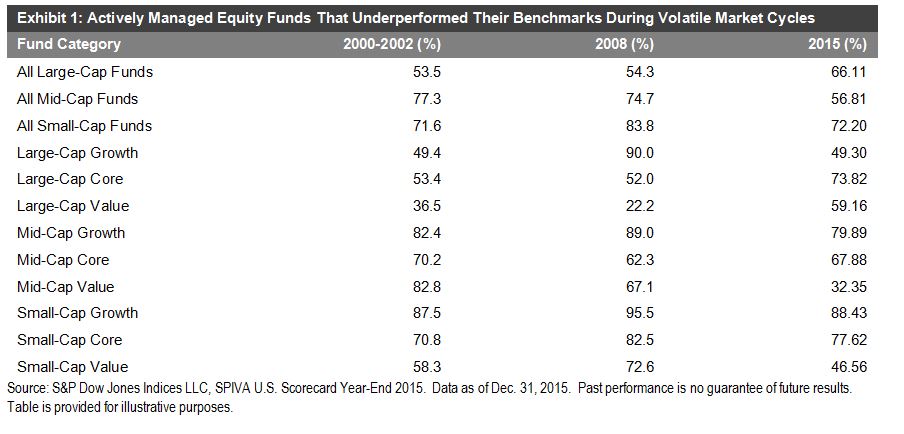

More than a year ago, a number of commentators expressed confidence that 2015 would be the year when active equity management proved its value. After all, the market had risen steadily for six years, and with stretched valuations, market volatility was likely to rise — creating opportunities for active managers to add value by skillful risk control.

This seems like a plausible theory — if only the facts had not conspired to rebut it. Our SPIVA report for calendar 2015 shows that the majority of actively-managed U.S. mutual funds underperformed cap-weighted index benchmarks. Similarly, the majority of large-cap institutional portfolios tracked in the eVestment database underperformed the S&P 500 Index.

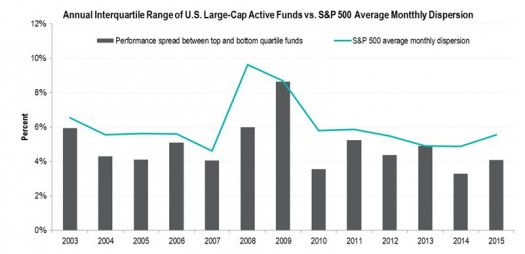

Why was 2015 so difficult for active U.S. equity managers? Answering this question requires us to distinguish between two oft-conflated concepts: the manager’s skill at stock selection or sector rotation, and the level of opportunity to demonstrate that skill. Beyond observing that, in a market dominated by institutional players, the average manager cannot expect to outperform the market average, we have no particular insight into manager skill. But opportunity can be measured systematically by the market’s dispersion, and dispersion in 2015, though slightly above 2014’s level, remained quite low by historical standards.

The level of a manager’s skill is independent of dispersion, but the value of his skill is dispersion-contingent. The graph below illustrates this by reference to the interquartile range for large-cap U.S. managers in our SPIVA database.

The bars represent the difference between top quartile and bottom quartile managers or, crudely speaking, the performance gap between “good” and “bad” managers in each year. The line is the average level of dispersion during the year. It’s hardly a perfect fit, but nonetheless it seems clear that managers have more scope to demonstrate their skill when dispersion is high.

In most markets, dispersion in early 2016 was higher than its average 2015 level. If this trend continues, 2016 could at last see the long-awaited stock pickers’ market, and a widening of the gap between top and bottom performers. If dispersion reverts to its 2015 levels, however, even good active managers will continue to face a challenging environment.

The posts on this blog are opinions, not advice. Please read our Disclaimers.