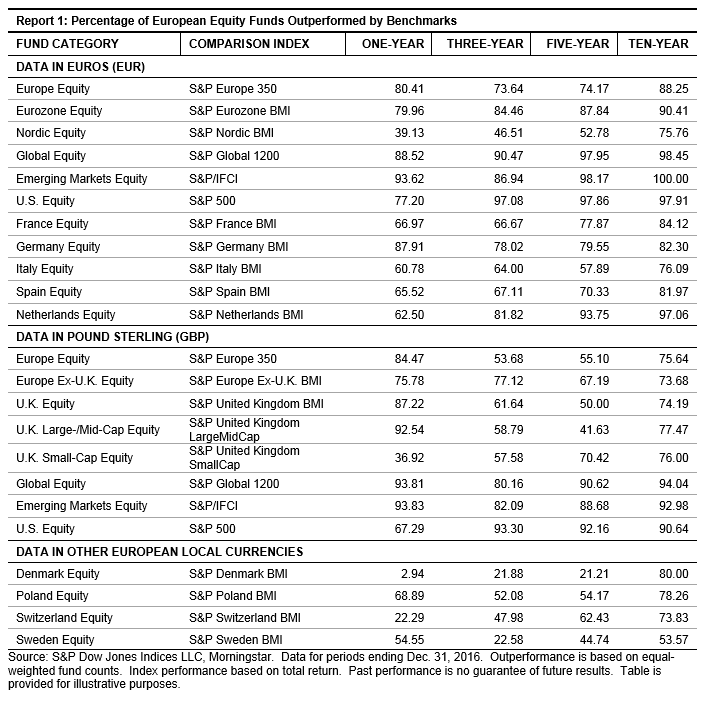

European equity markets, as measured by the S&P Europe 350, went up 3.44% in 2016, yet the average performance of active managers invested in Europe was negative, whether measured on an asset-weighted or equal-weighted basis. Over the one-year period, more than 80% of active managers invested in European equities underperformed their respective S&P DJI benchmark. This level of underperformance continued into the long run, and more than 88% of managers underperformed over the 10-year period.

A similar pattern was seen in other fund categories. More than 88% of managers invested in global markets underperformed their respective S&P DJI benchmark over the one-year period, and over 98% trailed it over the 10-year period. Underperformance was most severe in emerging market equity funds. Over 93% of actively managed emerging market funds failed to keep up with their S&P DJI benchmark over the one-year period, and all of the emerging market funds studied in the report trailed it over the 10-year period.

Even though the majority of the statistics looked unfavorable for active managers, there were a few notable exceptions. Nearly all active managers invested in Denmark and Switzerland beat the corresponding S&P DJI benchmarks over the one-year period. However, this was not repeated over the long run, and the majority of the managers in these categories underperformed the benchmark over the 10-year period.

For the full details of the report, please click here.