In this blog, the third in our introduction to Growth at a Reasonable Price (GARP) strategies, we look at risk and return.

The main objective of the S&P 500® GARP Index is to capture the performance of growth stocks with relatively high quality and value composite scores over a long-term investment horizon. Historically, the GARP strategy has delivered higher returns than the underlying benchmark.

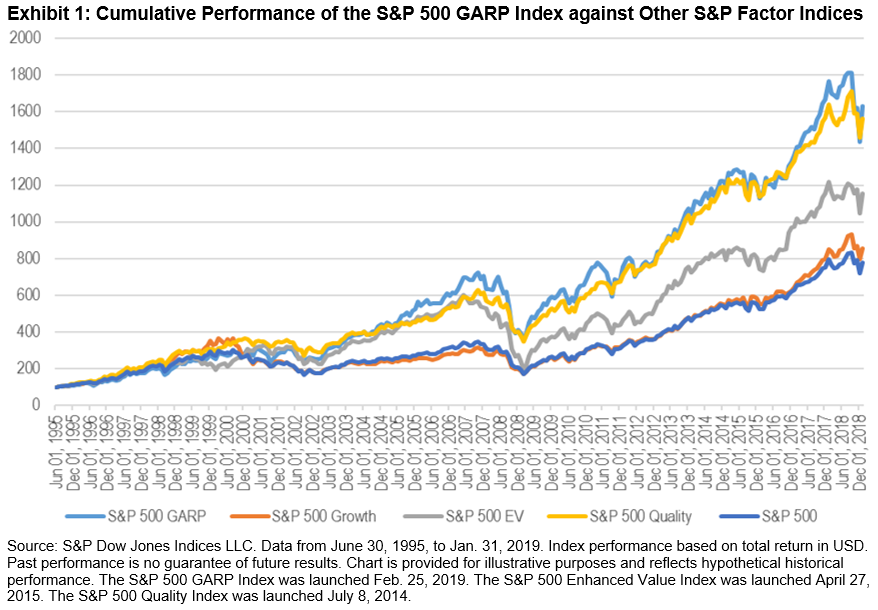

Rebasing all indices to 100 on June 30, 1995, the S&P 500 GARP Index reached 1,631.76 on Jan. 31, 2019, while the S&P 500 reached 777.91. In Exhibit 1, we compare the performance of the S&P 500 GARP Index with other factor indices—the S&P 500 Growth (855.24), the S&P 500 Enhanced Value Index (1155.30), and the S&P 500 Quality Index (1564.67).

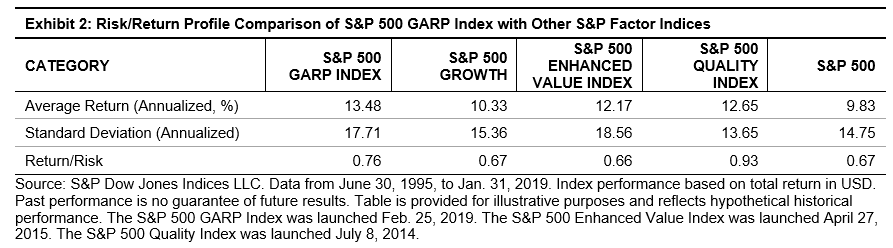

Exhibit 2 shows the average risk/return profile of the S&P 500 GARP Index against single-factor indices. The S&P 500 GARP Index had the highest annualized average return, at 13.48%. On a risk-adjusted basis, the S&P 500 GARP Index ranked second (0.76) after the S&P 500 Quality Index (0.93), but was higher than the other factor indices—the S&P 500 Enhanced Value Index (0.66) and S&P 500 Growth (0.67)—as well as the S&P 500 (0.67).

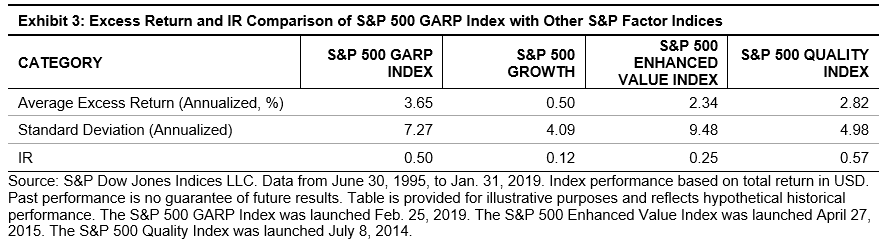

With the S&P 500 as the underlying benchmark, we can use the information ratio (IR) to evaluate whether a strategy was able to add value for each incremental unit of active risk taken (see Exhibit 3). The IR is defined as the expected active return divided by the tracking error (TE), where active return is the difference between the return of a strategy and the return of the S&P 500, and the TE is the standard deviation of the active return.

In Exhibit 3, the S&P 500 GARP Index had a positive IR of 0.50 over a long-term investment horizon. The index had a higher IR than the S&P 500 Growth (0.12) and S&P 500 Enhanced Value Index (0.25), but had a lower IR than the S&P 500 Quality Index (0.57).

In our next blog, we will continue to cover targeted factor exposures, sector composition, and performance attributions of the GARP strategy.

The posts on this blog are opinions, not advice. Please read our Disclaimers.