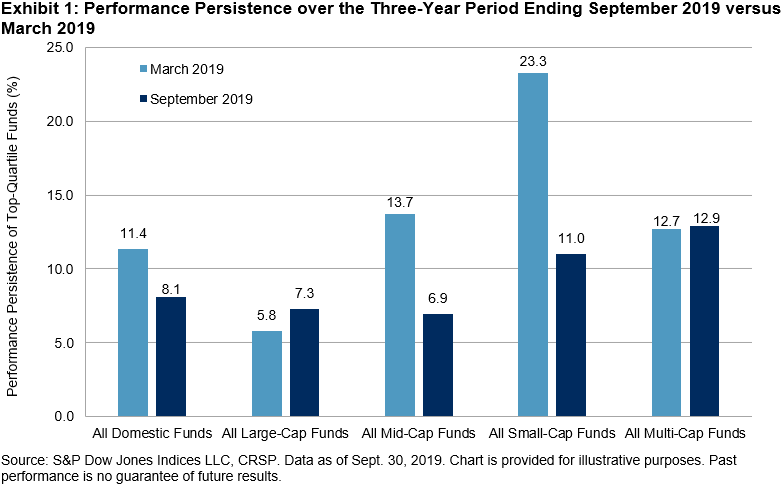

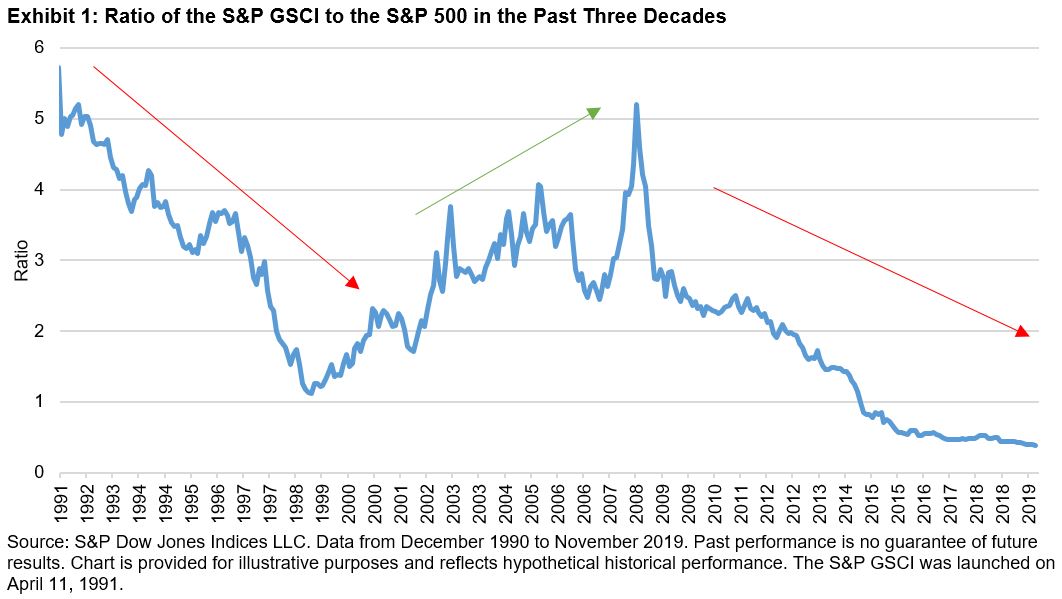

Similar to the 1990s, the last decade saw equities radically outperform commodities. Prior to that, the 2000s were more volatile, with large variations in the ratio of the S&P GSCI to the S&P 500. Could the new decade echo in a period of mean reversion for this ratio? There are several conducive factors present in the global commodity markets. These factors include geopolitical and populist tensions rising globally, several commodities trading at their cost or break-even levels, and supply risks accelerating due to continued climate change.

It has been difficult to compete against the bull equity market. However, with mixed political, trade, and economic news, there is an argument to be made that the long-held benefits of diversification may come back to the fore and commodities may re-emerge as one of a number of diversification instruments available to investors.

- Commodity Equities or Commodities

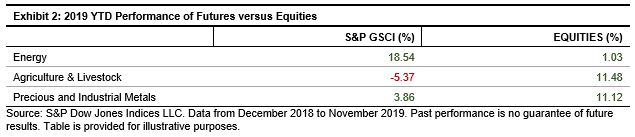

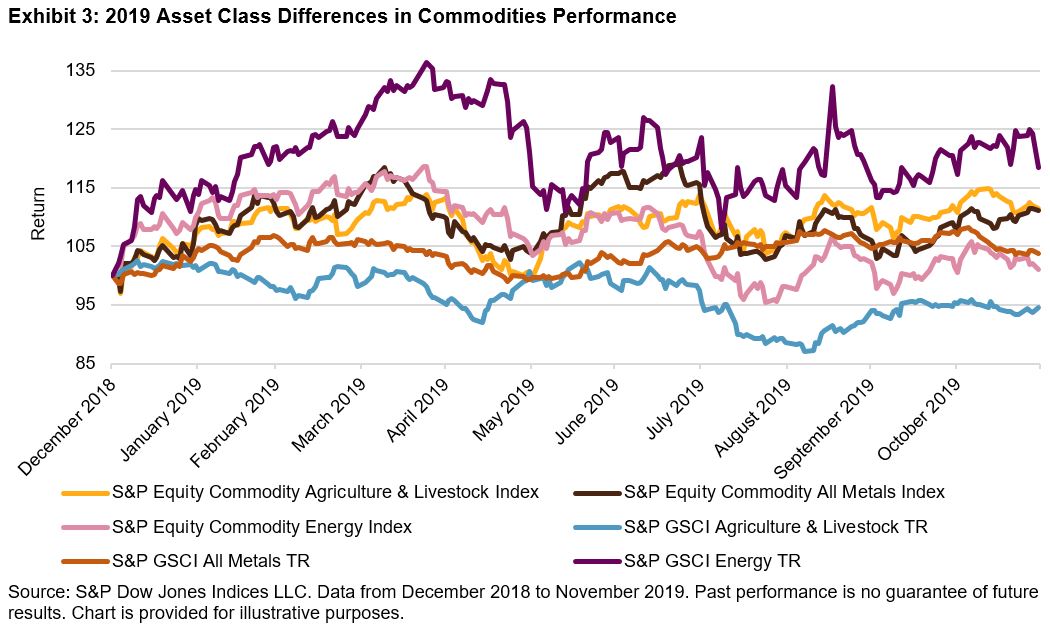

On a more granular level, in 2019, there have been some noticeable differences in the performance of individual commodity futures and their complementary equity sectors. Exhibit 2 reflects the S&P GSCI subcomponents of energy, agriculture and livestock, and precious and industrial metals in the futures column. For the equities column, we chose the corresponding S&P DJI equity commodity sector indices.

Looking at Energy, petroleum prices climbed this year due to sanctions on Iran and Venezuela as well as continued OPEC+ production cut compliance. However, equities underperformed due to bearish market sentiment, with high debt levels present across the sector. Our colleagues at S&P Global Ratings expect Energy to lead in terms of defaults over the next five years. Energy has been the worst-performing sector this year, while the S&P 500 has made several new highs. Agriculture and livestock merger and acquisition (M&A) activity and broad equity market support gave these equities the impetus to move higher regardless of the move lower in physical agricultural and livestock prices. The futures were affected by the ongoing U.S.-China trade war, heavy levels of supply, and the African swine flu outbreak. In contrast, precious metals were notably higher and the large gold miners benefited handsomely from higher gold prices.

For market participants looking for commodity exposure, it is important to consider the different instruments available to them. As 2019 has shown, the factors affecting commodity equities can extend well beyond the supply and demand dynamics of the underlying commodity.

