Your portfolio is like a hockey team. You don’t think so? It is. And VIX plays a key role. Stay with me while I explain.

Equities are your guys playing at center and on the wings. You expect production from them. Your team largely lives and dies by how consistently they score. Bonds are your defensemen. They come forward to create some additional offense at times, but their key responsibility is minimizing downside risk. The goalie? Perhaps not a perfect analogy, but let’s liken him to cash. Your last line of defense.

Where does the CBOE Volatility Index (VIX) fit in all this? Yes, if VIX were a hockey player, it would likely be on defense. But VIX is a special type of defensive player. In hockey parlance, VIX is an enforcer.

Someone took the time to write up a great description of what a hockey enforcer is. “An enforcer’s job is to deter and respond to dirty or violent play. . .the enforcer is expected to respond aggressively. . .” Further, “Enforcers are typically among the lowest scoring players on the team and receive a smaller share of ice time.” In other words, most of the time you can’t expect much from an enforcer and you may not want to have him on the ice much. But when it’s time for the enforcer to come to the rescue and protect the team, he does it in a big way — aggressively.

In your portfolio, VIX is your enforcer. Maintaining a VIX position can be painful. You would want to be selective as to when to allocate to VIX. But when things get really rough, you want to have VIX in the mix so it can aggressively defend your portfolio’s value, when every other asset class slinks away.

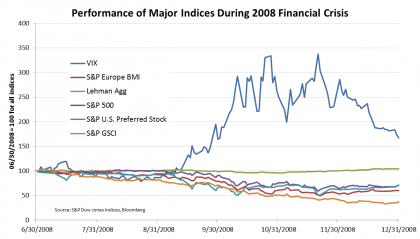

Below is a chart showing the performance of major indices during the last half of 2008, when the equivalent of a major hockey brawl broke out. You remember it – broken teeth and blood on the ice everywhere. VIX came to the rescue. Those who allocated even a small portion of their portfolio to VIX linked instruments got some serious protection.

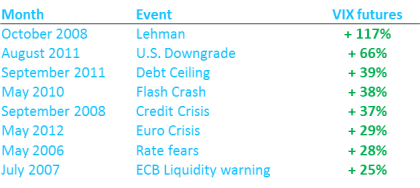

The 2008 crisis wasn’t the only time VIX stepped up. Time after time, VIX and the instruments linked to them have responded quickly and in a pronounced way to violent market moves.

We are still in turbulent times. If you feel under threat, you may want to hire an enforcer.

The posts on this blog are opinions, not advice. Please read our Disclaimers.