Tracking the mark up on retail size bond transactions can be a tricky effort particularly as mark ups have not be disclosed in the past. By comparing trades of bonds of similar characteristics we are able to isolate and calculate estimated transaction costs published in our study “Unveiling the Hidden Costs of Retail Buying & Selling”.

The good news is the transaction costs of retail size trades for municipal bonds have dropped to low points since we started tracking this data in 2011. In addition, transaction costs for corporate bonds have also improved.

Some important observations:

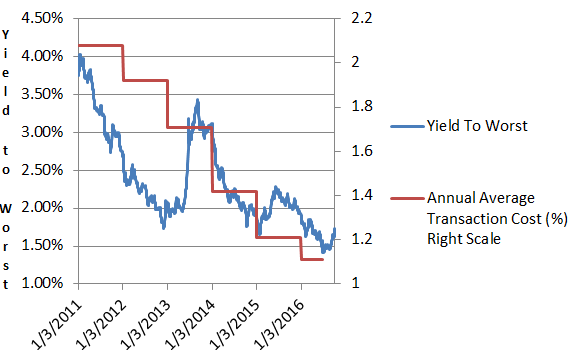

- As yields have fallen the annual average calculated transaction costs for retail size trades has also fallen.

- Retail size trades of municipal bonds have reflected transaction costs that have become, over time, more in line with retail size trades of corporate bonds. In 2011, the average municipal retail size trade had a trade cost of 2.08% while retail size trades of corporate bonds had a trade cost of 1.44%. As of June 2016, the municipal retail trade cost had fallen to 1.11% compared to 1.01% for corporate bonds.

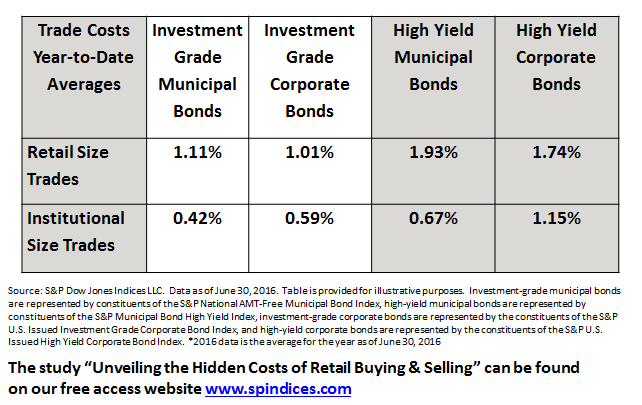

- While there remains a significant difference in the cost of a retail trade vs. an institutional size trade the difference appears to be more consistent and comparable between municipal bonds and corporate bonds. Please refer to Table 1.

A few factors could be driving the compression in calculated transaction costs:

- The evolution of the Department of Labor (DOL) rules.

- MSRB and FINRA efforts related to trade price transparency & disclosure.

- A compression in the interest rate environment.

Chart 1) Yields of the S&P National AMT-Free Municipal Bond Index and annual average transaction costs of retail size municipal bond trades of bonds in the index:

Table 1) Calculated trade costs of retail and institutional size blocks of bonds as of June 30 2016: