Commodities are a direct way to protect against inflation since they are the natural resources that build society. The same food and energy that is in CPI (Consumer Price Index from the Bureau of Labor Statistics,) is in the commodity indices like the S&P GSCI and DJCI, and more energy has provided more inflation protection since energy is the most volatile component of CPI.

In this video featuring Bob Greer and Boris Shrayer, the link between pension liabilities, inflation and commodities is discussed. They say commodities can be a nearly perfect hedge for real lifestyle costs when buying food and gasoline. However, pension assets need to accumulate more if they will pay out more in liabilities. The conversation extends beyond pensions to endowments and foundations where if levels of gift giving and supporting of staff at universities are maintained, then purchasing power needs to be preserved as inflation rates rise. The link between inflation and liabilities can be complex, where commodities are an imperfect hedge since some inflation from commodities may not move exactly with all types of inflation, like wage inflation for example.

One of the important things that Boris points out is that this inflation doesn’t just apply to institution but it impacts individuals “or anybody.” Without knowing for sure how inflation and interest rates might move in the future, strategies have evolved to minimize uncertainty around how much an account balance is worth as an income stream. For example, the conversation has changed from “how big should your 401K be at retirement?” to “what percentage of your current income do you need to replace annually for retirement (inflation protected)?” The latter style is akin to the defined benefit/pension conversation and much more relatable for retail clients. Why worry about hitting a certain savings number/account size when you’re not clear what the withdrawal rate will be or how much impact inflation may have during your retirement?

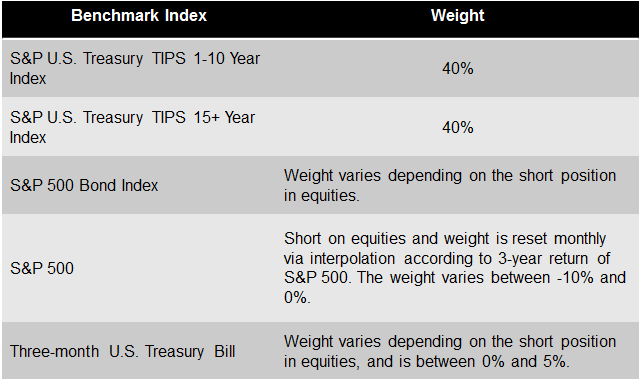

Two main applications enable this switch, and are implemented in the S&P STRIDE (Shift To Retirement Income and Decumulation) indices. The first uses a process that is analogous to dollar cost averaging into income producing assets. It is a three-phased glide path that is innovative because it not only de-risks the allocation automatically as investors pass TO and THROUGH retirement, but it also addresses inflation risk.

The three phases are:

- Accumulation. This consists of a conventional target date glide-path using stock and nominal bond indices.

- Transition. The index weight is gradually shifted from the target date glide-path to a pool of constituents that secure real future income.

- Decumulation. The income producing constituents are divested, modelling retirement income cash flows.

The table below shows what allocations look like at different ages with the other significant breakthrough that is the addition of TIPS (Treasury Inflation-Protected Securities.) Using a glide path approach with TIPS may help financial planners to provide clients a higher degree of stability when predicting inflation adjusted income during retirement.

The index series builds in a liability driven investment (LDI) strategy by shifting from equities and fixed income to TIPS, that is implemented during the transition phase. Notice there is a 75% allocation to TIPS by age 65, which is at the age when many individuals retire, and the TIPS allocation increases for another 25 years.

Interestingly, the S&P Target Tuition Inflation Index, that aims to grow with tuition inflation over the long term, has a similar allocation to TIPS as in the latter part of S&P STRIDE.

Although the tuition inflation has risen much more than general CPI, a large component of the tuition inflation increase is correlated with general CPI. However, the time horizon for college tuition is shorter than for the whole three-stage retirement life-cycle, so there is a constant 80% allocation to TIPS in the S&P Target Tuition Inflation Index to help preserve the capital while the remainder of the index allocates between stocks and nominal bonds, resulting in an index that has grown with tuition inflation.

Whether saving for retirement or college, TIPS help change the framework from addressing the question of how big savings are at a moment in time to how much of current income needs to be saved for the goal. Preserving purchasing power in the face of unknown interest rates and inflation can be better managed with TIPS, and can now be measured with indices using them.

I would like to acknowledge my colleague, Travis Robinson, Senior Director of Financial Advisor Channel Management at S&P Dow Jones Indices, for his contribution to this article regarding key points on S&P STRIDE. For more information on STRIDE, register for our upcoming webinar, “Strategies for Managing Retirement Income Risk” on October 24 at 2PM ET.

The posts on this blog are opinions, not advice. Please read our Disclaimers.