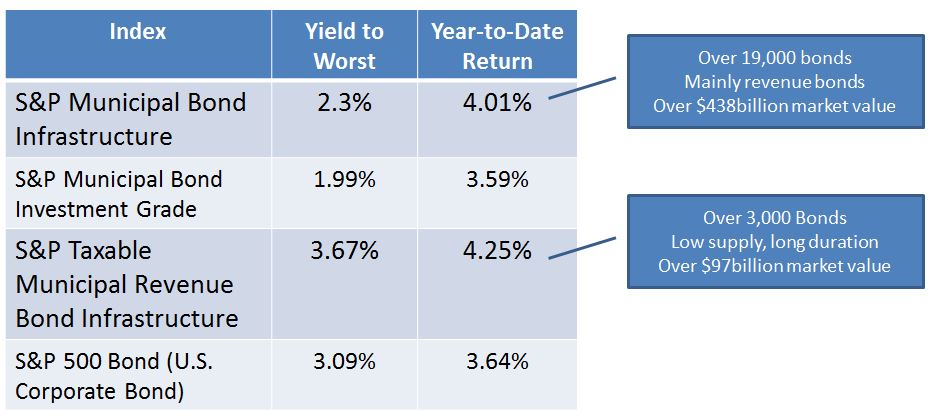

With the President’s focus on the U.S. infrastructure this coming week it is a good time to look at the existing infrastructure bond markets. Municipal bonds have long played a critical funding role in the U.S. infrastructure sector.

The 19,000 tax-exempt municipal bonds tracked in the S&P Municipal Bond Infrastructure Index mainly consist of investment grade bonds related to the transportation (roads, airports et al) and utility (water, sewer, power, resource recovery) segments of the market. As these are revenue bonds with slightly longer durations the average yield is naturally higher than the overall market, Year-to-date this group of bonds have outperformed the investment grade muni market.

On the taxable side of the market, the S&P Taxable Municipal Bond Infrastructure Index consists of bonds from the same segments as it’s tax-exempt counterpart. These taxable bonds have a duration of over 10 years making them appealing for the institutional market. In addition, the low supply of these investment grade bonds have created a scarcity value. As a result this segment of the bond market enjoys both a higher yield and overall better year-to-date performance than U.S. corporate bonds tracked in the S&P 500 Bond Index.

Table: Select indices, their yields and year-to-date returns as of June 2, 2017:

For more information on S&P’s bond indices including methodologies and time series information please go to SPDJI.com.

Please join me on LinkedIn .

The posts on this blog are opinions, not advice. Please read our Disclaimers.