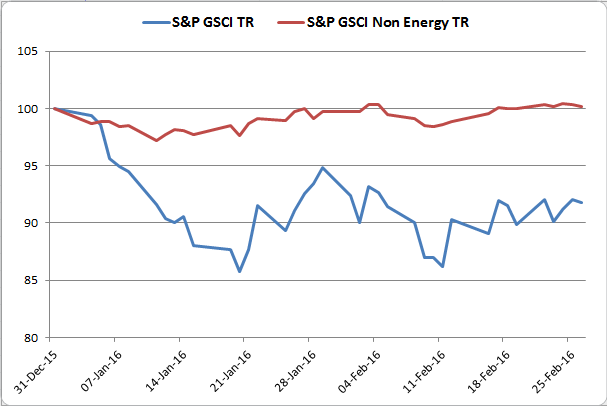

As February comes to an end, so might be the commodity catastrophe. Although the S&P GSCI Total Return lost another 3.2% in the month (through Feb. 26, 2015,) bringing the year-to-date performance down to -8.2%, half of the 24 commodities in the index were positive for the month. Further, at least one commodity from each sector gained in February, and the majority of sectors, 3 of 5, were positive for the month.

The S&P GSCI Precious Metals continue to lead in 2016, adding 8.7% in Feb., for a YTD gain of 14.2%. This is from gold’s gain of 15.1% YTD, making it the best performing commodity in the index for the year, and also for the month, up 9.3% in Feb. However, it’s not the best performing commodity for the month by much with zinc adding 8.1% and sugar up 7.2%.

Zinc’s gain contributed to the positive performance of 3.1% in industrial metals for the month plus all the constituents in the sector gained except nickel. There is tightening supply in the metals, especially in zinc, copper and lead, with the latter two, showing positive roll yields in February.

All three commodities in livestock were also positive in the month for a sector return of 1.5% MTD. Inventory increases in lean hogs reduced their monthly gain to just 24 basis points but the commodity is still posting a YTD gain of 8.7%, making it the third best performer of all the commodities in 2016 – only behind gold and zinc.

The agriculture sector did not fare as well in February, losing 3.3%, despite the gains in the softs. The USDA (United States Department of Agriculture) forecasted increased corn plantings and grain production that hurt the sector. However, sugar had its best day since 1993 from the volatile El Nino weather predicted that may lower supply in the coming year. If this weather pattern continues to reduce crop yields like in historical El Ninos, it may benefit all the prices in the sector.

At the same time, the El Nino is harmful to the performance of natural gas. It was the worst performing commodity for the month with a loss of 24.3%, bringing the S&P GSCI Natural Gas to its lowest level on Feb. 25, 2016 since March 24, 1999, almost 17 years. Since the world production weight is relatively small, the loss didn’t contribute significantly to the sector that lost 6.6% for the month. Petroleum was down 5.3%, despite gasoil’s 3.8% gain, but (WTI) crude oil gains of the magnitude witnessed during the month have only happened around other bottoms.

Ex-energy, commodities are positive for the year. The S&P GSCI Non Energy Total Return is up 14 basis points in 2016, finally reaching a turning point after its near 20% loss in 2015. That is pretty good considering the -8.2% loss year-to-date for the S&P GSCI.

It is optimistic given tightening inventories in industrial metals, the weather hurting crop yields in agriculture and the sporadic but big oil gains. In particular, it might be most promising if oil rises since if oil rises, it helps all other commodities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.