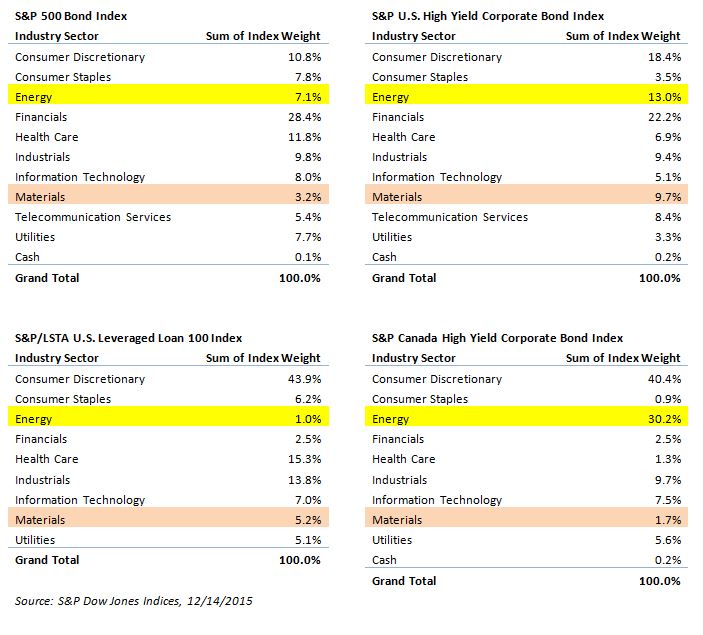

The S&P U.S. Issued High Yield Corporate Bond Index has just over USD1 trillion of par amount outstanding while its total return is down 3.11% for the month and down 4.51% YTD. The energy and materials sectors have been the sore spot for the high yield market, given the anxiety over credit quality, as current low prices in oil and commodities, along with a Fed increase in rates, may be a cause for concern for future earnings and the cost of capital. The return of the S&P U.S. Issued High Yield Corporate Bond Index ex energy and materials sectors would be less affected, returning -2.14% for the month and -0.05% YTD.

The growth of the high yield market since the 2008 financial crisis has been significant; the par amount outstanding of the S&P U.S. Issued High Yield Corporate Bond Index increased by 65% from Dec. 31, 2008, to Dec. 15,, 2015. As shown in Exhibit 1, the growth in issuance within the energy and materials sectors has been significant as well. At its highest in September 2014, the energy sector reached USD 207 billion and has since dropped to USD 122 billion. Materials was as low as USD 33 billion in March 2009 before peaking at USD 102 billion in December 2014, and it was at USD 81 billion par outstanding as of Dec. 16, 2015.

Exhibit 1: Energy & Materials Sector Growth

Source: S&P Dow Jones Indices LLC., Data as of Dec. 15, 2015. Past performance is no guarantee of future results. Chart is provided for illustrative purposes and contains hypothetical historical performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.