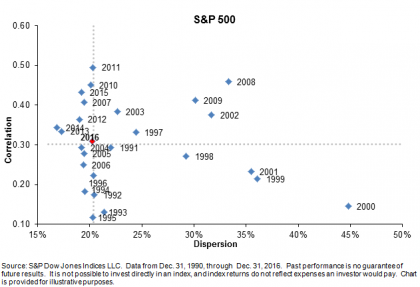

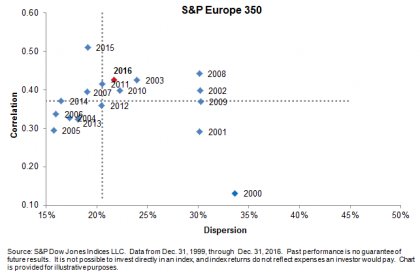

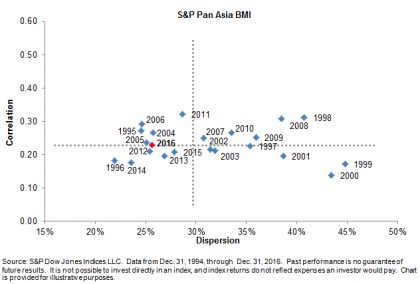

In geopolitical terms 2016 was a tumultuous year. From the outcome of the Brexit referendum to the surprising conclusion of the U.S. presidential election, 2016 was a year of political surprises. The markets, braced or not, reacted differently in each case. We saw heightened correlation in the aftermath of Brexit and observed higher dispersion immediately after the U.S. presidential election. Heightened dispersion and/or correlation levels can accompany market weakness, but in both of these cases, the markets rallied and dispersion and correlation readings returned to average levels in fairly short order.

Despite being buffeted by remarkable political events, 2016 looks unremarkable in terms of our dispersion-correlation map. For the U.S., November’s spike in dispersion after the election was resolved by the end of December. Dispersion returned to below-average levels and, for all of 2016, dispersion and correlation essentially plot at the midpoint for the last 26 years. One would be hard-pressed to find a more nondescript point. It’s a very similar story in Europe, even though the U.K.’s exit from the European Union is a work in progress. In Asia, dispersion is lower than average while correlation is right around average. Market dynamics can certainly change quickly, but dispersion levels suggest that adding value by active management will continue to be challenging.

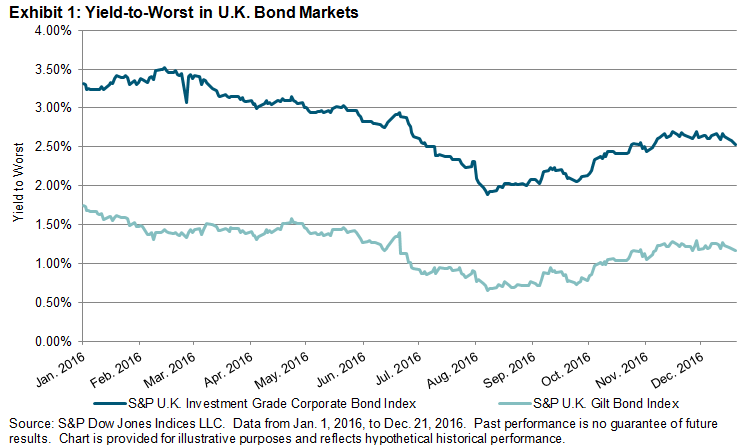

Dispersion-Correlation Maps