Interest rates have influenced the performance of REITs relative to bank shares

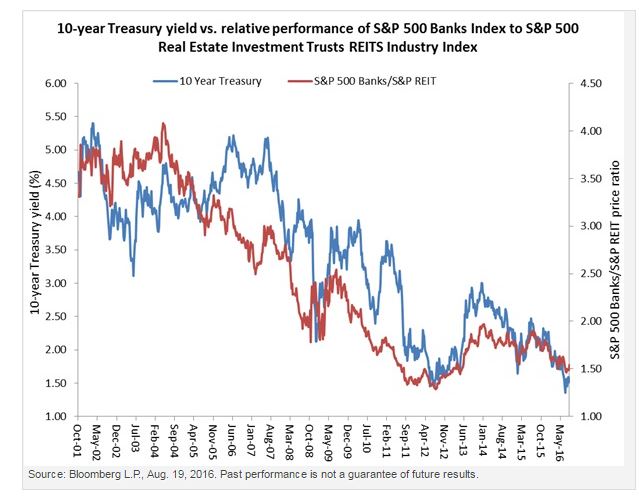

Interest rates have a strong influence on equity REIT performance, as evidenced by the graphic below, which displays the relationship between the 10-year Treasury yield and the relative performance of the S&P 500 Banks Index to the S&P 500 Real Estate Investment Trusts REITS Industry Index. Note that banks have generally outpaced REITs when interest rates are rising, and have tended to lag when interest rates are declining. This relationship can be most clearly seen after the Great Recession (early 2009).

This pattern of relative performance may be linked to improved bank profitability in a high or rising interest rate environment and the desire of investors to own REITs for yield purposes in a falling or low rate environment. In a sense, REITs become a bond substitute. The breakout of REITs from the financials sector may better focus investors on the relationship between banks and REITs.

This chart also indicates that the price of bank stocks have been lagging the price of REITs for more than a decade. The price ratio of the S&P 500 Real Estate Investment Trusts REITS Industry Index to the S&P 500 Banks Index was over 4.0 in 2004 and has slumped to 1.5, although it is off the low seen in 2012.1

A potential rise in rates could have ramifications for bank stocks, REITs

Banks may look cheap relative to REITs right now, but a catalyst will likely be needed to reverse that trend. Higher interest rates would be one such catalyst. Predicting the direction of the 10-year Treasury yield is always difficult. However, the pace of economic growth, the direction of inflation and interest rates overseas may help investors interpret the interest rate landscape and outlook for the relative performance of bank shares to REITs. Let’s review the factors:

- Economic growth has found firmer footing of late due to a more favorable inventory cycle (a decline in the growth rate of the inventory-to-sales ratio) and reduced headwinds from foreign exchange, as the US dollar has traded more sideways over the past year. Industrial production was down 0.5% year over year in July, but up from a trough of -2.0% in March.1 To put the current level of industrial production into context, industrial production peaked at 3.9% in July 2014.1 Movement of production into firmly positive growth territory could be a catalyst that lifts yields.

- Inflation has shown signs of slow acceleration. The consumer price index less food and energy has risen to 2.2% on a year-over-year basis from its February 2014 low of 1.6%.1 However, it has not been able to breach the post-recession high of 2.3% established in April 2012 and February 2016.1 A rally in inflation over 2.3% could put upward pressure on the 10-year Treasury yield and focus the Treasury market more closely on inflation.

- Lastly, yields remain negative in Germany and Japan and make the current Treasury yield just below 1.60% look attractive. A normalization of rates in Germany and Japan could lead to higher 10-year Treasury yields.

———————————————————————————

Important information

Correlation is the degree to which two investments have historically moved in relation to each other.

Dividend yield is the amount of dividends paid over the past year divided by a company’s share price.

Price ratio compares the price of one security (or basket or securities) to another security (or basket of securities). In this case, the prices of two indexes are compared.

A real estate investment trust (REIT) is a closed-end investment company that owns income-producing real estate.

Relative performance refers to the performance of an asset or investment relative to another asset, investment or benchmark.

The consumer price index (CPI) measures change in consumer prices as determined by the US Bureau of Labor Statistics.

The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. VIX is the ticker symbol for the Chicago Board Options

Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility.

The Dow Jones U.S. Mortgage REITs Index comprises real estate investment trusts, corporations or listed property trusts that are directly involved in lending money to real estate owners.

The S&P 500 Real Estate Investment Trusts REITS Industry Index defines and measures the investable universe of publicly traded real estate investment trusts domiciled in the United States.

The S&P 500 Utilities Sector Index is an unmanaged index considered representative of the utilities market.

The S&P 500 Financials Index comprises those companies included in the S&P 500 that are classified as members of the GICS® financials sector.

The S&P Banks Index comprises stocks in the S&P Total Market Index that are classified in the GICS asset management & custody banks, diversified banks, regional banks, other diversified financial services and thrifts & mortgage finance sub-industries.

The S&P Insurance Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS insurance brokers, life & health insurance, multi-line insurance, property and casualty insurance and reinsurance sub-industries.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The S&P 500 Diversified Financials Industry Group Index is a capitalization-weighted index that is considered representative of the diversified financials industry group.

An investor cannot invest directly in an index.

Past performance is no guarantee of future results.

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Investments focused in a particular industry or sector are subject to greater risk and are more greatly impacted by market volatility, than more diversified investments.

Investments in real estate related instruments may be affected by economic, legal, or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid.

Treasury securities are backed by the full faith and credit of the US government as to the timely payment of principal and interest.

Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 50,000, 75,000, 100,000 or 200,000 Shares.

The information provided is for educational purposes only and does not constitute a recommendation of the suitability of any investment strategy for a particular investor. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED |

MAY LOSE VALUE |

NO BANK GUARANTEE |