Three times a year the Federal Reserve surveys bank lending officers about credit standards, loan pricing and the demand for borrowing. The Survey provides insights into business and consumer borrowing as well as where the economy may be headed. The results of the July 2016 survey, released today, echo the details in last week’s GDP report: consumers are spending money and helping the economy while business is not rushing to invest.

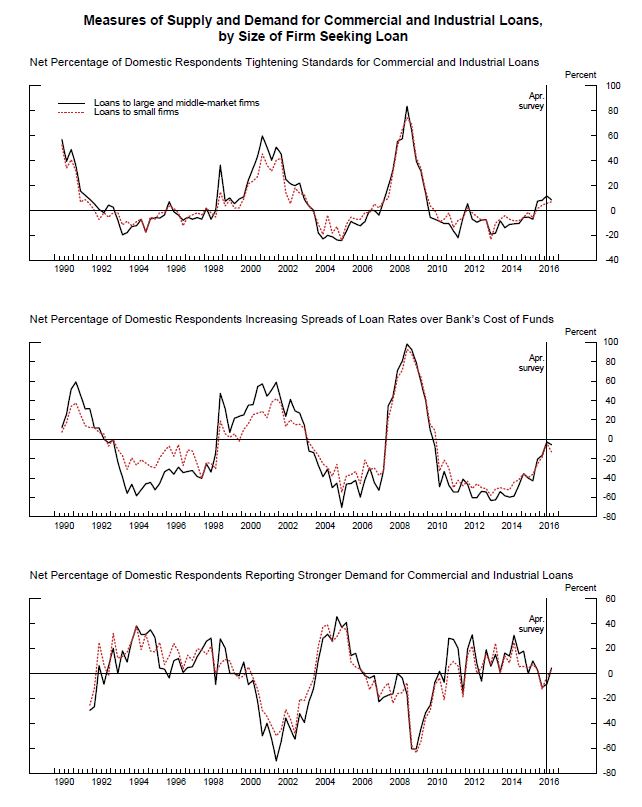

The first set of charts summarizes the Survey findings about Commercial & Industrial (C&I) loans, the principal part of bank lending to business. The Survey measures results by the net percentage of banks reporting stricter credit standards, larger pricing spreads or increased loan demand. The C&I picture reveals a slight tightening of credit standards (top panel). The data show a small decrease in the pricing spread, the difference between the interest rates charged by the bank and the rate it pays for funds. Loan demand in the bottom panel shows a very small portion of banks reported increased loan demand compared to a net decline in the previous survey earlier in the year.

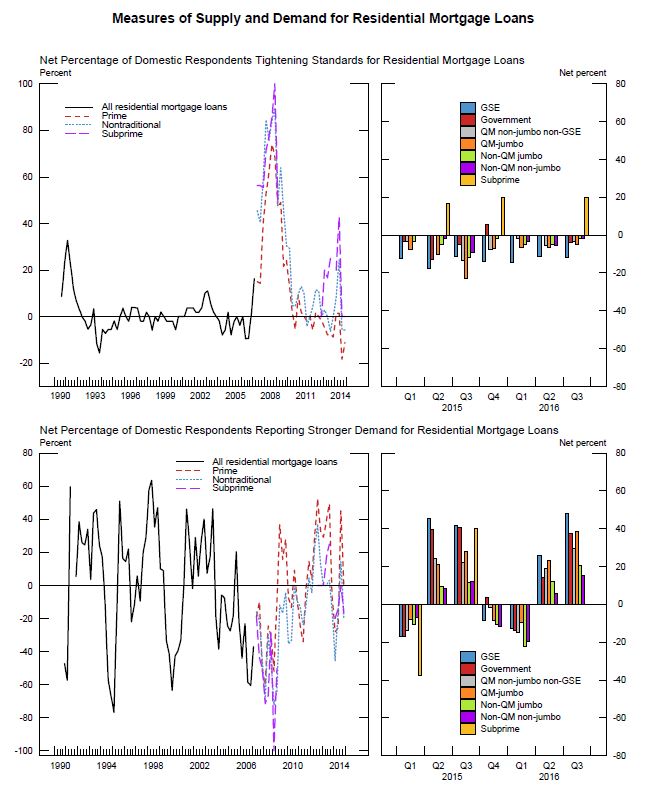

Bank lending in the residential mortgage market has been active. The second set of charts shows changes in lending standards and loan demand for mortgages. Both these areas have been volatile and in both the housing boom and bust are easy to spot. Since the beginning of 2015, banks have been easing mortgage lending standards across all mortgage types except sub-prime. For bankers, this may be the lesson of the financial crisis; for borrowers the lesson hasn’t been fully learned. The lower right hand chart shows that demand for sub-prime loans follows the other categories closely. Some banks reported that they do not make sub-prime mortgage loans.

Another section of the report compares current credit standards to the average since 2005. Sub-prime borrowers seeking mortgages, auto loans or credit cards will find that standards are tighter today than typical since 2005; prime borrowers will find current standards are close to the average since 2005.

The charts are from the Federal Reserve July 2016 Senior Loan Officer Survey.

The posts on this blog are opinions, not advice. Please read our Disclaimers.