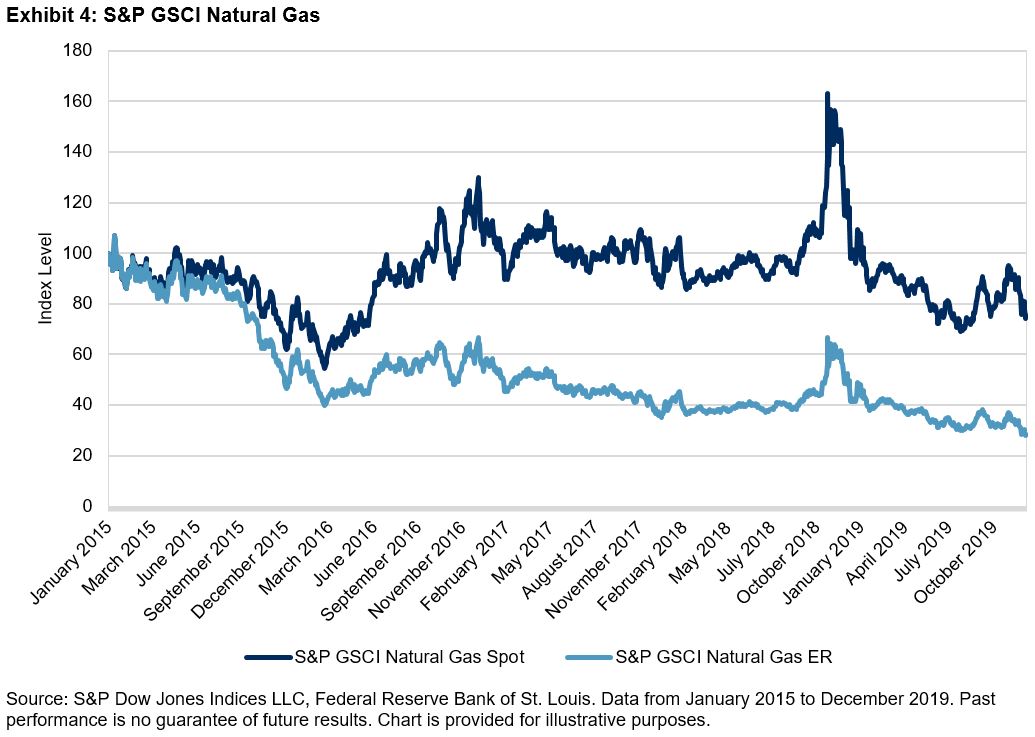

- Natural Gas – A Hard Lesson in Curve Structure

It looks likely that natural gas will end the year with the poorest performance of all the single‑commodity S&P GSCI constituents. By the middle of December 2019, the S&P GSCI Natural Gas was down an eye-watering 31% for the year. As has been the case for many years, chronic contango in the natural gas futures curve contributed significantly to the persistent underperformance of index returns compared with spot prices for natural gas. According to our colleagues at S&P Global Platts, 2020 will be the first year when gas demand growth, including sizable liquefied natural gas (LNG) feedgas demand growth, exceeds gas production growth in the U.S. It remains to be seen if this switch in dynamics is sufficient to flip the futures curve from contango to backwardation, but there is little doubt that the ongoing growth in LNG demand has the potential to change the dynamics of the broader natural gas market.

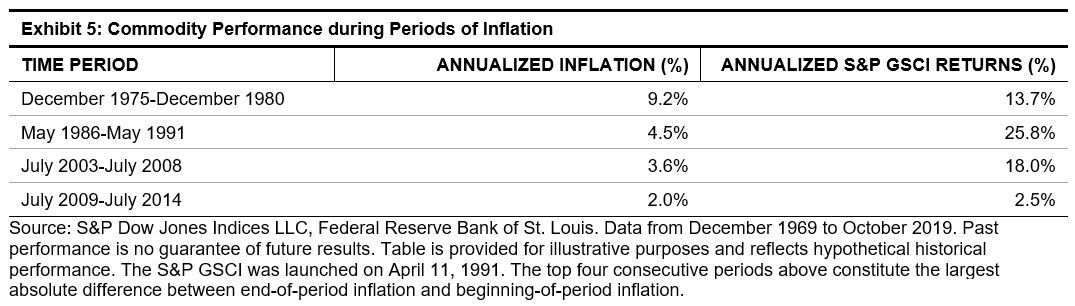

- Inflation Protection – Will Investors Ever Need It Again?

The current low-inflation environment may be unjustifiably penalizing commodities as a long-term inflation hedge. Inflation can be notoriously difficult to forecast, and market participants can experience an inflation shock before inflation expectations are adjusted upward. Inflation across the major global economies has been in a coma for many years, and negative bond yields would suggest that few investors have inflation at the top of their list of worries heading into the New Year. However, consider that a litany of headwinds—the trade war, Brexit, the slowdowns in Europe and China—if they accelerate, it could encourage levels of domestic fiscal stimulus that may stoke inflation expectations. It’s a long shot, but not out of the realm of possibility.

- IMO 2020

With the first major regulation hitting fuel markets since the removal of lead in gasoline in 1973, market participants have become concerned about potential volatility that may be on the horizon in petroleum markets. The new IMO 2020 rule requires container ships to switch from fuel made with 3.5% sulfur to 0.5% unless they are equipped with exhaust-cleaning scrubbers. Most shippers will comply by switching to very low sulfur fuel oil or marine gasoil. With demand picking up for sweet crude grades like WTI and European Brent, which produce higher levels of distillates, there has already been a divergence of prices between sweet crude grades and sour crudes from countries such as Canada, Mexico, and Venezuela.

Outside of the impact on the petroleum market, it will be fascinating to see what impact, if any, these new regulations have on global shipping markets beyond higher marine transport costs. With approximately 90% of the world’s trade carried by sea, any type of disruption could, in the worst case, be an unwelcome drag on global economic activity.

The author would like to thank Jim Wiederhold for his contribution to this blog.

The posts on this blog are opinions, not advice. Please read our Disclaimers.